Publishing note: At the time of this article’s publication, the current status of the SEC climate disclosure rule has been voluntarily stayed pending judicial review of consolidated challenges by the Court of Appeals for the Eighth Circuit.1

With the pending implementation of the SEC’s new climate disclosure rule, public companies now know how to measure their emissions to be in compliance with the pending implementation of the SEC's new climate disclosure rule. Understanding how the rule approaches greenhouse gas (GHG) emissions accounting is critical for public registrants. The regulation will likely require thousands of large accelerated filers (LAF) and accelerated filers (AF) to report GHG emissions—many for the first time (See our article, “SEC’s Climate Disclosure Rule (Stayed)”).2,3 Using the financial data provider Refinitiv’s database,4 the SEC estimates that less than half of LAFs and 15% of AFs disclosed GHG emissions in 2022, illustrating the need for guidance on how to estimate and report GHG emissions.

To better understand the impact of the SEC’s disclosure rule, organizations may find themselves faced with the following questions regarding the reporting of the GHG emissions metrics section in the final SEC rule,5 including:

- How do organizations determine which GHG emissions are material?

- What emissions does an organization need to report?

- What standard should be used to report emissions?

- When and where do organizations need to report?

- What steps can be taken to prepare for SEC GHG reporting?

How to Determine Which GHG Emissions Are Material?

The key to GHG emissions reporting is understanding whether the registrant’s emissions are material. For questions on what constitutes material, the SEC defers to the 1976 U.S. Supreme Court case TSC Industries Inc. v. Northway, Inc., which notes “a substantial likelihood that the ... fact would have been viewed by the reasonable investor as having significantly altered the ‘total mix’ of information made available.” 6

The SEC offers example instances7 in which GHG emissions could be considered material for the registrant:

- The emissions calculation and disclosure are significant enough to create a climate transition risk that will likely impact the business, its operations, or its financial condition.

- The requirement to report emissions under a foreign or state law, e.g., California 2023 Senate Bill 219 (See “California Enacts GHG & Climate Reporting Laws Requiring Major Action by U.S. Companies”), or the EU’s Corporate Sustainability Reporting Directive (CSRD).

- An update on progress against public GHG emissions reduction targets or goals.

What Emissions Does an Organization Need to Report?

