On June 21, 2024, the IRS released the much-anticipated revised draft Form 6765, Credit for Increasing Research Activities, aka the research and development (R&D) tax credit. The IRS released this revised draft form after the IRS received comments from various external stakeholders after the release of the Form 6765 proposed changes on September 15, 2023.

While the information requested on the draft form is more comprehensive than the current form, it is similar to what the IRS may request in an audit and also similar to what is requested under CCM 20214101F (CCM), related to research credit refund claims. The stated intent of the changes is to provide taxpayers with a consistent and predefined format for tax reporting and improve the information received for tax administration.

Form 6765 Updates: Key Takeaways

- According to the IRS, Section G of the draft Form 6765 requires taxpayers to provide certain qualitative information in support of the credit claim for a portion of their qualified research expenses (QREs), i.e., 80% of QREs but not more than 50 business components, such as:

- Business Component Name

- Business Component Type

- Information Sought to Be Discovered

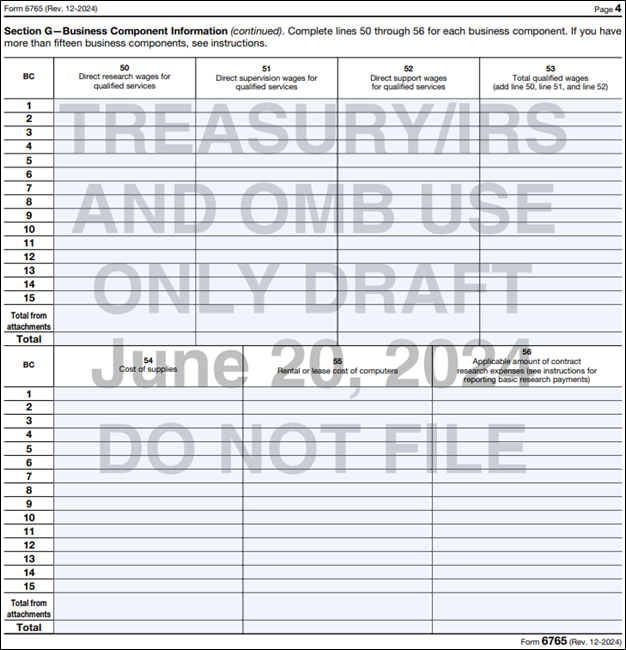

- In addition, Section G of the draft Form 6765 requires taxpayers to provide qualified costs by cost type and business component.

- The revised guidelines provide for a cap on the number of business components that must be represented in Section G. This could significantly change the amount of effort required to complete the form for some businesses.

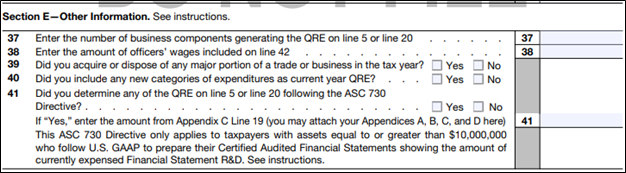

- Section E also requires information previously not disclosed on Form 6765, including:

- What was the number of business components generating claimed QREs?

- What was the amount of officers’ wages included in QREs?

- Did the company acquire or dispose of any major portion of a trade or business in the tax year?

- Did the company include any new categories or expenditures as current year QREs?

- Did the company leverage the Accounting Standards Codification (ASC) 730 guidance in computing QREs?

- The changes will be applicable for tax years 2024 and forward, with a few exceptions:

- Section G will be optional for taxpayers who meet the definition of a qualified small business (QSB) under Internal Revenue Code (IRC) Section 41(h)(1) or (2) and taxpayers with less than $1.5 million in QREs and less than $50 million of gross receipts.

- Section G is optional for all taxpayers in 2024 but will be applicable for taxpayers in 2025 unless they are excluded based on QSB status or through the established threshold of QREs and gross receipts.

