Forvis Mazars Considers the Tax Implications of the Upcoming Election

This Election Guide is intended to be a resource as you consider the tax implications of the upcoming 2024 election. This is not a partisan document, but rather an attempt to answer some of the most common questions Forvis Mazars has received regarding this topic. This is a summary of facts, with observations and insights included from Forvis Mazars’ legislative consultants, the news, and other sources. Whether you are a business owner, a corporate executive, or an interested individual taxpayer, this guide explores the congressional races, key players in both chambers, policies of both presidential candidates, and a look into historical trends from past elections.

The information contained in this guide is current as of September 1, 2024, unless otherwise noted.

Congressional Races

By the end of 2025, many tax laws are set to “sunset” or phase out. Therefore, this coming year is set to be one of the busiest for lawmakers tasked with tax policy—in fact, some have even coined 2025 the “Tax Super Bowl” in Congress. This backdrop further amplifies the importance of the upcoming congressional races. The following are common FAQs that may help in understanding the landscape of the congressional races, which may in turn affect the outcomes of tax proposals next year.

What is the current congressional makeup, and what seats could be affected by the election?

This is the current makeup of the 2024 Congress:

| Democrats | Republicans | |

|---|---|---|

| House* | 212 | 220 |

| Senate | 51** | 49 |

* There are three vacant seats in the House as of September 1, 2024.

** Four of the Democratic senators are Independents.

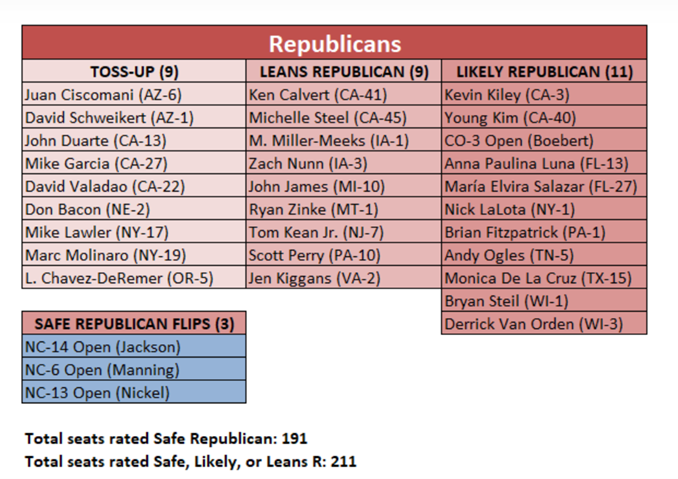

In the House, Republicans currently have a slight majority. Looking at the 2024 election, polling indicates that of the 435 House seats, approximately 175 are solid Democratic seats and 189 are solid Republican seats—leaving approximately 39 Democratic seats and 32 Republican seats “in play.” The election results in these “in play” seats will determine which party controls the House and by what margin.

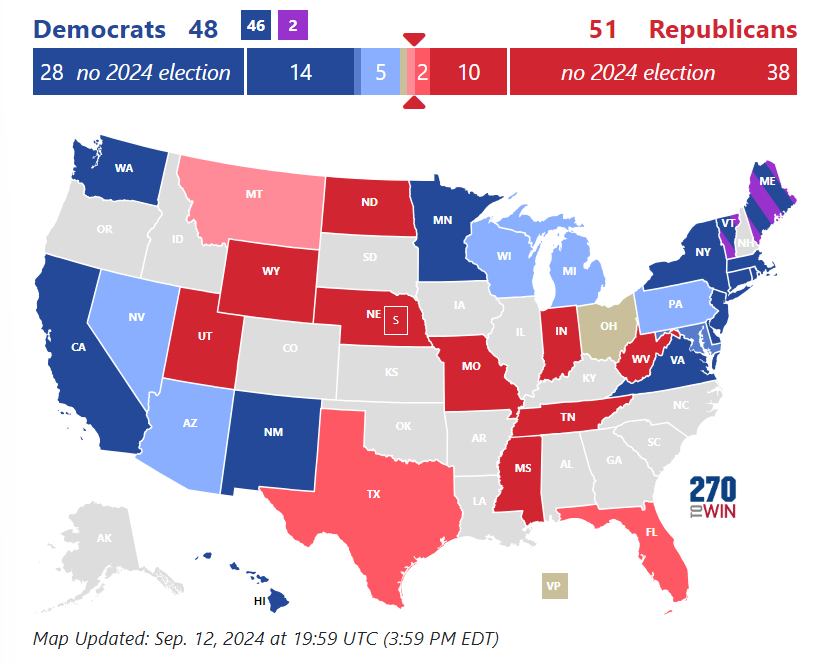

In the Senate, Democrats currently have a narrow majority and face a difficult election—of the 34 Senate seats up for election in 2024, 23 are held by Democrats, whereas only 11 are held by Republicans. Furthermore, these 11 Republican Senate seats are likely to remain Republican, according to legislative consultants of Forvis Mazars. If former President Donald Trump wins, Republicans would need to pick up one additional Senate seat to obtain the majority, as J.D. Vance would become the “tie-breaking” voting member of the Senate as the vice president.

