August was the month of a NAIC National Meeting. Let’s be truthful here—sometimes NAIC National Meetings can seem long and tedious. But, since the meetings take place three times a year in a different location each time, they can be teamed up with more interesting activities either before or after the meeting. For example, the just-completed August meeting was in Seattle. What could be better than to team up the meeting with a cruise? Maybe a cruise to Alaska? Or, if the meeting is in December in Salt Lake City, how about a side trip to Park City and a dog sled ride? There are so many possibilities! Any one of them can make these regulatory meetings much nicer. With that in mind, below you will find summaries from this month’s National Meeting.

Life Risk-Based Capital (RBC) Working Group – August 13, 2023

Beginning bright and early at 8 a.m., the Working Group adopted the Life RBC Newsletter for this year-end and the 2022 Life RBC filing statistics. Both will soon be published on the Working Group’s webpage. Its working agenda was revised to remove the development of an economic scenario generator (ESG) (this is now being handled by the Generator of ESG Subgroup, which reports to both the A and E Committees) and to add the goal of monitoring the ESG governance framework and implementing use in statutory reserve and capital calculations. A few existing goal dates also were updated. The American Council of Life Insurers (ACLI) gave a presentation on proposed changes to the Life RBC formula for the handling of conforming repurchase agreements. The proposal was then exposed for a 45-day comment period, ending September 29. A brief discussion on the recently revised C-2 risk reporting format followed, but a more detailed meeting on the subject will be scheduled for September. As the last topic, the chair mentioned that one of the items the Working Group will look at going forward is covariance. This work will be in addition to work being done by the Academy and the Risk Evaluation Ad Hoc Group.

Statutory Accounting Principles Working Group (SAPWG) – August 13, 2023

The Working Group had a full agenda, with the meeting involving a lot of discussion on several different topics. It took the following actions.

| Reference # | Subject | Disposition |

|---|---|---|

| 2019-21 | Incorporates the principles-based bond definition into SSAP Nos. 21R, 26R, and 43R as of January 1, 2025. | Partially adopted/some re-exposed through September 29. (See below.) |

This is the principles-based bond definition that has been in the works for the last few years. The definition itself was adopted and will be incorporated into Statements of Standard Accounting Practice (SSAP) Nos. 21R, 26R, 43R, and a few other miscellaneous SSAPs. However, another set of related revisions to SSAP No. 21R was exposed for comment through September 29. The proposed language provides guidance for the accounting of debt securities that do not qualify as bonds, as well as measurement guidance for residuals. And finally, as part of the new proposal, a blanks proposal to revise Schedule BA reporting for debt securities that do not qualify as bonds also was exposed for comment. NAIC staff will work with the Valuations of Securities Task Force (VOSTF), the Capital Adequacy Task Force, and the Blanks Working Group (BWG) on the Schedule BA project.

| Reference # | Subject | Disposition |

|---|---|---|

| 2022-01 | Revises the definition of liability in SSAP No. 5R. | Adopted, effective immediately. |

| 2022-11 | Clarification in SSAP Nos. 20 and 21R that underlying collateral for collateral loans must be an admitted invested asset. | Re-exposed until September 12. |

This proposal was re-exposed for comment due to a last-minute letter received from the Securities Valuation Office (SVO) asking that fair value be allowed as an accounting option for SSAP No. 48 assets used as collateral. The key element here would be the optionality for valuation. Optionality is not usually provided for in statutory accounting. The original language indicates that these assets would use the net equity value for valuation and also would be required to have annual audits.

| Reference # | Subject | Disposition |

|---|---|---|

| 2022-12 | Nullification of INT 03-02: Modification to an Existing Intercompany Pooling Arrangement as of December 31, 2023. | Re-exposed through September 29. |

| 2022-14 | Would extend the definition of tax credits in SSAP Nos. 93 and 94R. | Re-exposed through September 29. |

| 2022-19 | Adopts INT 23-01: Net Negative (Disallowed) Interest Maintenance Reserve (IMR) through December 31, 2025. | Adopted, effective immediately. |