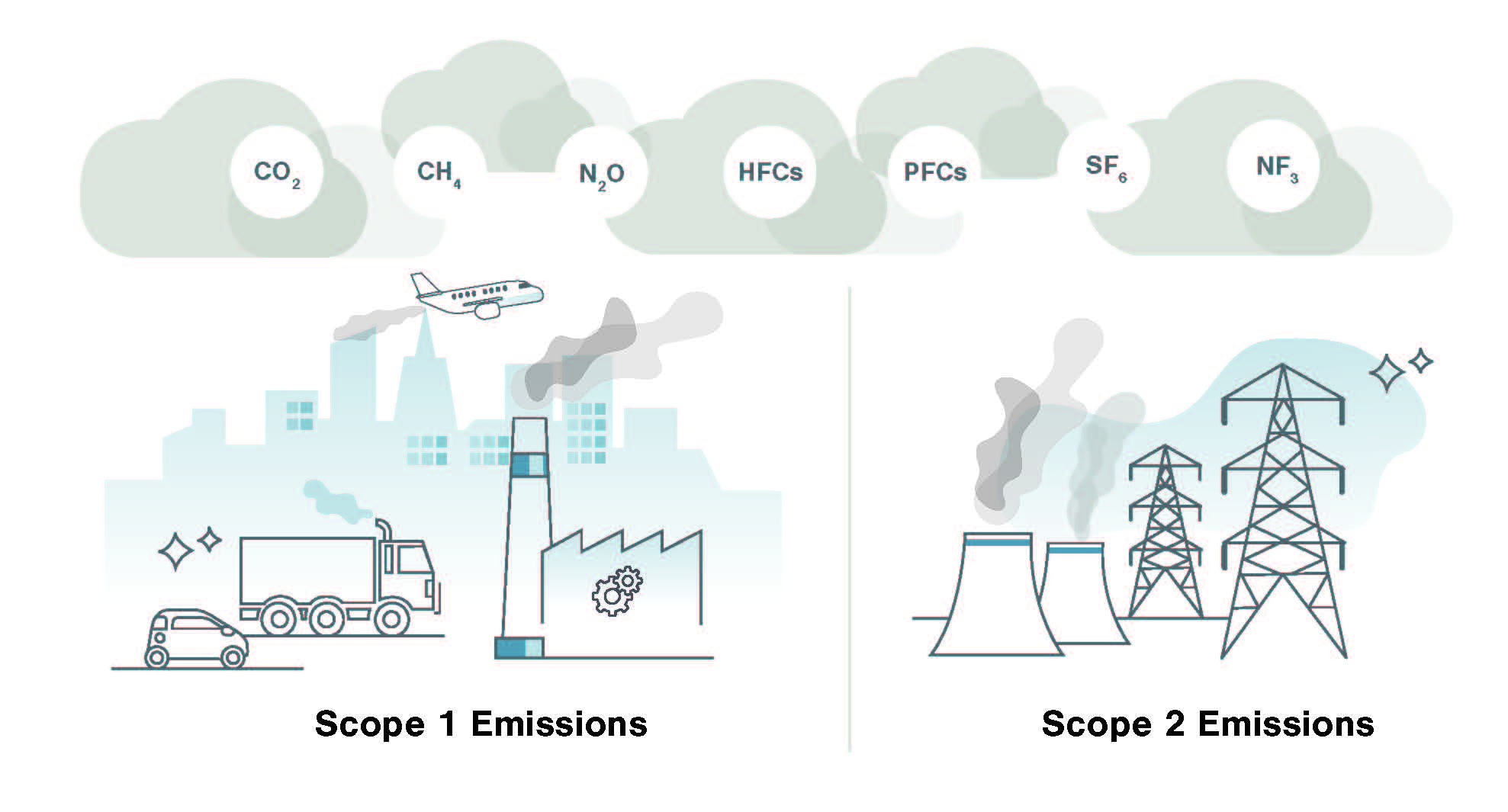

If material to the LAF or AF, a registrant must disclose its Scope 1 emissions and/or its Scope 2 emissions. Scope 1 emissions are direct GHG emissions that stem from sources that a reporting entity controls. For example, a comprehensive report stretches across the footprint of the company—including international operations if applicable.

Applicable SEC registrants will need to report Scope 1 and Scope 2 emissions. Scope 1 includes the emissions directly attributable to the company’s operations. Scope 2 emissions are associated with the purchase of electricity, steam, heating, and cooling.

Applicable SEC registrants will need to report Scope 1 and Scope 2 emissions. Scope 1 includes the emissions directly attributable to the company’s operations. Scope 2 emissions are associated with the purchase of electricity, steam, heating, and cooling.

Scope 2 emissions are indirect GHG emissions “largely from the generation of purchased or acquired electricity consumed by the registrant’s operations.” 8

There are two Scope 2 accounting methods:

- Location-based: Averaged emissions intensity of the electricity grids where the energy consumption occurs.

- Market-based: Emissions from electricity that companies have chosen through contractual instruments, such as power purchase agreements and renewable energy certificates.9

Depending on the methodology used, a registrant could be required to report both location- and market-based methods for organizations with operations in markets with electricity contractual instruments. In addition, a registrant must disclose individual GHG emissions gas of the disclosed emissions if individually material and, if so, report it disaggregated from the other gases. The SEC lists greenhouse gases below:

- Carbon dioxide (CO2)

- Methane (CH4)

- Nitrous oxide (N2O)

- Nitrogen trifluoride (NF3)

- Hydrofluorocarbons (HFCs)

- Perfluorocarbons (PFCs)

- Sulfur hexafluoride (SF6)

For example, an oil and gas company might need to report methane emissions separately because the organization has public methane emissions reduction targets.