Can you speak to retirements in the House and Senate?

House

Currently, there are 26 Democrats and 26 Republicans retiring from the House at the end of this year, although few are in competitive congressional districts. There are a number of House Committee on Ways and Means tax writers retiring, including Reps. Dan Kildee (D-MI), Earl Blumenauer (D-OR), Brad Wenstrup (R-OH), and Drew Ferguson (R-GA).

Senate

In the Senate, a few influential Democrats or Independents are retiring in 2024, and their representative locations are identified as potential contenders for “flips” to the Republicans—namely Joe Manchin (WV), Debbie Stabenow (MI), and Kyrsten Sinema (AZ). Other retirements include Ben Cardin (D-MD), Tom Carper (D-DE), Bob Menendez (D-NJ), Mitt Romney (R-UT) and Mike Braun (R-IN).

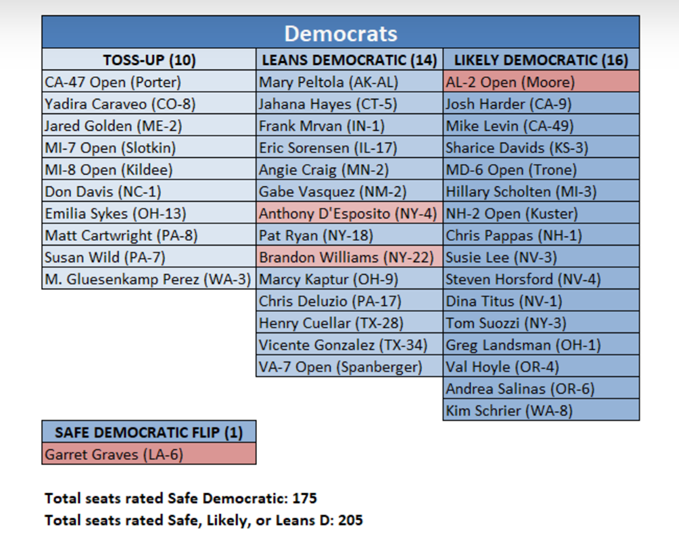

Do you have a visual of seats in motion or predictions for this election?

See the Appendixes 1–3 for maps to visualize upcoming retirements, predictions, and contested seats in Congress. Note that all predictions are made by sources external to Forvis Mazars and do not represent an opinion by Forvis Mazars.

Who holds leadership positions in tax committees? Are any of them up for re-election?

Below is a list of active participants who hold leadership positions in tax-related committees. Given their role, they often decide whether tax legislation advances for consideration. Although the House members of this list are up for re-election this year, the press largely considers their seats “safe” for this upcoming cycle. Both leaders of the Senate Finance Committee are not “in cycle” in the 2024 election.

| Democrat | Republican |

|---|---|

| Rep. Richard Neal (MA):Ranking Member, Committee on Ways and Means | Rep. Jason Smith (MO):Chair, Committee on Ways and Means |

| Sen. Ron Wyden (OR):Chair, Senate Finance Committee | Sen. Mike Crapo (ID):Ranking Member, Senate Finance Committee |

What are the major tax policy priorities of each party?

Based on a variety of sources, below are some of the tax policy priorities of each party.

| Democrat | Republican |

|---|---|

| Extension and expansion of the Child Tax Credit and other tax incentives targeting lower-income individuals | Extension and permanency of 2017 Tax Cuts and Jobs Act (TCJA) individual and estate tax relief |

| Increase tax rates on corporations and high-net-worth individuals as a funding mechanism to provide tax relief for lower-income individuals but no tax increases on families making less than $400,000 | Additional tax relief |

| Extension and expansion of clean energy tax incentives enacted by the Inflation Reduction Act (IRA) | Repeal of IRA clean energy incentives and increased IRS funding |

What are legislators doing now to prepare for 2025 tax changes?

