Publishing note: At the time of this article’s publication, the current status of the SEC climate disclosure rule has been voluntarily stayed pending judicial review of consolidated challenges by the Court of Appeals for the Eighth Circuit.

On March 6, 2024, the SEC passed a significant new regulation, The Enhancement and Standardization of Climate-Related Disclosures for Investors, requiring public companies to provide detailed disclosures related to climate risks, impacts, and strategies. For many listed companies, preparing for these new disclosure requirements requires urgent action.

Understanding the New Requirements

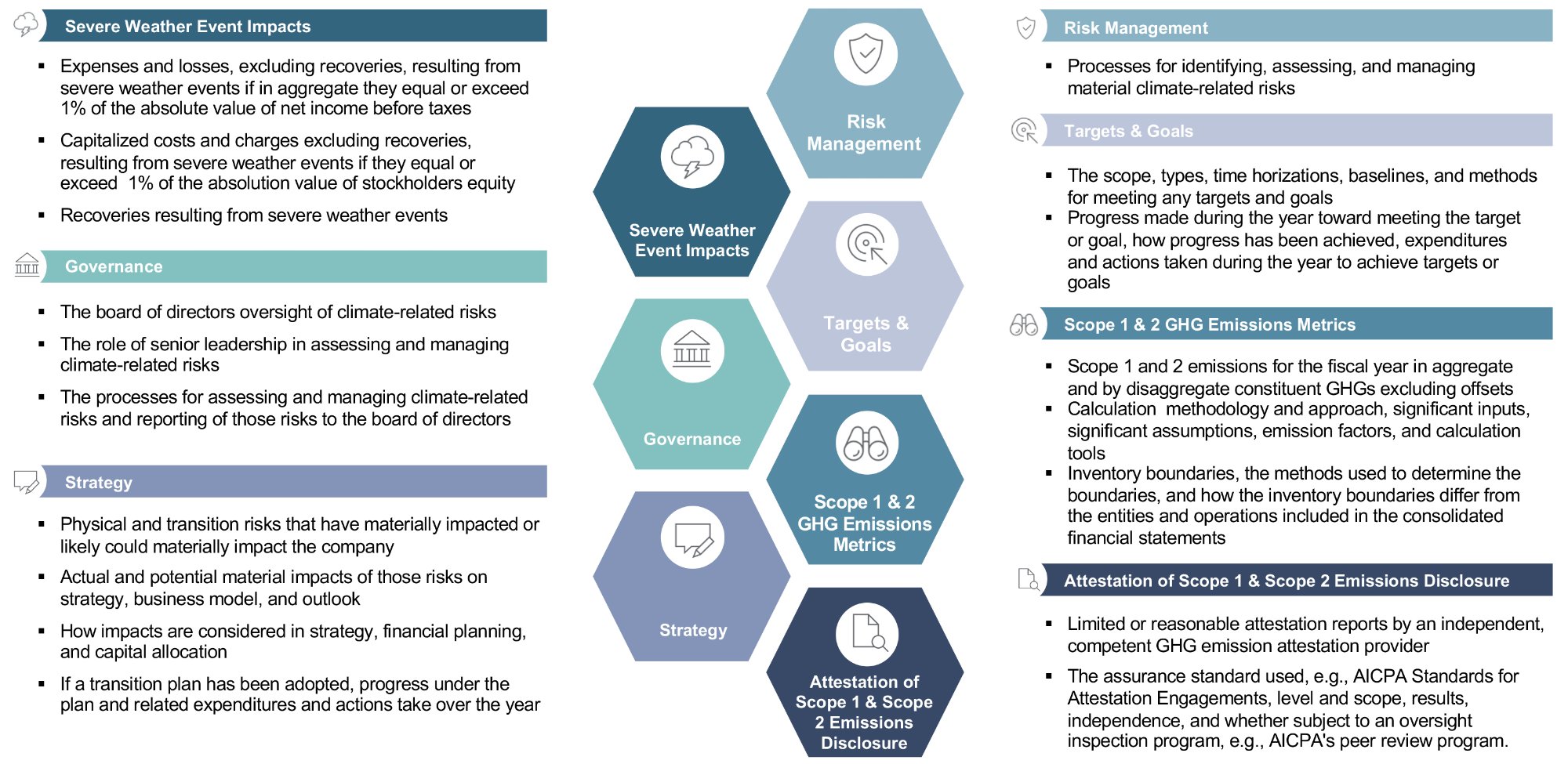

The rules require disclosing climate-related risks that are likely to have an actual or potential material impact on the company. It is important that organizations thoroughly review and understand the new requirements. Some key requirements include:

- Disclosing short-term, i.e., the next year, and long-term, i.e., beyond the next year, climate-related risks that are likely to have a material financial impact, including specific physical risks from severe weather events and longer-term weather patterns and transition risks from regulatory, technology, and market changes related to climate

- Outlining the governance, risk management processes, and oversight mechanisms related to identifying, assessing, and managing climate risks

- Explaining the actual and potential impacts of climate-related risks on strategy, business model, and outlook

- Describing any climate-related targets or goals and providing detailed plans and progress updates around target achievement

- Reporting emissions differences:

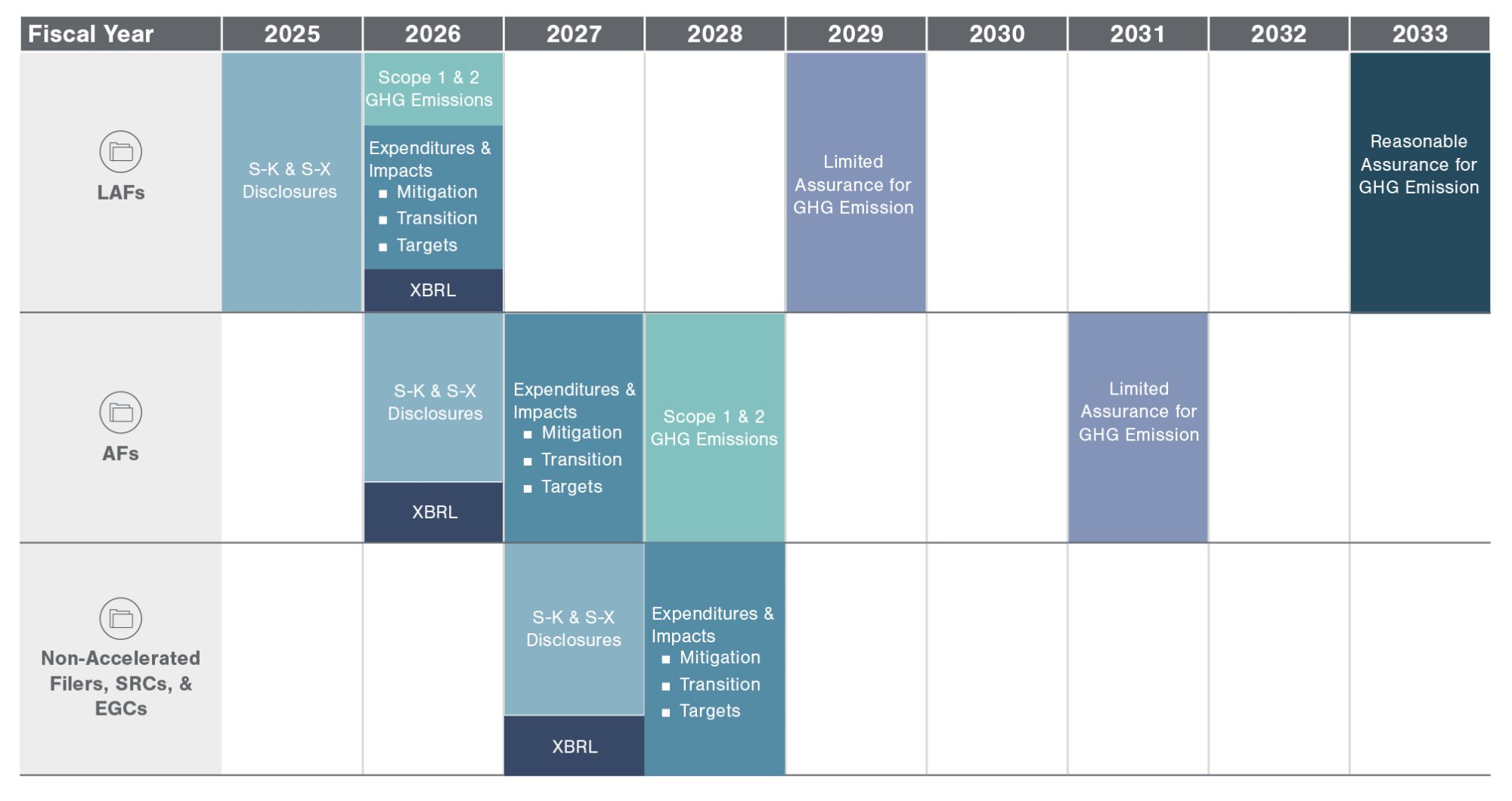

- Large, accelerated filers (LAFs) and accelerated filers (AFs) are required to report Scope 1 and 2 greenhouse gas (GHG) emissions and have those amounts assured.

- Non-accelerated, smaller reporting companies (SRCs), and emergent growth companies (EGCs) are not required to report emissions. There are detailed requirements around climate-related targets, transition planning, and risk management.

See Figure 1 for a summary overview of the requirements and Figure 2 for disclosure timelines.

Figure 1

While the rules, including form instructions, are only 45 pages, the 841 pages of preamble include the SEC’s guidance on key details to consider when complying with the rules.