What Standard Should Be Used to Report Emissions?

Registrants reporting their Scope 1 and/or 2 GHG emissions will need to describe the underlying methodology used to calculate those emissions, significant inputs, and significant assumptions. The registrant will also need to disclose:

- If the organizational boundaries materially differ from the scope of operations included in the registrant’s consolidated financial statements, the registrant will provide a brief explanation of this difference in sufficient detail for a reasonable investor to understand.10

- A brief discussion of the approach to categorization of emissions and emissions sources.

- A brief description of the protocol or standard used to report the GHG emissions, including:

- the calculation approach

- the type and source of emission factors, which is a representative value that relates an activity, e.g., burning natural gas, to carbon dioxide equivalent (CO2e) emissions for that activity

- calculation tools used to calculate GHG emissions

The SEC rule preamble notes the GHG Protocol, ISO 14064, and EPA11 as example of methodologies that the registrant could use, though the organization could rely on other methodologies. It is important to note that GHG emissions disclosures will require assurance by an independent third party beginning as soon as 2029, depending on an organization’s filing status. Therefore, selecting a methodology that is appropriate for the business and maintaining records on the calculation methods employed warrants attention when setting up the GHG emissions reporting program.

When & Where Do Organizations Need to Report?

An organization’s reporting deadline corresponds with its filing status. LAF registrants reporting under the rule will start to report GHG emissions data for fiscal year 2026 data in 2027, and AF registrants will start to report FY 2028 data in 2029 (below figure). Any GHG emissions metrics required to be disclosed on Form 10-K may be incorporated by reference from the registrant’s Form 10-Q for the second fiscal quarter in the fiscal year immediately following the year to which the GHG emissions metrics disclosure relates.12

| Registrant Type | Report | Report FY Emissions | FY Emissions Assurance Requirements |

|---|---|---|---|

| LAF | Scope 1 & 2 | 2026 | Limited: 2029 Reasonable: 2033 |

| AF | Scope 1 & 2 | 2028 | Limited: 2031 |

What Can Be Done to Prepare for SEC GHG Reporting?

First, LAFs and AFs should work closely with investor relations personnel to discuss whether emissions reporting is material to the organization and, if so, whether it is Scope 1, Scope 2, or both. Even more granular emissions reporting could be material for companies that have set individual emission-type reduction targets, such as a methane emissions reduction target.

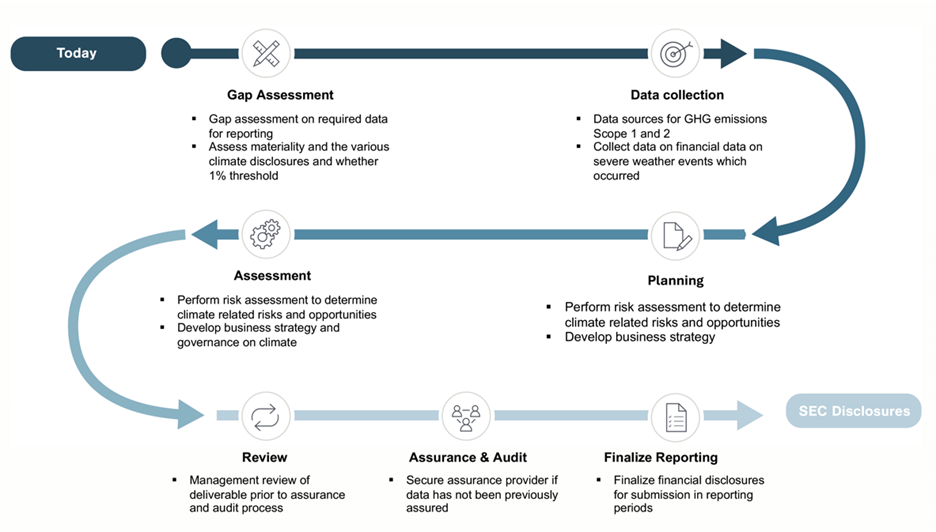

Next, companies should create a GHG inventory management plan that sets up the firm for future success in reporting emissions by clearly outlining the key organizational information, surfacing data management practices, establishing a base year of emissions reporting, and identifying the pathway to assurance.

