Prior to the issue of IRS Notice 2024-41 (the Notice), which modified Notice 2023-38, many taxpayers were not inclined to pursue the Domestic Content Bonus Credit available under the Inflation Reduction Act (IRA), or were finding the likelihood of meeting the Domestic Content requirements challenging, to say the least. The Domestic Content Bonus Credit allows for an additional bonus amount (2% or 10%, depending on whether a taxpayer is eligible for a 6% or 30% credit) for taxpayers claiming a tax credit under Internal Revenue Code Section 45, §45Y, §48, and §48E if the clean energy property was manufactured within the United States.

For this purpose, applicable projects may consist of steel/iron and/or manufactured products (collectively referred to as “applicable project components”). Manufactured products are in turn made up of various “manufactured product components.” The general Domestic Content rule requires 100% of any structural steel or iron and not less than the adjusted percentage of the total costs of manufactured products that are components of a qualified facility to have been mined, produced, or manufactured within the United States. For qualified facilities that begin construction before , the adjusted percentage is 40% (20% for an offshore wind facility). The adjusted percentage is 45% for next year and increases to 55% for qualified facilities that begin construction after 2026 (55% for qualified offshore wind facilities that begin construction after 2027).

Notice 2023-38

According to the IRS, Notice 2023-38 provided that all applicable project components that are manufactured products are deemed to be produced in the U.S. if the Adjusted Percentage Rule provided in the notice is satisfied. Notice 2023-38 further provided that a manufactured product is considered to be produced in the U.S. if: (1) all manufacturing processes of the manufactured product take place in the U.S., and (2) all of the manufactured product components of the manufactured product are of U.S. origin. It further provided that a manufactured product component is considered to be of U.S. origin if it is manufactured in the U.S., regardless of the origin of its subcomponents. Notice 2023-38 also stated that the Adjusted Percentage Rule shall be satisfied if the Domestic Cost Percentage for an applicable project equals or exceeds the adjusted percentage that applies to the applicable project. The Domestic Cost Percentage is defined in Notice 2023-38 as the percentage produced by dividing the domestic manufactured products and components costs by the total manufactured products cost.

Thus, Notice 2023-38 established that for a taxpayer to determine its Domestic Cost Percentage for an applicable project it would need to know the direct costs of the manufacturers of applicable manufactured products and manufactured product components. The issue here becomes clear—both domestic and foreign manufacturers would have to provide visibility into the cost structure of their products resulting in their customers having a clearer picture of the markup they were paying for the products. The manufacturers would have to be willing to provide the information for their customers to be able to claim the Domestic Content Bonus Credit. As a result, taxpayers may have been discouraged in the past from trying to claim the credit as manufacturers may have been unwilling to provide this cost information or, at the very least, made it very difficult for their customers to obtain this information. The IRS’ answer to this problem is the New Elective Safe Harbor. While Notice 2024-41 also includes updates related to specific applicable project types, this article focuses on the newly available safe harbor and the opportunities it avails those in the clean energy space.

Insight from Forvis Mazars: While many may have disregarded the Domestic Content Bonus Credit due to its requirements for manufacturer direct cost disclosure, the New Elective Safe Harbor provides taxpayers with a more straightforward opportunity to obtain the additional credit amount. Prior to purchasing components of a project, consider whether it is worth selecting an American manufacturer in consideration of the new safe harbor.