While the rules, including form instructions, are only 45 pages, the 841 pages of preamble include the SEC’s guidance on key details to consider when complying with the rules.

Securing Resources

Even companies with robust climate disclosures will likely need to devote additional resources to understand and meet the new disclosure requirements. For companies that have yet to establish governance over climate-related risk or have begun reporting emissions, it is imperative to position for compliance with the new rules.

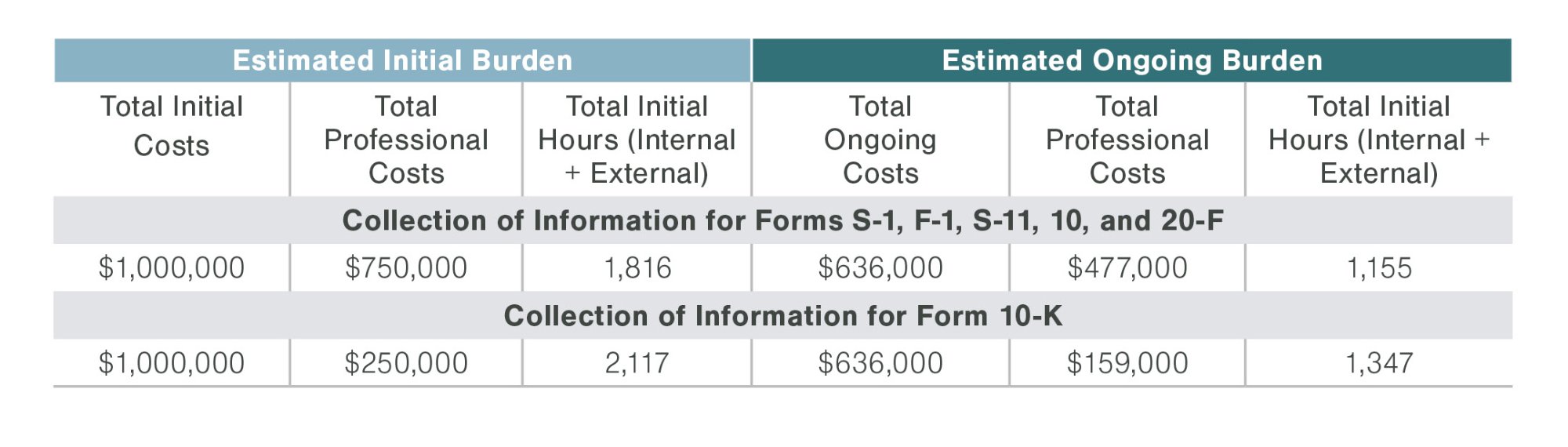

The SEC’s cost estimates for the average filer are included in Table 1. During the development of the rules, the SEC received comments indicating that the cost of compliance may be underrepresented.

Table 1: Initial & Ongoing Costs Estimates1

Obtaining organizational buy-in and securing the necessary resources is critical for success. By earmarking funds for implementation activities to meet the requirements of the rules, organizations can better address compliance risks and get value out of the exercise to potentially stand out in the market. If misstated, SEC disclosures can lead to severe consequences, including loss of investor confidence, financial penalties, and legal actions. A robust budget allows companies to invest in necessary tools, training, and personnel to help minimize compliance risks.