The above INT provides limited-time optional guidance allowing net negative (disallowed) IMR to be admitted where the reporting company has an authorized control level RBC ratio greater than 300% (after adjustments to remove admitted positive goodwill, electronic data processing equipment and operating software, deferred tax assets, and admitted IMR). The admitted amount also is limited to 10% of adjusted general account capital and surplus (same adjustments as above). There are some special limitations for unrealized gains from derivatives. In the statement, the asset will be reported as an aggregate write-in to miscellaneous other-than-invested assets and named “Admitted Disallowed IMR.” And finally, an amount equal to the general account admitted net negative IMR will be allocated from unassigned funds to an aggregate write-in for special surplus funds. The INT will be effective through December 31, 2025 and automatically nullified on January 1, 2026. However, the effective date can be nullified earlier or extended at any time, mostly depending upon work to be done by an ad hoc subgroup to work on a long-term solution. SAPWG NAIC staff will provide BWG with a disclosure memo for posting, providing year-end 2023 guidance. A blanks proposal will be developed to add disclosures and attestation requirements into the Notes and General Interrogatories for year-end 2024.

| Reference # | Subject | Disposition |

|---|---|---|

| 2023-01 | Review A/S instructions for included accounting guidance that should only be in SSAPs. | Will move forward and propose revisions as found. Asked for input from others. |

| 2023-02 | Revises SSAP No. 43R adding the modeling of collateral loan obligations (CLOs) and specifying CLOs do not qualify as legacy securities. | Adopted, effective immediately. |

| INT 23-02 | Proposed INT 23-02: Third Quarter 2023 Inflation Reduction Act – Corporate Alternative Minimum Tax (CAMT), recommends disclosure of whatever information is available regarding applicable reporting status for third-quarter reporting. | Exposed through September 12. |

| 2023-04 | INT 23-03 – CAMT Guidance provides guidance beginning with year-end 2023 reporting. | Exposed through September 12. |

The above two items are related, as both deal with issues of the CAMT. If adopted, INT 23-02 will officially cover third-quarter reporting. However, since the INT also would supersede existing accounting guidance, a two-thirds vote of the Working Group will be required for adoption. For the third quarter, if the reporting entity is able to make a reasonable estimate regarding the CAMT 2023 liabilities, the estimate should be disclosed. If a reasonable estimate is not determinable, that fact should be disclosed. Instead of opening and rewriting SSAP No. 101, SAPWG determined that INT 23-03 would be implemented for year-end 2023 reporting. The INT is more detailed than what had previously been discussed and also includes transitional guidance and disclosures. Paragraph 11c of SSAP No. 101 is specifically included. Remember, the CAMT will only apply to a limited number of insurers; those with average annual adjusted financial statement income in excess of $1 billion for the three prior taxable years (determined on a tax-controlled group basis).

| Reference # | Subject | Disposition |

|---|---|---|

| 2023-05 | Extends expiration date of INT 20-01 to December 21, 2024. | Adopted, effective immediately. |

| 2023-06 | Rejects Accounting Standards Update (ASU) 2021-10 as not applicable to SSAP No. 24 but adds disclosure of government assistance. | Adopted, effective immediately. |

| 2023-07 | Adopts with modification ASU 2019-08 by adding guidance in SSAP Nos. 95 and 104R to include share-based consideration payable to customers. | Adopted, effective immediately. |

| 2023-08 | ASU 2019-07, rejection. | Adopted, effective immediately. |

| 2023-09 | ASU 2020-09, rejection. | Adopted, effective immediately. |

| 2023-10 | ASU 2022-05, rejection. | Adopted, effective immediately. |

| 2023-12 | Addresses different types of residual investments that are reported in Schedule BA. | Re-exposed through September 12. Intend to adopt for 2023 year-end reporting. |

| 2023-13 | Revisions to SSAP No. 34 clarifying the statement disclosure of paid-in-kind interest. | Adopted, effective immediately. |

| 2023-14 | Provides an overall concept for a long-term project for Asset Valuation Reserve/IMR – SSAP No. 7 accounting guidance. | Nothing exposed but put on maintenance agenda to begin work. |

| 2023-15 | Would remove statement instructions permitting the specific allocation of non-interest-related losses to IMR. | Exposed through September 29. |

| 2023-16 | Requests regulator and industry input on further Schedule BA reporting categories under SSAP No. 48. | Exposed through September 29. |

| 2023-17 | Further restricts investments reported as cash equivalents and/or short-term under SSAP No. 2R. | Exposed through September 29. |

