On November 29, 2024, Treasury and the IRS issued proposed regulations for previously taxed earnings and profits (PTEP) under Section 959. The PTEP regulations include regulations that address basis adjustments under Section 961. The proposed §961 regulations give long-awaited guidance to the existing rules that allow a basis adjustment for PTEP when earned or distributed. The purpose of the basis increase is to prevent double taxation of the inclusion upon a subsequent sale or exchange of stock in a controlled foreign corporation (CFC). In correlation, the purpose of the basis reduction is to prevent a double benefit when a recognition event occurs.

Background

Section 961(a) allows for an increase in a U.S. shareholder’s basis in CFC stock, with respect to income that has been previously taxed under §951(a) or §951A, and therefore shielding future gain when there is undistributed PTEP within a CFC. Section 961(b)(1) provides that when a U.S. shareholder receives an amount excluded from gross income under §959(a), the basis of the stock or other property is reduced by the amount that is excluded. Further, if the amount excluded exceeds the basis of the stock or other property, then §961(b)(2) indicates that this amount is treated as a gain from the sale or exchange of such property.

Property Unit and Basis Adjustment

The proposed regulations under §961 provide for three types of basis adjustments. The types of basis adjustments depend on whether the direct owner of the “property unit” is a covered shareholder1, partnership, or CFC. The three types of property units are:

- 961(a) ownership unit and adjusted basis: A §961(a) ownership unit is a share of stock of a foreign corporation directly owned by a covered shareholder, or a partnership interest directly owned by a covered shareholder, and through which the covered shareholder owns stock of a foreign corporation. The basis adjustment is made by the covered shareholder on the basis of the property unit it owns.

- Derivative ownership units and derived basis: A derivative ownership unit is a share of foreign stock held by a partnership and thus indirectly owned by a covered shareholder. It also includes interest in a lower-tier partnership, but it does not include shares held by foreign corporations. The partnership is allocated as a derived basis in a derivative ownership unit, maintained separately with respect to each covered shareholder. The basis may be positive or negative and operates similarly to basis adjustments under §743(b).

- 961(c) ownership units and §961(c) basis: A §961(c) ownership unit is a share of stock held by a CFC in a foreign corporation and owned indirectly by a covered shareholder. Each share of stock in the foreign corporation is considered a separate section. §961(c) basis is maintained for each covered shareholder that indirectly owns the unit. Even though the regulations are written to apply to a foreign corporation, the drafted regulations only apply to shares of stock in CFCs. Treasury and the IRS are considering whether these rules should be extended to foreign corporations or interest in partnerships held by foreign corporations, including CFCs. This proposal can allow for basis adjustments to be made down a chain of CFCs for global intangible low-taxed income (GILTI) inclusions from lower-tier CFCs.

Share-by-Share Approach

The proposed regulations differ from prior proposed regulations by emphasizing that the §961(a) basis is tracked per share and does not shift to another share when PTEP is distributed on the other share. These revised share-by-share rules under §961(a), when co-mingled with other PTEP sharing regulations, leave the potential for unexpected gains to be triggered. It is important to keep an eye on transactions in which PTEP distributions create the negative derived basis or when a negative basis may impact CFC stock transfers and certain nonrecognition transactions. Also, with the share-by-share approach, results could allow for losses in one share not offsetting gains from other shares.

Increases in the basis of the property unit are generally based on a hypothetical distribution rule equal to the amount of the income inclusion recognized by the covered shareholder based on the last day of the CFC’s tax year. There is an actual distribution rule if a CFC distributes PTEP before the last day of the tax year. Under either rule, the basis adjustments are made at the beginning of the year.

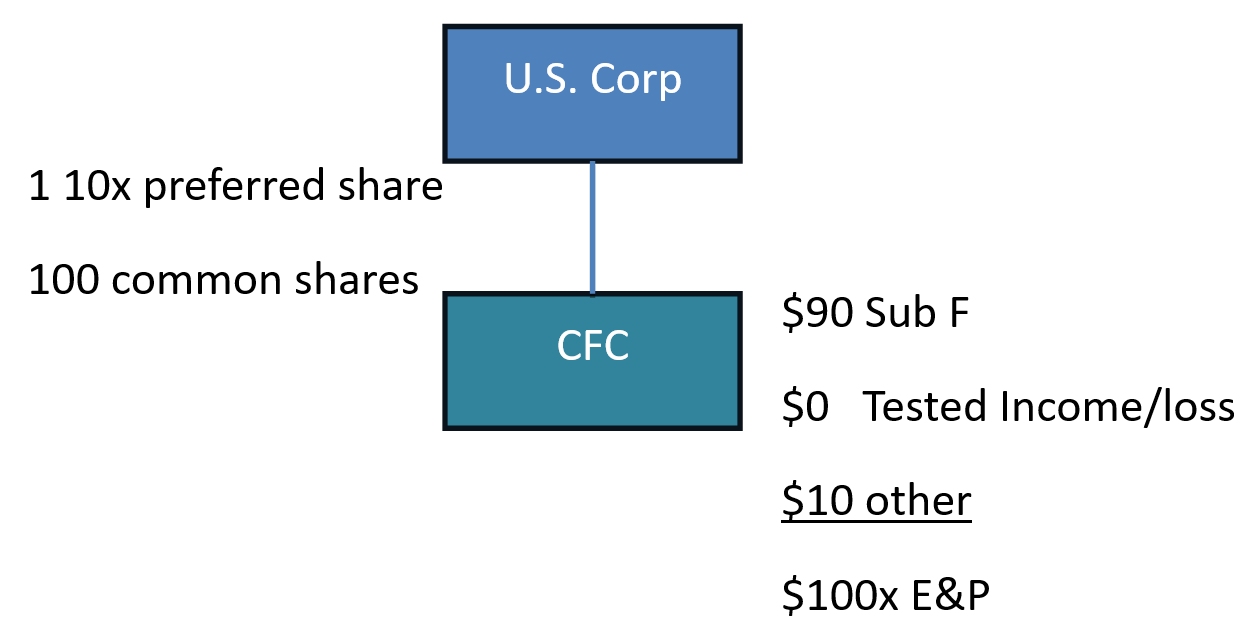

The following example illustrates these rules from the Preamble:

In this example, $90 of PTEP is created under §959 for the Subpart F inclusion. While only $9 of the $90 PTEP income is attributable to the preferred share, the proposed regulations increase the basis of the preferred share by $10 and the common shares by $80, as the first $10 of PTEP is likely to be distributed to the preferred share. The reasoning behind the difference between the income and the basis allocation is if only the income amount of PTEP is allocated, and the first $10 is distributed to the preferred share and thus, a $1 gain is created under §961(b)(2).

Tracking the basis on a share-by-share basis requires a bit more work than the previous guidance and will likely bring additional reporting requirements in the future.

How Forvis Mazars Can Help

The proposed PTEP regulations create additional complexity for taxpayers as the rules can apply at both the shareholder and corporate levels. Our tax professionals can help look over your situation so you can better understand your options. If you have questions or need assistance, please reach out to a professional at Forvis Mazars.

- 1A “covered shareholder” is defined as a U.S. person other than a domestic partnership.