Obtaining organizational buy-in and securing the necessary resources is critical for success. By earmarking funds for implementation activities to meet the requirements of the rules, organizations can better address compliance risks and get value out of the exercise to potentially stand out in the market. If misstated, SEC disclosures can lead to severe consequences, including loss of investor confidence, financial penalties, and legal actions. A robust budget allows companies to invest in necessary tools, training, and personnel to help minimize compliance risks.

Figure 2

Conducting a Readiness Assessment

Organizations need to objectively gauge their current ability to produce the required climate disclosures and identify any gaps that need addressing. Key aspects to consider include:

- Climate risk and impact data and forecasting: Discern whether necessary data, metrics, and forecasting capabilities are available to help adequately identify, analyze, and quantify actual and potential climate risks and impacts.

- Risk management processes: Understand whether the existing enterprise risk management (ERM) framework is sufficient to help identify and mitigate climate-related risks.

- GHG emissions inventory management: Consider the organization’s ability to report GHG emissions by fiscal year, explain any differences between the GHG inventory boundaries and the consolidated financial statement boundaries, and meet attestation requirements based on the AICPA’s attestation standards.

- Resources: Identify the right in-house climate knowledge and qualified external advisory services to assist with compliance.

- Disclosure controls and process: Study the proper reporting processes, internal controls, and verification procedures in place to produce consistent, compliant climate disclosures.

If any of the above are identified as a gap, organizations should consider adding it to an SEC compliance road map and prioritizing these actions.

Create a Compliance Road Map

Once organizations have identified any preparedness gaps, a detailed road map should be created that lays out the key activities and investments required over time to help meet the new SEC climate disclosure rules. This road map should:

- Include a gap analysis comparing your current disclosure state versus required disclosures.

- Establish a timeline for enhancing data collection processes, reporting procedures, risk management frameworks, and capabilities. Phase improvements over time to spread effort and investment.

- Incorporate technology solutions to streamline data aggregation and reporting where possible. Automate disclosures for efficiency.

- Assign responsibility for specific road map actions to key individuals and teams.

- Build in a cadence of touch points to monitor progress and adjust plans as needed.

- Report progress to senior leadership and the board of directors.

The road map can serve as a detailed plan outlining the necessary steps to comply with the regulation. Organizations need to identify and study where efficiencies may be gained by building off of existing business processes, data collection efforts and reports, and IT systems to streamline reporting efforts.

Secure Organizational Buy-In & Build a Team

Organizations will need active engagement and buy-in across the organization to help comply with the SEC's climate disclosure rules. Key strategies for driving organizational alignment include:

- Educate and secure commitment from senior leadership and board members on the requirements of the rules, the timing, and resource requirements.

- Build a team to coordinate necessary inputs, internal controls, and disclosures by working closely with financial reporting, accounting, internal audit, risk management, operations, and investor relations teams to coordinate necessary inputs and disclosures. Bring in a trusted consultant to advise and supplement the team where needed.

- Utilize internal audit teams to inspect climate disclosures prior to release.

- Hire reputable, qualified third-party auditors to provide external support on climate disclosures.

Turning Compliance Into Strategic Opportunity

While the SEC climate disclosure rules represent a significant compliance obligation, it also provides strategic opportunities. Organizations should consider taking steps to:

- Link disclosures to the overall business strategy and sustainability commitments.

- Attract investors by going above and beyond minimum reporting requirements to showcase the company's sustainability leadership.

- Leverage enhanced climate data collection and reporting to uncover performance improvements, new risks, and opportunities for action.

Conclusion

With proactive planning, strong cross-functional collaboration, and a focus on transparency, organizations can create a robust SEC climate disclosure that complies with the regulation. The process can also be a springboard to reinforce a company's business strategy and improve operational and financial performance.

For more information, visit ESG & Climate Risk or reach out to one of our professionals.

- 1See PRA Table 3. Estimated Total Burden Hour Effects of the Final Rules in the SEC’s final rules: The Enhancement and Standardization of Climate-Related Disclosures for Investors.