Jason Smith has established various House Committee on Ways and Means Republican “tax teams” tasked with fact finding in anticipation of the expiration of the 2017 TCJA individual and estate tax relief at the end of 2025. As an opportunity to hear from industry experts and other constituents, these tax teams may prove helpful to inform legislators about the inherent complexities of the laws sunsetting in 2025. It is anticipated that Senate Finance Committee Republicans will implement a similar “tax working group” mechanism to solicit taxpayer feedback.

Presidental Race

Similar to the congressional race, the presidential candidates are including more tax policy in their rhetoric given the impending 2025 “Tax Super Bowl.” When coupled with their historical commentary on various tax topics, the platforms put forth by both candidates provide a better understanding of how they may react to various proposals come 2025.

What are the tax policy platforms of each presidential candidate? If not formally announced as part of their platforms, what have the candidates discussed historically on key tax topics?

Donald Trump

Trump’s tax focus will be on the extension or permanency of the 2017 TCJA individual and estate tax relief. TCJA related topics include everything from the 20% Section 199A deduction, the amount of the standard deduction, existence of a personal exemption, the alternative minimum tax exemption, and a variety of international tax items. He also has referenced an interest in additional tax relief, including a further reduction in the corporate tax rate, as well as exempting tips, Social Security benefits, and overtime wages from taxation.

Kamala Harris

Although as a senator and 2020 presidential candidate Vice President Kamala Harris endorsed a far-left progressive tax platform (including full repeal of the 2017 TCJA), she has quickly adopted President Joe Biden’s tax platform as a presidential candidate, including no tax increases on those earning less than $400,000, an increase in the corporate rate to 28%, and adoption of a host of tax increases on the wealthy and businesses from recent Biden budget proposals. To date, she also has included a number of affordable housing-focused priorities, including tax incentives for builders of affordable housing and a $25,000 pay-out for first-time homebuyers.

Summary Comparison

Further comparisons of the candidates are in the table below, which includes information from both recently issued 2024 presidential platforms and historical commentary on the topics:

| Topic | Trump | Harris |

|---|---|---|

| TCJA | TCJA extension and/or permanence for all | Extend TCJA provisions for those earning under $400,000 |

| Tax Relief for American Families and Workers Act of 2024 | Extension of business provisions related to bonus depreciation, research and development (R&D), and the interest expense deduction limitation | Extension and expansion of Child Tax Credit |

| Corporate Tax Rate | Potential further corporate tax rate reduction to 20% (or lower) | Increase corporate tax rate from 21% to 28% |

| Housing | Aid to first-time homebuyers, focus on developing available land | Homebuilder incentives, $25,000 first-time homebuyer payout |

| IRA | IRA at least partial repeal | Maintain IRA credits, $100 million in grants for Energy Department—EV manufacturing |

| Aid to Working Class | Tip and Social Security taxation exemption | Tip taxation exemption |

What is J.D. Vance’s history with tax policy?

J.D. Vance, Trump’s nominee for vice president, has had a less-publicized tax policy history. First, there are a few bills that he sponsored—neither of which have co-sponsors—that target endowments of private educational institutions: the Encampments or Endowments Act and the College Endowment Accountability Act. The latter would “raise the excise tax on endowment net investment income from 1.4 percent to 35 percent for secular, private colleges and universities with at least $10 billion in assets under management.”1 In line with Trump’s priorities against the IRA, he has introduced the Drive American Act, which is intended to repeal the clean vehicle tax credit. Further in line with Trump are bills he has co-sponsored, including immediate expensing for R&D costs, Section 199A deduction permanence, and estate tax repeal.

Vance is a co-sponsor on a bill introduced by Democrat Sheldon Whitehouse (D-RI) titled the Stop Subsidizing Giant Mergers Act, which targets taxing large corporate reorganizations.

What is Tim Walz’s history with tax policy?

As a member of Congress for 12 years, Tim Walz—Harris’ nominee for vice president—was involved in quite a few tax bills. Coming in at around 200 tax bills in total, topics of the bills with Walz’s connection that made it into law include military tax incentives and amendments for the firearms excise tax.

He also voted with most of his Democratic colleagues against TCJA provisions. That being said, Walz has not always voted in line with the majority of his party. On the federal level, back in 2010 he voted in support of President George W. Bush’s tax cuts. As governor of Minnesota, Walz significantly raised taxes on the wealthy and businesses to finance tax relief for lower- and middle-income residents of the state.

Which “battleground” states could determine who wins the White House in the 2024 election?