This revision further chisels out which investments can be included as cash equivalents in Schedule E – Part 2 and as short-term investments in Schedule DA. In concept, the only items that could be reported in these two schedules would be money market mutual funds, cash pooling, and issuer credit obligation bonds under SSAP No. 26R with maturity dates of three months or less (Schedule E – Part 1 reporting) or three to 12 months (Schedule DA reporting) from date of acquisition. Asset-backed bonds are already prohibited from being reported as cash equivalents or short-term investments. Not only is this proposal a direct outcome of the Bond Definition Project but also is a result of insurers trying to “play the system” by ending short-term collateral loan investments only to reissue those collateral loans from other lenders, maintaining an appearance of not being substantially similar.

| Reference # | Subject | Disposition |

|---|---|---|

| 2023-18 | Would adopt ASU 2016-19 with modifications to some GAAP technical corrections and improvements. | Exposed through September 29. |

| 2023-19 | Recommends rejection of ASU 2018-09. | Exposed through September 29. |

| 2023-20 | Recommends rejection of ASU 2020-10. | Exposed through September 29. |

| 2023-21 | Removes the 10-year transition guidance initially embedded in SSAP Nos. 92 and 102, as the 10-year period has passed. | Exposed through September 29. |

| 2023-22 | Clarifies in SSAP No. 54R that gross premium valuation under A-010 and cash-flow testing under Actuarial Guideline 11 are both required. | Exposed through September 29. |

The Working Group received an update on U.S. GAAP exposures.

Financial Regulation Standards and Accreditation (F) Committee – August 13, 2023

The F Committee announced that in an earlier regulator-to-regulator meeting, it voted to continue accreditation to Missouri, New Hampshire, South Dakota, and Texas. During this meeting, the Committee adopted the 2020 revisions to the Insurance Holding Company System Regulatory Act (#440) and the Insurance Holding Company System Model Regulation with Reporting Forms and Instructions (#450) as significant elements of Part A accreditation standards effective January 1, 2026. The adoption of these two models as accreditation standards would implement the group capital calculation (GCC) and a liquidity stress test (for Life insurers) for all states. The state commissioner, however, may grant an exemption from filing the GCC at least once or for groups meeting specific requirements. The group adopted its 2024 charges, with no changes from the 2023 charges.

Joint Meeting of the Financial Stability Task Force and the Macroprudential Working Group (MWG) – August 13, 2023

During the meeting, updates on Financial Stability Oversight Council developments and international issues were provided. The MWG provided current information on the status of its 13 main objectives. MWG assigned itself the following objectives:

- Operational, governance, and market conduct practices.

- Definition of private equity.

- Asset manager affiliates and disclaimers of affiliation.

- U.S. Department of Labor protections.

- State guaranty funds.

- Offshore/complex reinsurance.

Referrals to other groups include:

- The Group Solvency Issues Working Group regarding holding company structure, ownership, and control regulatory review.

- The Risk-Focused Surveillance Working Group regarding:

- Affiliated service agreements and Form D filings,

- Affiliated investment management agreements, and

- Owners of insurers with short-term focus and/or unwilling to support a troubled insurer.

- The SAPWG to identify related party-originated investments, including structured securities.

- The Life Actuarial Task Force regarding disclosure requirements for the risks of privately structured securities and how insurers model the risks and pension risk transfer business supported by complex investments.

- The VOSTF regarding reliance on rating agencies.

Some of these considerations will be ongoing for several years.

