On November 1, 2024, CMS issued the 2025 Medicare Physician Fee Schedule Final Rule. The rule finalized a number of significant policies that will impact how Rural Health Clinics (RHCs) operate, and are ultimately reimbursed for, services provided.

RHC Productivity Standards

Effective for cost report periods beginning on or after January 1, 2025, RHCs will no longer be required to meet provider productivity standards and risk negative impacts to the RHC’s all-inclusive rate if those productivity standards are not met. While RHCs will no longer be negatively impacted if providers fail to meet the historical productivity standards (4,200 visits per full-time equivalent (FTE) physician and 2,100 visits per FTE Advanced Practice Providers), we recommend management closely monitor the productivity of those providers against historical trends and industry benchmarks to identify areas of opportunity to improve volumes and explore staffing models for the clinic.

RHC Primary Care Requirement Clarification

Historically, RHCs were expected to be “primarily engaged” in furnishing primary care services, which has been interpreted to mean that 51% of the RHCs available provider hours and/or the number of patient encounters must be related to primary care. In an effort to increase flexibility for RHCs, decrease provider burden, and improve access to specialty care for the communities served by RHCs, CMS is changing its requirement to state that RHCs must provide primary care services.

We recommend current or future RHCs explore if it would be beneficial to incorporate specialty services in the RHC based on provider availability and the needs of the communities they serve. We also recommend RHCs provide sufficient primary care services to serve their communities, even though the 51% primary care threshold is being removed.

Changes to RHC Required Labs

CMS has finalized the removal of two (2) of the six (6) labs that are required to be performed by RHCs:

- Hemoglobin and hematocrit

- Examination of stool specimens for occult blood

Payment for Preventive Vaccine Costs

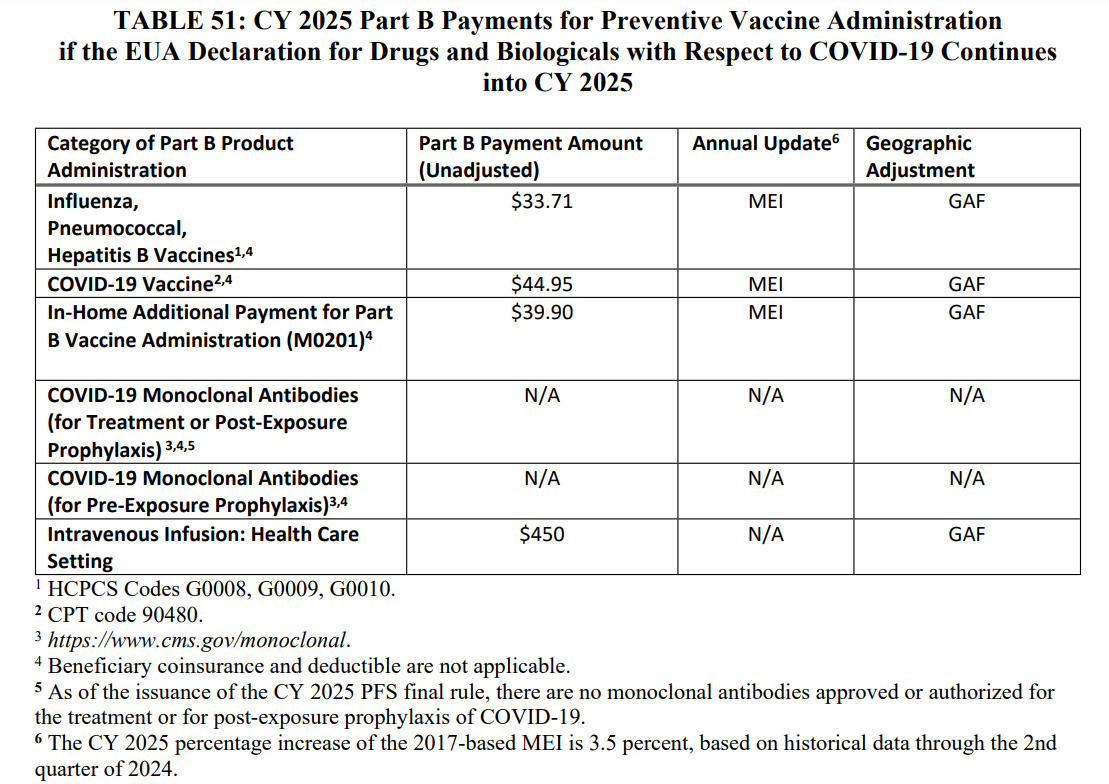

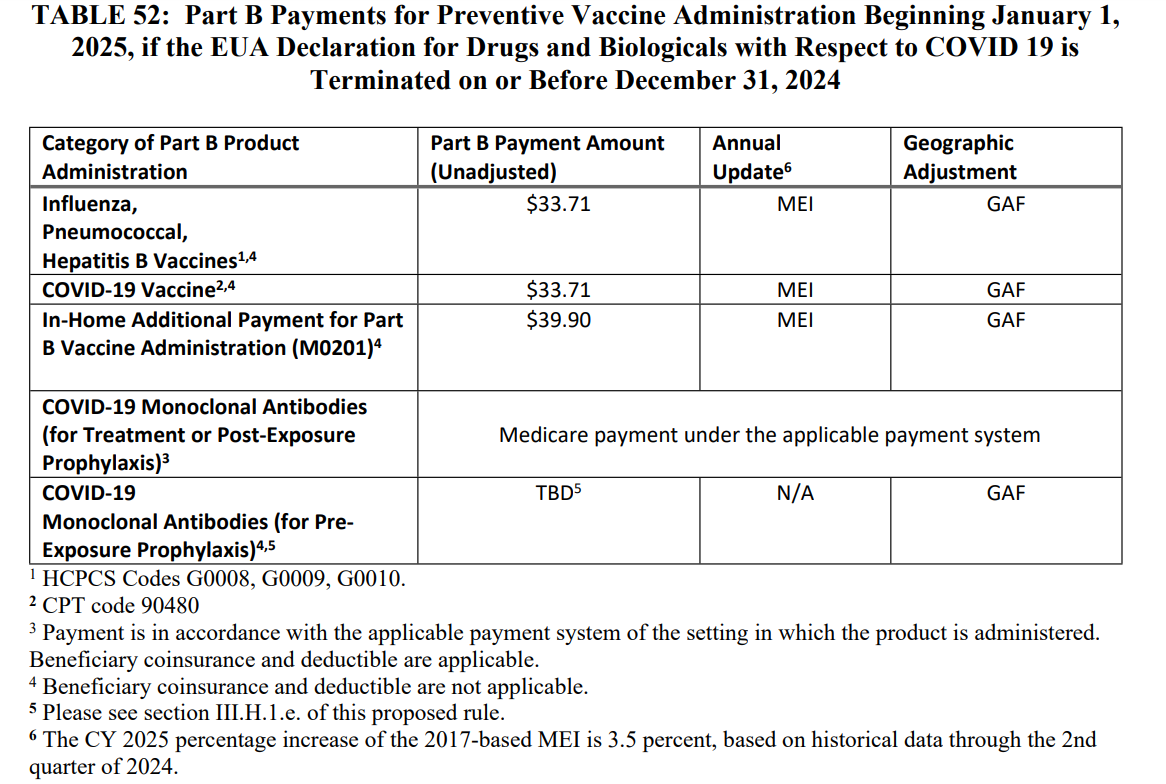

The final rule will allow for RHCs and FQHCs to help improve their cash flows by allowing the organizations to bill and be paid by Part B for preventive vaccines and their administration at the time of service. Payments for these claims will be made according to Part B payment rates and will be reconciled when the organization submits the annual cost report. Tables 51 and 52 below outline the payment rates for these preventive vaccines under Part B:

Source: “Medicare and Medicaid Programs: Calendar Year 2025 Payment Policies under the Physician Fee Schedule and Other Changes to Part B Payment and Coverage Policies; Medicare Shared Savings Program Requirements; Medicare Prescription Drug Inflation Rebate Program; Medicare Overpayments,” federalregister.gov.

Source: “Medicare and Medicaid Programs: Calendar Year 2025 Payment Policies under the Physician Fee Schedule and Other Changes to Part B Payment and Coverage Policies; Medicare Shared Savings Program Requirements; Medicare Prescription Drug Inflation Rebate Program; Medicare Overpayments,” federalregister.gov.