Two-hundred and seventy electoral votes are needed to win the presidency. Current polling suggests there are 226 “solid” electoral votes for Vice President Harris and 235 “solid” electoral votes for former President Trump. The remaining 77 electoral votes are spread among the “battleground” states that will ultimately determine who wins the White House—Arizona (11), Georgia (16), Nevada (6), Michigan (15), Pennsylvania (19), and Wisconsin (10). As the election continues, there is the potential that other states, such as North Carolina (16) and Florida (30), also come into play.

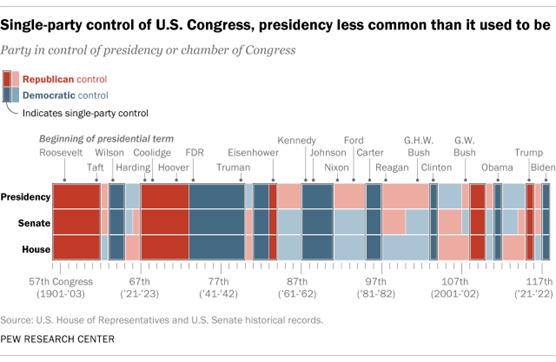

Has there been a historical correlation between the party of the presidential winner and the party controlling Congress?

Historically, it has not always been the case that the House and Senate majorities have been aligned with the winning president’s party. The chart below shows that—especially in recent times—there has been more variation in which party controlled the chambers of Congress, along with the presidency. However, the first year of the three most recent presidents’ terms has all seen single-party control. Whether that trend continues in 2024 is yet to be determined.

There are a bunch of ideas on each presidential candidate’s platform. How can I tell what is realistic to become law?

Undoubtedly, tax platforms of candidates include some serious proposals that could make their way into Congress come 2025. However, congressional control will ultimately play the largest part in whether—or to what extent—these proposals become reality. Even if one party were to “sweep” the election and win the White House and both houses of Congress, they would need to hold significant majorities in both the House and Senate to move the more controversial proposals contained in their platforms.

Regardless of the outcomes of the congressional races, many topics discussed in the news or even included in more publicized platforms are not introduced as realistic initiatives to become law. Instead, the topics are used politically—to appeal to a certain group of voters or to differentiate themselves from the opposing candidate.

Should we expect to see any legislation passed in the “lame duck” session following the election?

The likelihood of a “lame duck” tax bill is highly dependent on the election results. There is hope that the Tax Relief for American Families and Workers Act of 2024, which passed the House in January 2024 but failed a procedural vote in the Senate in August 2024, will receive consideration.

If you have any additional tax-related questions, please reach out to a professional at Forvis Mazars.

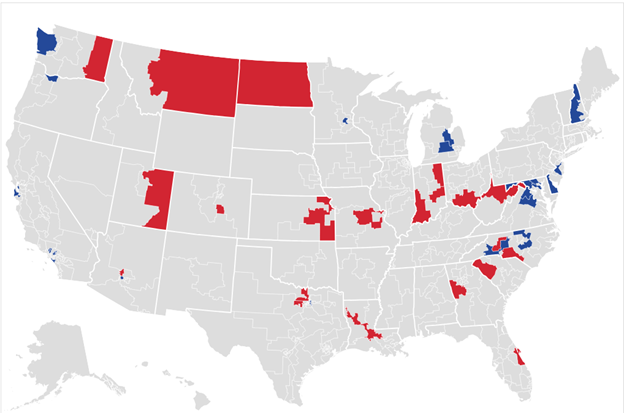

Appendix 1

A full listing of retirements, those seeking a different office, or deaths can be found here: https://pressgallery.house.gov/member-data/casualty-list. A map of upcoming House retirements is below (current as of September 16, 2024).

Appendix 2

According to The Center for Politics at the University of Virginia at the end of July 2024, the following is a depiction of its predictions for the House in the upcoming election (current as of September 16, 2024).

Appendix 3

Contested Senate seats can be visualized with the map below. The color coding closer to the middle of the key is seen as more contentious, according to 270 to Win as of mid-September.

- 1“Senate Democrats Block Vance Legislation to Tax Large University Endowments,” vance.senate.gov, December 14, 2023.

- 2“"Single-Party Control of U.S. Congress, Presidency Less Common Than It Used to Be,",” pewresearch.org, February 3, 2021.

- 3 https://www.270towin.com/2024-house-election-find/2024-retirements#google_vignette.

- 4 “2024 House Ratings,” centerforpolitics.org, Updated July 31, 2024.

- 5 https://www.270towin.com/2024-senate-election/