The New Elective Safe Harbor

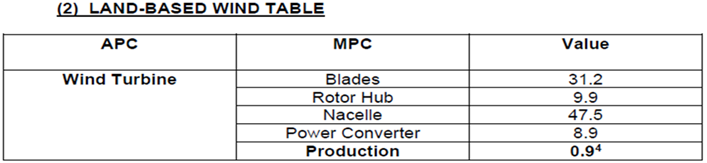

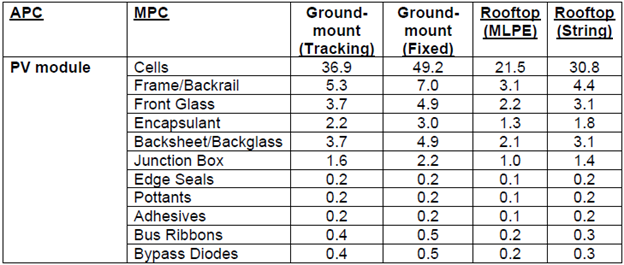

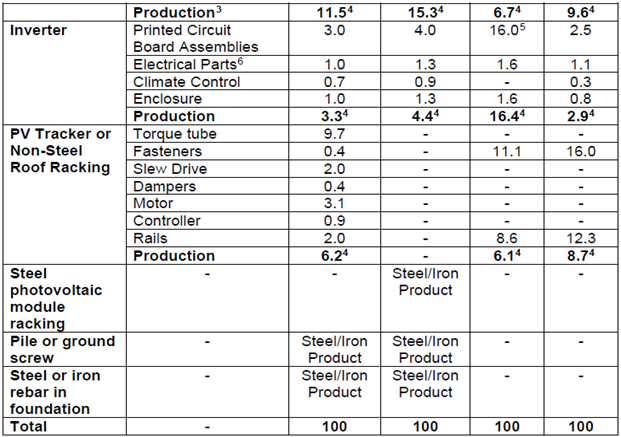

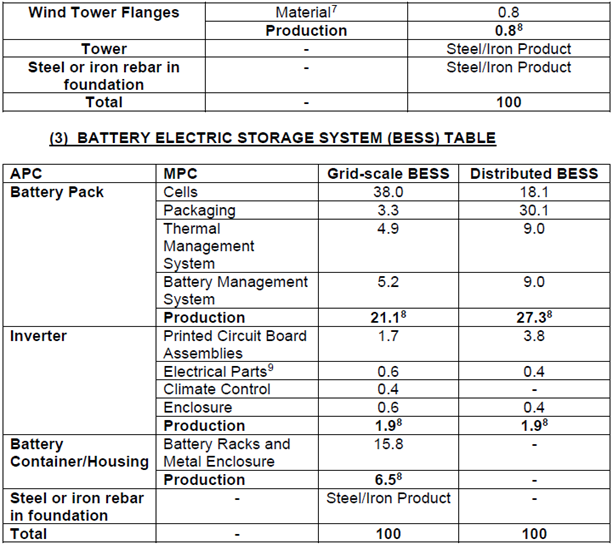

If a taxpayer properly makes the election on the Domestic Content Certificate Statement and relies consistently on “Table 1” (see the appendix of this article), then taxpayers will be deemed to meet the Domestic Content requirements under the New Elective Safe Harbor. As seen in Table 1, not only does this resource allow for classifying components of applicable projects but also provides an associated cost percentage that can be used for the Domestic Cost Percentage and the Adjusted Percentage Rule. In short, it negates the need for procuring direct costs from manufacturers.

Notice 2024-41 states that the applicable project components listed in Table 1 were not meant to be an exclusive and exhaustive set of applicable project components. Therefore, if a taxpayer’s applicable project excludes components listed in Table 1, the additional components should be treated as having zero value for the Domestic Cost Percentage calculation. In addition, the presence of additional components within the applicable project in excess of those listed within Table 1 does not disqualify the taxpayer from using the New Elective Safe Harbor, nor from meeting the Domestic Content requirements. The excess components simply are not accounted for in the calculation. Further, the taxpayer must use Table 1 for all manufactured products and components within the applicable project. That is, taxpayers can’t “pick and choose” which manufactured products should use the safe harbor and which should not.

Insight from Forvis Mazars: Taxpayers should make sure that the New Elective Safe Harbor is the best answer for the entirety of the applicable project for the life of the project prior to making the election.

How It Works

The key to meeting the Adjusted Percentage Rule is calculating the Domestic Cost Percentage. To calculate this, determine which manufactured products and components are considered domestic. From there, the taxpayer analyzes each of these U.S. Manufactured Products or U.S. Components in accordance with Table 1, ignoring excess components of the applicable project and assigning a zero value to unused components within the table. The taxpayer then adds the resulting percentages to obtain the Domestic Cost Percentage. This percentage is compared to either the 100% or 40% threshold referenced earlier, depending on the type of property. If the Domestic Cost Percentage exceeds these thresholds, then the Domestic Content requirements are met.

It is possible to have “the same type of Manufactured Product or Manufactured Product Component… from both foreign and domestic sources (Mixed Source Item or MSI).”1 If this is the case, an Assigned Cost Percentage should be calculated using a new formula outlined in the notice. Also discussed in the notice is how to calculate the Domestic Cost Percentage for investment tax credit projects that include both solar photovoltaic systems and battery energy storage systems.

