During presidential election years, investors may feel uncertainty creeping in when it comes to their portfolios. However, historical data shows little correlation between the party in power and portfolio performance. With this in mind, consider the following in regard to your portfolio as we enter the last few months of 2024.

The stock market runs on earnings, and earnings are driven predominantly by macroeconomic trends. The U.S. economy is large and dynamic, and companies large and small benefit from this. That very dynamism propels the economy and supports solid long-term earnings growth. It also allows companies to adjust to a changing world economy, as technology and global trade reshape the financial landscape.

That same dynamism applies to policy changes. Firms are adept at changing their businesses and strategies as legislative priorities change. Over time, these abilities resulted in increased corporate profitability and stock values.

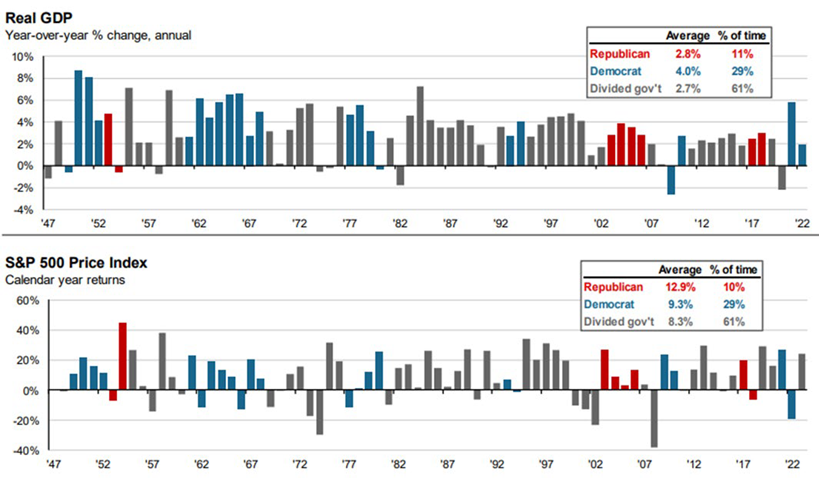

Nevertheless, this flexibility does not remove the impact of fiscal policy. Tax and spending policy, as well as regulation, can slow or speed up the economy. However, fiscal policy is just one of many factors that determine economic growth and influence its long-term trajectory. A review of political control versus market performance (shown in the chart below) indicates periods of weak returns driven by broad events, e.g., the Tech Bubble or the Global Financial Crisis, not the party in power at the time.

Source: BEA, Standard & Poor’s, FactSet, J.P. Morgan Asset Management. Data is calendar year/Data as of December 31, 2023.

Source: BEA, Standard & Poor’s, FactSet, J.P. Morgan Asset Management. Data is calendar year/Data as of December 31, 2023.

Despite the consistent flow of downbeat rhetoric amid this presidential election year, history shows there is little correlation between the party in power and portfolio performance. Election seasons are full of noise, so it is critical that investors instead keep their focus on economic trends into the final portion of 2024. The winning ticket for your portfolio is to maintain a sound, long-term investment strategy.

Our professionals at Forvis Mazars are here to help you with portfolio and other wealth management strategies at any time. For more information, please reach out to one of our Private Client professionals.