RBC Investment Risk and Evaluation Working Group – August 13, 2023

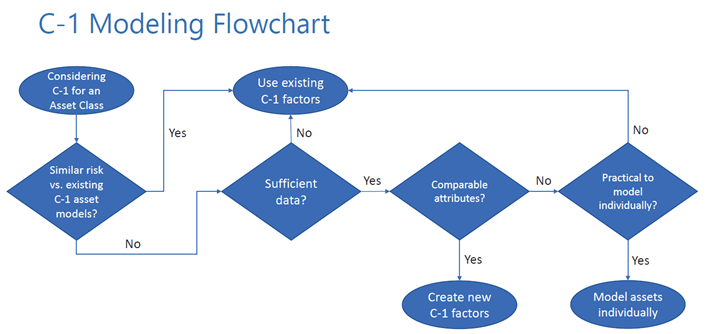

After hearing some updates on work being done by the VOSTF and SAPWG on issues of interest to this Working Group, the American Academy of Actuaries (Academy) provided a presentation on Structured Securities RBC. This may come as a surprise, but the Academy highlighted simplicity in its presentation; that is, more is not always better. The Academy began by stressing that assets handled separately within the C-1 of Life RBC (R-1 of Property RBC and H-1 of Health RBC) do not necessarily indicate the need for modeling and/or a new set of RBC factors. The presentation began with a discussion of the following flowchart, including an explanation of each of the decision possibilities it indicates.

Source: content.naic.org1

The Academy then went on to explain what it felt the seven principles of structured securities C-1 risk should be. They are as follows:

- The purpose of RBC is to help regulators identify weakly capitalized insurers; therefore, small inaccuracies in RBC requirements may not justify a change to the RBC formula.

- RBC measures the impact of risk on statutory surplus. Changes in accounting treatment will affect C-1 requirements.

- RBC arbitrage can only be measured for ABS where the underlying collateral has an established asset-class-specific C-1 requirement.

- The motivation behind creating an ABS structure should have no bearing on its C-1 requirements.

- C-1 requirements on ABS should treat the collateral as a dynamic pool of assets, incorporating future trading activity that is likely to occur based on historical data or mandated by the structure’s legal documents.

- RBC is based on the holdings of an insurer; assets not owned by an insurer should not impact its RBC.

- C-1 requirements for ABS should be calibrated to different risk measures where appropriate.

The presentation ended by asking which of the principles regulators supported and whether there ought to be other principles included in the RBC for asset-backed securities. For those interested in reviewing the presentation, it was posted on the Working Group’s website as part of the meeting’s material. Unlike many technical presentations by actuaries (sorry actuaries), this one is simple and easy to follow and understand.

Risk-Focused Surveillance Working Group – August 14, 2023

Although this Working Group is not a regular in Forvis Mazars’ NAIC summaries, it has a couple of projects of which everyone should be aware. The first project has been in the works for a while and is near fruition. The Working Group has crafted proposed changes to the NAIC’s Financial Analysis Handbook and Financial Condition Examiners Handbook providing additional guidance for state insurance regulators when reviewing service agreement between insurers and their affiliates. In particular, adjustments were made regarding cost-plus reimbursement contracts and the documentation insurers will need to provide to support such arrangements. After tweaking the latest edition of the revisions, the Working Group agreed to refer the guidance to the Financial Analysis Solvency Tools Working Group and the Financial Conditions Examiners Handbook Technical Group for adoption consideration. The second project is newer and resulted from a referral from the MWG. That issue is affiliated investment management agreements and capital maintenance agreements. The Working Group viewed a presentation on the topic, which pinpointed possible areas of concerns and questions to be addressed. The Working Group decided to form a drafting group and begin developing guidance for the agreements to be considered for the above NAIC handbooks.

Accounting Practices and Procedures Task Force – August 14, 2023

The meeting began with the Task Force adopting its 2024 charges. There are no changes in the goals from the previous year, which can be found on the Task Force’s webpage. The Task Force then heard and adopted the reports of its two working groups, SAPWG and BWG.