Impact on Taxpayers

With the updates listed in the draft Form 6765, taxpayers should consider an approach for their R&D tax credit claim that captures the information needed to complete the draft form. For many, this may mean keeping a detailed project list throughout the year or utilizing a cost-tracking system. It also may be prudent to begin the R&D Study earlier in the year to allow time to gather the qualitative information that is newly requested on the draft form. Although Section G reporting is not being required until 2025, the information requested aligns with the information that is likely to be requested under IRS examination. Thus, taxpayers may want to adopt a study methodology to comply with newly requested information sooner rather than later.

Evolution of Research Credit Claims

Form 6765 currently requires reporting of quantitative information related to the R&D tax credit computation; however, recent court cases have highlighted the IRS’ increased demand for taxpayers to adequately support the R&D credits claimed through detailed project accounting records and contemporaneous documentation, e.g., Little Sandy Coal v. Commissioner, Betz v. Commissioner, or Leon Max v. Commissioner. Further, in 2021, the IRS began requiring certain qualitative information to be submitted with an amended return that generated a refund due to a research credit through the CCM. The new draft Form 6765 formalizes the heightened support requirements sought by IRS examiners for all taxpayers who seek to claim an R&D tax credit.

Summary of Changes to Form 6765

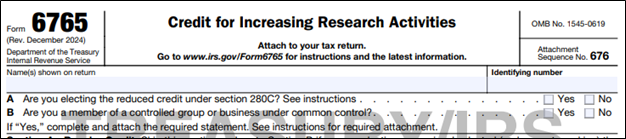

As mentioned earlier, the draft Form 6765 requires qualitative information to be filed with the credit. Prior to Section A, taxpayers will answer two questions regarding the reduced credit election and classification as a controlled group or business under common control. Within Section E of the form, taxpayers will be required to answer five additional questions of “Other Information,” all in regard to qualitative information. In Section G, taxpayers will have to identify each business component and provide information sought to be discovered on a per component basis. It also is here in Section G where taxpayers provide qualified research expenses by business component.

Details of Changes to Form 6765

The first question, Item A, gives taxpayers the option to elect the reduced credit under IRC §280C. The second question, Item B, asks if the taxpayer is a member of a controlled group or business under common control. This remains the same request as presented in the initial release of proposed changes.

Section E – Other Information

The addition of Section E – Other Information consists of five new questions for all taxpayers to complete. This section is consistent with Section E in the proposed changes. The five questions are shown below.

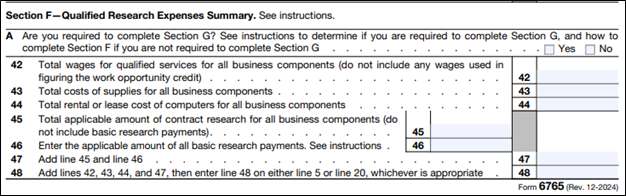

Section F – Qualified Research Expenses Summary

The addition of Section F – Qualified Research Expenses Summary, is simply a summary of QREs by cost type. It is here in Section F where total QREs are calculated for purposes of completing the credit computation under Section A – Regular Credit or Section B – Alternative Simplified Credit. This section is new to the form, but the information remains the same as to what taxpayers have previously provided for credit claims.

In addition, it’s worth noting the checkbox on row A of this section. Should the taxpayer not be required to complete Section G of this form, the taxpayer is to review instructions for how to complete Section F. Instructions will be released at a later date.