In addition, in the Manufactured Product Component column of Table 1 is an item titled “Production.” Production costs are only allowed within the Domestic Cost Percentage calculation if all Manufactured Product Components are made within the United States.

The rules in this notice are likely best understood with an example. The following is adapted from the first and second examples of the notice itself:

Example 1

Applicable Project 1 is a wind facility, which includes the following Applicable Project Components:

| Product Description | Component Description | U.S./Foreign | Steel/Iron or Manufactured Product |

|---|---|---|---|

| Wind Turbine | Non-U.S. (some components foreign—see below) | Manufactured Product | |

| Blades | U.S. | ||

| Rotor Hub | Foreign | ||

| Nacelle | U.S. | ||

| Wind Tower Flanges | Non-U.S. | Manufactured Product | |

| Tower | U.S. | Steel/Iron | |

| Steel Rebar in Foundation | U.S. | Steel/Iron | |

| Interconnection Transformer | N/A, Not Listed in Table 1 | N/A, Not Listed in Table 1 | |

| Substation | N/A, Not Listed in Table 1 | N/A, Not Listed in Table 1 |

The Adjusted Percentage Rule requires 40% of this applicable project to be manufactured within the U.S., as an onshore wind facility is considered a manufactured product under §45(b)(9)(C).

The taxpayer should use Table 1 for the two highlighted components, the blades and the nacelle, as they are U.S. Manufactured Product Components. The following is an excerpt from Table 1:

Therefore, according to Table 1, the Domestic Cost Percentage of Applicable Project 1 is:

31.2% blades + 47.5% nacelles= 78.7% Domestic Cost Percentage

Considering this percentage exceeds 40%, assuming the taxpayer correctly elects to use the New Elective Safe Harbor, Applicable Project 1 meets the Domestic Content requirements.

Note that the presence of the interconnection transformer and substation within the project do not disqualify the project from meeting the safe harbor, even though they are not listed within Table 1. Also note that the rotor hub within this project is ignored given it is manufactured outside of the United States. In addition, a power converter is listed within the Land-Based Table in Table 1. Considering this project does not have a power converter, the percentage listed within the table is ignored. Considering not all Manufactured Product Components are made within the U.S., the “Production” component percentage listed within Table 1 is not considered.

Insight from Forvis Mazars: In considering which components to purchase from domestic manufacturers, consider Table 1 and which components would provide qualification under the Adjusted Percentage Rule. In Example 1, if only the Nacelle were manufactured domestically, then Applicable Project 1 would still have qualified. Determining which components provide more “bang for your buck” using Table 1 could be a useful approach to budgeting and planning clean energy projects.

Certification

As mentioned previously, taxpayers can only use the New Elective Safe Harbor if they make the election on a properly filed Domestic Content Certification Statement. According to the notice, this statement should be “attached to Form 8835, Renewable Electricity Product Credit; Form 3468, Investment Credit; or other applicable form for reporting domestic content bonus credit amounts under §§ 45, 45Y, 48, or 48E filed with the taxpayer’s annual return submitted to the IRS for the first taxable year in which the taxpayer reports a domestic content bonus credit amount for such Applicable Project.”

Insight from Forvis Mazars: The notice also mentions that there are “forthcoming proposed regulations” on the topic, which may alter the rules outlined in the notice and/or implement comments received. That being said, using Table 1 and the New Elective Safe Harbor may allow for a more widely pursued Domestic Content Bonus Credit. Initially, the purpose of this bonus credit was to support the manufacture of clean energy property domestically. Whether there will be a correlation with the safe harbor’s introduction and a greater pursuit of domestic manufacturing is yet to be seen. However, taxpayers claiming either the investment or production tax credits should certainly consider the Domestic Content Bonus Credit now more than ever.

Appendix

Table 12

Forvis Mazars offers a complimentary tool that can help simplify the IRA discovery process. TaxCred PRO™ for Clean Energy is an interactive questionnaire that generates a customized clean energy tax incentive report. Learn about the IRA tax credits and deductions you or your business may be eligible for and your estimated tax benefit amounts.

If you have any questions or need assistance, please reach out to a professional at Forvis Mazars.