Executive Committee – August 14, 2023

During its meeting, the Committee adopted the report of the Audit Committee. The report provided an overview of proposed 2024 NAIC revenues, reappointed the NAIC’s audit firm to perform its 2023 audit, included a discussion on potential changes to the grant and zone financials, and provided an update on the 2024 budget calendar. Other reports that were received or adopted included the report of the Internal Administration Subcommittee, a cybersecurity report, the report of the Acting Chief Executive Officer, the National Insurance Producer Registry, the Interstate Insurance Product Regulation Commission, and the report of its task forces. A status report on the State Connected strategic plan was furnished.

Capital Adequacy Task Force – August 14, 2023

The Task Force adopted the minutes of the Health RBC, Life RBC, Property Casualty RBC, and RBC Investment Risk and Evaluation Working Groups. After adopting its working agenda, the Task Force exposed for comment through September 13 its 2024 proposed charges and a revised procedures document. The revised procedures apply to not only the Task Force, but also all of its Working Groups. The revisions emphasize deadlines for submitting RBC proposed changes to the Task Force and/or any of its Working Groups, responsibilities of the NAIC support staff, and what will be published and when by the NAIC. Both exposed items can be found on the Task Force’s webpage. After receiving an update on the activities of its Risk Evaluation Ad Hoc Group, the group then discussed the recent market turmoil and its possible impact on insurer investments.

Valuations of Securities Task Force (VOSTF) – August 14, 2023

After adopting 2024 charges, the Task Force received and discussed comments on a proposal to the amend the Purposes and Procedures Manual of the NAIC’s Investment Analysis Office (P&P Manual) regarding the definition of a NAIC designation. Based on the discussion and comments received, adoption was postponed pending further work. Most of the meeting’s time was spent on a proposed P&P Manual amendment that would give the SVO discretion over NAIC designations assigned through the Filing Exempt (FE) process. This issue is a direct result of work being done by the MWG. If adopted, this amendment would give the SVO authority to override NAIC designations derived through the FE process. As one might imagine, this is a very controversial topic. Several comments were received on the matter, both in writing and verbally. The big question is, why should the SVO be given such power? Commenters pointed out that the FE process uses ratings provided by NAIC-approved credit rating providers (CRPs). Not only are these CRPs approved by the NAIC, but also are governed by the SEC, which in turn has designated the CRPs as Nationally Recognized Statistical Rating Organizations (NRSROs). Since the SVO has maintained for years that it is not a rating agency, what has changed to now make it more knowledgeable than the NRSROs? Again, the only action taken at this meeting was to hold more discussions on the topic. However, the VOSTF has crafted a set of questions to submit to the different CRPs to assist regulators in better understanding the role of CRPs in insurance financial solvency regulation. Updates were provided to the Task Force on the Structured Securities Group’s work on modeling of collateralized loan obligations and work being done by the SAPWG involving investments.

Health Insurance and Managed Care (B) Committee – August 14, 2023

The B Committee heard reports/updates from the following:

- Consumer Information Subgroup

- Health Innovations Working Group

- Health Actuarial Task Force

- Regulatory Framework Task Force

- Senior Issue Task Force

- Consumer Information Working Group

- Special Committee on Race and Insurance Health Workstream

A panel discussion was presented on preventive services from a consumer-focused perspective. The presentation included the Affordable Care Act’s preventive service requirements and the fact that despite these services being available with no cost-sharing to the covered member, those services were not well utilized, especially in certain communities. The presenters included recommendations for state insurance regulators to address the issue. The Committee heard an update on the Medicaid redetermination process following the end of the COVID-19 public health emergency.

Life Insurance and Annuities (A) Committee – August 15, 2023

During this meeting, the Committee adopted the report of the Life Actuarial Task Force. Noble Consulting Services provided a report on the risks facing the life and annuity industry, while the United Services Automobile Association discussed the unique life insurance needs of the military. The meeting ended with an update of the Life Workstream of the Special Committee on Race and Insurance.

