On October 7, 2023, California Gov. Gavin Newsom signed into law Senate Bill (SB) 253, Climate Corporate Data Accountability Act, and SB 261, Greenhouse Gases: Climate-Related Financial Risk. This new SB 253 legislation requires U.S. companies doing business in California with more than $1 billion of annual revenue—regardless of where that revenue is earned—to submit assured annual reports of greenhouse gas (GHG) emissions starting with their fiscal year 2025 emissions reported in 2026. The SB 253 requirements will impact more than 5,000 companies. Under SB 261, U.S. companies doing business in California that produce more than $500 million of annual revenue—regardless of where that revenue is earned—are required to submit a report of climate-related financial risk every other year with the first report due by January 1, 2026. The SB 261 requirements will impact more than 10,000 companies.

SB 253 – Climate Corporate Data Accountability Act

SB 253 requires reporting entities to disclose GHG emissions annually beginning with FY 2025 Scope 1 and Scope 2 emissions reported in 2026. Limited assurance is required for the first four years of reporting, and reasonable assurance is required beginning with FY 2029 Scope 1 and 2 emissions to be reported in 2030.

Beginning with FY 2026 emissions to be reported in 2027, reporting entities are required to annually disclose Scope 3 emissions no later than 180 days after disclosing Scope 1 and Scope 2 emissions. Limited assurance is required for Scope 3 emissions disclosures beginning in FY 2030.

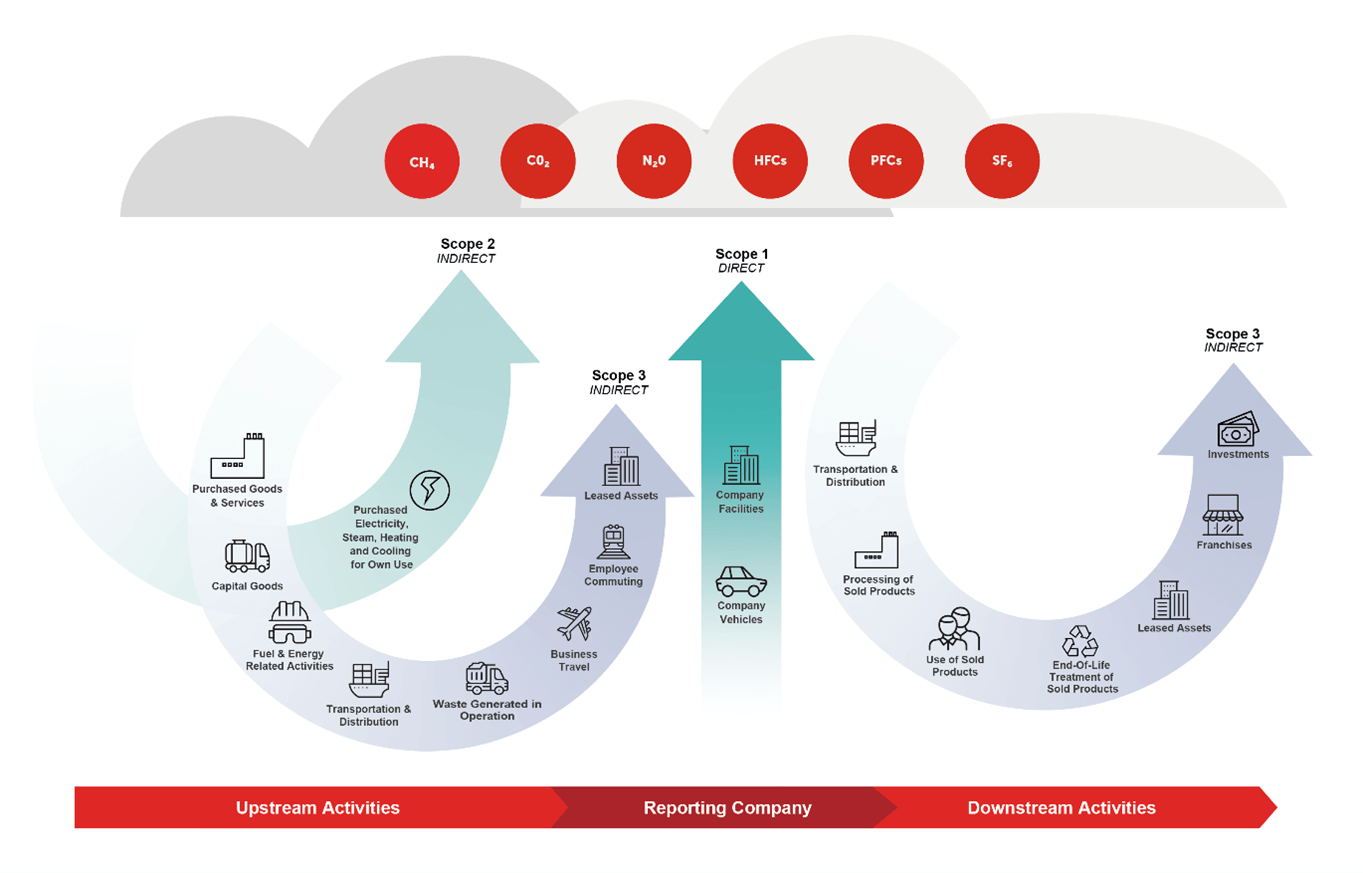

As shown in the graphic below, Scope 1 consists of GHG emissions from any source that a reporting entity owns or directly controls. Scope 2 consists of indirect GHG emissions from consumed electricity, steam, heating, or cooling a reporting entity has purchased or acquired. Scope 3 consists of indirect GHG emissions from upstream and downstream activities in the reporting entity’s value chain. Examples of Scope 3 emissions include, but are not limited to, employee commuting, processing and use of sold products, purchased goods and services, and business travel.