- Gap Assessment

- Gap assessment on required data for reporting

- Assess materiality and the various climate disclosures and whether 1% threshold

- Data Collection

- Data sources for GHG emissions Scope 1 and 2

- Collect data on financial data on severe weather events which occurred

- Asessment

- Perform risk assessment to determine climate related risks and opportunities

- Develop business strategy and governance on climate

- Planning

- Performance risk assessment to determine climate related risks and opportunities

- Develop business strategy

- Review

- Management review of deliverable prior to assurance and audit process

- Assurance and Audit

- Secure assurance provider if data has not been previously assured

- Finalize Reporting

- Finalize financial disclosures for submission in reporting periods

Third, to prepare for the SEC GHG disclosure rule, organizations must understand that GHG accounting is inherently cross-functional. Individuals in financial accounting, facilities management, and supply chain management should be involved. A point person within the organization should be quickly identified, and be prepared to deliver clear communication to many stakeholder groups on reporting requirements.

Start Counting Carbon & Other Emissions Now to Prepare for the SEC Rule

The finalized SEC climate-related disclosure requirements will push companies to disclose GHG emissions for the first time, while others that have a long history of reporting will need to review their GHG accounting methodological rigor—especially as limited assurance audit requirements come into effect FY 2029 for some filers.

Failing to comply with the regulation could be costly if the SEC publicly intervenes or investor-led lawsuits are filed and jeopardize the company’s reputation and financial bottom line. Organizations unaccustomed to reporting GHG emissions should start counting their carbon emissions now to be prepared for the upcoming reporting requirements.

If you have any questions or need assistance, please reach out to a professional at Forvis Mazars.

- 1“The Enhancement and Standardization of Climate-Related Disclosures for Investors, File No. S7-10-22,” sec.gov, April 26, 2024.

- 2Agricultural producers or other registrant that operates manure management systems are exempt from the Scopes 1 and 2 emissions reporting due to a provision in the Consolidated Appropriations Act. 2023.

- 3“Accelerated Filer and Large Accelerated Filer Definitions.” sec.gov. April 23, 2020.

- 4“Environmental, Social and Governance Scores From Refinitiv.” LSEG.com. May 2022.

- 5 “17 CFR §229.1505.” ecfr.gov. August 15, 2024.

- 6 “SEC Staff Accounting Bulletin: No. 99 – Materiality.” sec.gov, August 12, 1999.

- 7 “SEC: 89 FR 21668, pg. 21680-21683.” govinfo.gov. March 28, 2024.

- 8 “SEC: The Enhancement and Standardization of Climate-Related Disclosures for Investors: 17 CFR 210, 229, 230, 232, 239, and 249, Footnote 1011.” federalregister.gov. April 11, 2022.

- 9If renewable energy credits are a material component of the registrant’s GHG emissions targets or goals, the registrant should be attentive to the additional reporting requirements found in 17 CFR §229.1504(d).

- 10If the organizational boundaries materially differ from the scope of entities and operations included in the registrant’s consolidated financial statements, the registrant will provide a brief explanation of this difference in sufficient detail for a reasonable investor to understand. 17 CFR §229.1505

- 11 “Greenhouse Gas Reporting Program (GHGRP).” epa.gov. April 26, 2024.

- 12California Enacts GHG & Climate Reporting Laws Requiring Major Action by U.S. Companies. International registrants that disclose GHG emissions will have 225 days after the completion of the fiscal year to report emissions for that fiscal year. 17 CFR §229.1506