Financial Conditions (E) Committee – August 15, 2023

This meeting was very routine and began with the adoption of the minutes of its Task Forces and Working Groups. Two items were pulled out of the individual minutes for discussion by the Committee. Those items were the Macroprudential Reinsurance Worksheet and Interpretation (INT) 23-01: Net Negative (Disallowed) IMR, which had been adopted earlier by SAPWG. Both items were adopted, with New York abstaining from the INT 23-01 vote. The next order of business was supposed to be a presentation on the use of artificial intelligence (AI) by Canadian regulators. However, not much time was devoted to the use of AI, but rather how the presenter had designed worksheets to accelerate regulatory work and then convinced “seasoned” regulators to use them. The final order of business was a discussion on a possible framework for insurer investment regulation. A document, Framework for Regulation of Insurer Investments – A Holistic Review, was released for comment through October 2. The paper touches upon several insurer investment topics but does appear to support the concept of developing an effective governance structure for the due diligence of CRPs. The memo provides what are referred to as “concrete proposals” for the modernization of the role and capabilities of the SVO and “high-level guidelines” for considering consistency of capital across assets while recognizing the limitations of absolute capital parity. The document also stresses use of external consultants for many of its recommendations, renaming of the SVO and VOSTF to better reflect responsibilities, and possibly reduce the size of the VOSTF membership (or its successor) to encourage active regulator engagement on issues. (In other words, the current task force has too many members.)

Property and Casualty Insurance (C) Committee – August 15, 2023

After adopting the minutes/reports of its task forces and working groups, the C Committee adopted Understanding the Market for Cannabis Insurance: 2023 Update, an updated white paper from the 2019 version. The group heard two different presentations. One was from the Consumer Federation of America on telematics and the need for regulatory guidance in several of its uses, followed by a consumer representative presentation on the problem of homeowners being underinsured. The Committee discussed public school insurance but decided to cover this issue in more detail at a later time. It was announced that a state regulator drafting group is developing a data call to collect property insurance data to better understand property insurance markets and the insurance protection gap.

Market Regulation and Consumer Affairs (D) Committee – August 15, 2023

The D Committee adopted the reports of its task forces and working groups. It adopted revisions to the collaboration actions chapter of the Market Regulation Handbook to provide more transparency to states about the Multistate Settlement Agreement process. The Voluntary Market Regulation Certification Program also was adopted. This program establishes and maintains minimum standards promoting sound practices relating to the market conduct examination, market analysts, and related activity. An update on international issues regarding the activities of the International Association of Insurance Supervisors’ Market Conduct Working Group was provided. The meeting ended with a presentation from Missouri on data visualization for market analysis. What is data visualization? It is the graphical representation of information and data. The idea is that by using visual elements like charts, graphs, and maps, data is easier to understand.

Joint Meeting Executive Committee and Plenary – August 16, 2023

This final meeting wrapped up the NAIC’s Summer National Meeting. After adopting by consent the committee, subcommittee, and task force minutes, several other group reports were received. (Adoption of minutes/reports is required only if something needs to be approved for implementation. Receiving a report happens when it only includes activities but no adoptions and/or revisions to regulatory items that would need approval.) Amendments to the 2024 Valuation Manual, the Nonadmitted Insurance Model Act (#870), and the Mortgage Guaranty Insurance Model Act (#630) also were approved. The white paper, Understanding the Market for Cannabis Insurance: 2022 Update, was adopted and recent activity by the E Committee involving residual investments was approved.

Ending Note

Seattle averages 156 days of rain annually. That’s like rain every other day. Luckily there was no rain during this National Meeting. Unluckily, however, the temperatures were much higher than the average 72 degrees for August. Temperatures were well into the 90s, which those living in Seattle complained about (a lot) and made those visiting from the Midwest feel right at home (which was not needed).

If you have any questions or need assistance, please reach out to a professional at Forvis Mazars or use the Contact Us form below.

- 1“Principles for Structure Securities RBC,” American Academy of Actuaries, Presentation to NAIC’s RBCIRE, content.naic.org, August 13, 2023.