Source: Adapted from GHG Protocol1

SB 261 – Greenhouse Gases: Climate-Related Financial Risk

SB 261 requires covered entities to publish reports biennially of their climate-related financial risk, which includes disclosures in accordance with the Final Report of Recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD). The first reporting deadline is January 1, 2026.

As shown in the table below, the TCFD disclosure recommendations—now requirements in California—include 11 disclosures organized under four pillars: governance, strategy, risk management, and metrics and targets.

| Governance | Strategy | Risk Management | Metrics & Targets |

|---|---|---|---|

| Disclose the organization's governance around climate-related risks and opportunities. | Disclose the actual and potential impacts of climate-related risks and opportunities on business, strategy, and financial planning. | Disclose how the organization identifies, assesses, and manages climate-related risks. | Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities. |

| a. Describe the board's oversight of climate-related risks and opportunities. | a. Describe the climate-related risks and opportunities identified over the short, medium, and long term. | a. Describe your processes for identifying and assessing climate-related risks. | a. Disclose the metrics used to assess climate-related risks and opportunities. |

| b. Describe management's role in assessing and managing climate-related risks and opportunities. | b. Describe the impact of climate-related risks and opportunities on businesses, strategy, and financial planning. | b. Describe the organization's processes for managing climate-related risks. | b. Disclose Scope 1, 2, and 3 GHG emissions and related risks. |

| c. Describe the potential impact of scenarios, including a 2°C scenario, on your businesses, strategy, and financial planning. | c. Describe how processes for identifying, assessing, and managing climate-related risks are integrated into overall risk management. | c. Describe the targets used to manage climate-related risks and opportunities and performance against targets risk management. |

Source: TCFD

The following table provides a summary of the major provisions of the laws:

| SB 253 Climate Corporate Data Accountability Act | SB 261 GHGs: Climate-Related Financial Risk | |

|---|---|---|

| Who is impacted? | >5,000 U.S. companies

| >10,000 U.S. companies

|

| Are there exemptions? | None | Insurance companies 2 |

| What is required? | Annual reports of GHG emissions | Biennial reports of climate-related financial risks, covering the following topics:

|

| When is it effective? |

| First report by January 1, 2026 |

| What are the assurance requirements? |

| N/A |

| What are the reporting standards? | Final Report of Recommendations of the TCFD (June 2017)6 | |

| What are the penalties for non-compliance? | Up to $500,000/year | Up to $50,000/year |

Recommended Actions to Take Now

Measuring and reporting emissions, establishing assurance-level controls, and obtaining assurance is typically a multiyear journey for companies. California’s deadlines do not allow for the time typically taken by companies that report under the GHG Protocol.

Evaluate applicability: To determine if your company is doing business in California, query accounts receivable, accounts payable, and payroll for California addresses.

Assess current practices: Evaluate your company’s existing practices for GHG emissions data collection and reporting as well as climate-related risk management to help identify gaps or areas to align with the GHG Protocol, the TCFD, and assurance standards.7

Develop an action plan: Create a comprehensive plan outlining the necessary steps to comply with the requirements. Identify and evaluate where efficiencies may be gained by building upon existing business processes, data collection efforts and reports, and IT systems.

Implement necessary changes: Make required changes to your company’s processes, systems, and documentation to comply with the requirements. These adjustments may involve updating data management practices or reporting mechanisms.

Monitor regulatory updates: Stay updated on clarifications to requirements that develop during CARB's rule-making process in 2024.

Conclusion

The ESG & Climate Risk team at Forvis Mazars has many years of experience with GHG emissions reporting and financial risk management and can help you prepare GHG emissions and climate-related financial risk disclosures. We can provide assurance or assist with assurance readiness and development of internal controls for GHG emissions reporting. We also can help you develop mitigation and adaptation strategies to manage your climate-related financial risks. If you have any questions or need assistance, please reach out to a professional at Forvis Mazars.

See our related FORsights™ for more information:

- Climate Change Has Broad Economic Implications Now & in the Future – How Will It Affect Your Business?

- Attestation and Internal Control Considerations for ESG Programs

- Five Critical Insights in Applying COSO’s Guidance for ICSR

- Behind the Curtain: What You Need to Know About ESG Assurance

- 1"Corporate Value Chain (Scope 3) Accounting and Reporting Standard,” ghgprotocol.org.

- 2Insurance companies are already required to make an equivalent report. On April 8, 2022, the National Association of Insurance Commissioners, which includes California’s insurance commissioner, adopted a standard for insurance companies to report their climate-related risks in alignment with the TCFD.

- 3The California Air Resources Board is to adopt regulations for SB 253.

- 4“Corporate Standard,” ghgprotocol.org.

- 5“Corporate Value Chain (Scope 3) Standard,” ghgprotocol.org.

- 6“Recommendations of the Task Force on Climate-Related Financial Disclosures,” fsb.org, June 2017.

- 7“Attestation Engagements on Sustainability Information (Including Greenhouse Gas Emissions Information and Climate-Related Financial Disclosures,” aicpa-cima.com, 2023.