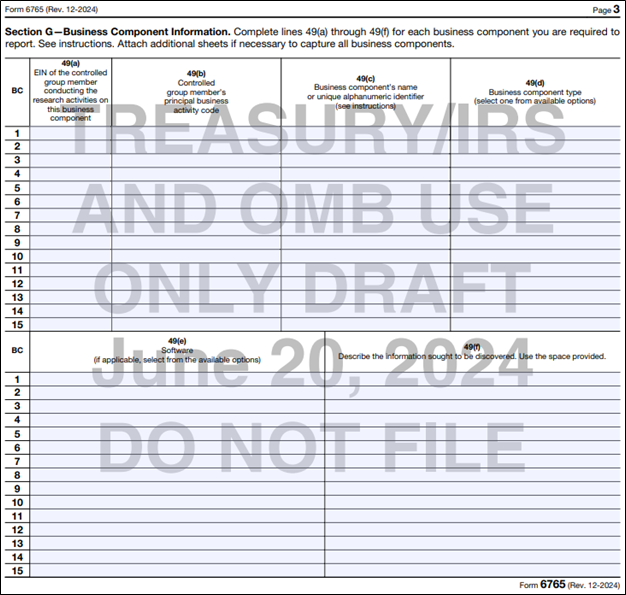

Section G – Business Component Information

The addition of Section G – Business Component Information, is the largest administrative burden of the form changes and what taxpayers have been eager to see change since the proposed changes issued last September.

The IRS reduced the number of business components that must be reported in Section G compared to the proposed changes. Taxpayers should report Section G information for 80% of total QREs in descending order by the amount of total QREs per business component, but no more than 50 business components (with special instructions for taxpayers using the ASC 730 guidance who can report ASC 730 QREs as a single line item on Section G).

In addition, the amount of information that must be provided with respect to the reduced number of business components on Section G also has been reduced compared to the proposed changes. For example, the IRS eliminated whether a business component is new/improved, a sale/license/lease, and the narrative requirement (for original returns) that describes the information sought to be discovered. The selections for the type of business component are reduced, and the definitions for officers, controlled group reporting, and business component descriptive names will be clarified in the instructions.

Perhaps most pertinent to taxpayers is that the IRS has provided that the revised Section G will be optional for all filers for tax year 2024 (processing year 2025). This will allow taxpayers time to transition to the Section G format. Section G will be effective for tax year 2025 (processing year 2026), subject to qualifiers in the instructions.

According to the IRS, beyond the optional reporting of Section G for all filers in tax year 2024, Section G will remain optional for the following taxpayers going forward:

- QSB taxpayers, defined under §41(h)(1) & (2), who check the box to claim a reduced payroll tax credit; or

- Taxpayers with total QREs equal to or less than $1.5 million, determined at the control group level, and equal to or less than $50 million of gross receipts, as determined under §448(c)(3) (without regard to subparagraph (A) thereof), claiming a research credit on an originally filed return.

Implications & Observations

While the draft Form 6765 provides some clarity on what information will be required to file future research credit claims, uncertainty remains related to the additions of Sections E and G. The concerns below related to each section remain mostly the same as when the proposed changes were issued in September 2023 and should be noted by taxpayers who plan to claim R&D credits in future years.

Potential Taxpayer Questions

The draft Form 6765 generates additional questions. In the release of the draft form, the IRS has provided that instructions will be released at a later date, which should provide clarity on potential taxpayer questions. However, as of now, certain items on the updated form create uncertainty for the taxpayer.

Section E Question

- In Section E, line 48, how does the IRS define a “new category of expenditures”?

Section G Questions

- What is the IRS’ expectation for the business components reported on Form 6765? In the past, the IRS has accepted grouping of business components by product line or cost center.

- Is the intent of Section G to require reporting at the product level?

- How do the shrink-back rule and recent case law complicate this reporting?

- What level of detail is required in explaining the information sought to be discovered (line 49(f))? We can look to question 20 in the IRS’ Research credit claims (Section 41) on amended returns frequently asked questions as a starting point for the desired level of detail, but more clarification is needed from the IRS.

- What happens if a taxpayer does not complete Section G? Would the R&D tax credit claim be disallowed?

- How should taxpayers who utilize a statistical sample report their business components? Statistical sampling has been relied upon in situations where taxpayers have more business components than can be feasibly reported or documented, sometimes in excess of 1,000 business components per year. Would these taxpayers be required to provide the requested information in Section G for 80% of the business components in descending order, or just those that were selected in the statistical sample?

While draft Form 6765 still raises some questions, taxpayers should begin preparing for future credit claims. Taxpayers who wish to continue claiming research credits in future years should strongly consider adopting business component accounting, maintaining diligent records of business component development, and keeping contemporaneous documentation readily available to meet IRS expectations for R&D tax credit claims.

If you have any questions or need assistance, please reach out to a professional at Forvis Mazars.