Because of the system changes that will need to be implemented to allow for these Part B reimbursements, CMS will allow RHCs and FQHCs to bill for the administration of those vaccines effective for dates of service beginning on or after July 1, 2025.

We recommend that RHCs begin working with their billing systems and revenue cycle vendors to understand what changes need to be made to be able to bill for these services at the time of service. We also recommend RHCs continue to maintain accurate and detailed records of the vaccines performed in their clinics so an accurate reconciliation may be performed when the annual cost report is filed.

Changes to Care Coordination Services

Historically, RHCs and FQHCs were only eligible to bill for care coordination services using Current Procedural Terminology (CPT) code G0511 and were reimbursed under a special payment rule. The final rule updates this policy to allow RHCs to report individual CPT and Health Care Common Procedure Coding System (HCPCS) codes that describe the specific care coordination service provided. CMS is implementing a transition period until at least July 1, 2025, to allow RHCs to update their billing systems to submit these individual CPT and HCPCS codes. The nonfacility physician fee schedule amount will be paid when the individual code is on an RHC claim, either alone or with other payable services.

CMS has also finalized a policy that allows RHCs to bill add-on codes associated with those care coordination services, improving the payment accuracy when care coordination services are rendered.

The ability to bill for individual CPT codes and add-on codes, as opposed to billing for services using CPT code G0511, will likely provide RHCs with a greater level of visibility into the care management services being rendered to the patients served by the clinic. It should be noted that because the individual CPT codes will be billed, there is a chance that the reimbursement of those CPT codes may be less than what the clinic may have received when code G0511 was submitted.

RHC & FQHC Telecommunication Services

CMS will continue to allow telecommunication services rendered via interactive audio and video telecommunications through December 31, 2025. These services will continue to be billed using HCPCS code G2025. Payment for behavioral health services performed via telecommunications will be made at the RHC’s all-inclusive rate, while nonbehavioral health services will be reimbursed at a weighted average of all telehealth services on the telehealth list. The final rule also continues the policy to delay the in-person visit requirement for mental health services until January 1, 2026.

It should be noted that nonmental health telehealth visits will still be reimbursed at a special payment rate as opposed to the clinic’s all-inclusive rate. In addition, those nonmental health telehealth visits should not be included in visit counts for the RHC on the annual cost report. We recommend RHCs continue to understand the role of telehealth services in their clinics, specifically for those patients who may face transportation difficulty or need to see a specialist that is not available at the RHC or the RHC’s parent hospital.

Intensive Outpatient Program (IOP) Services in RHCs & FQHCs

While the current IOP payment amount for RHCs, based on three services offered per day, CMS has finalized a new payment rate for IOP services when four or more services are offered per day. The new payment rate will be in alignment with the IOP payment rate for hospital outpatient departments when four or more IOP services are offered per day. The time and space required for IOP services will still need to be excluded from the RHC’s cost on the annual cost report. However, the increased reimbursement may offset decreases to the allowable costs on the cost report, allowing some RHCs to implement IOP services in their clinic without decreasing the total reimbursement received. We recommend RHCs consider the need for IOP services in their market and calculate the potential financial impact of implementing those services.

Dental Services in RHCs & FQHCs

The final rule clarifies that RHCs will be paid under the all-inclusive rate methodology when dental services are related to other covered medical services. The final rule also clarifies that a dental service may be separately billed from a medical visit on the same day, as long as the dental service is related to other covered medical services.

We recommend RHCs consider the community’s need for dental services and the RHC’s ability to provide those services. Organizations will need to consider the cost of establishing a dental practice if one is not already in place as well as the need to recruit a dental provider willing to provide those services. If the RHC is able to recruit a dental provider and a sufficient community need exists, the addition of the dental service line may present an opportunity to increase services offered to the community as well as the reimbursement received by the clinic.

The changes included above represent potentially major changes to the operations and financial performance of RHCs. Healthcare organizations that either currently operate or are considering RHC designation by CMS should carefully gauge the operational and reimbursement impacts of these changes. Organizations should also consult with their cost report preparers to prepare an estimate of the impact on operations, billing, or regulatory reimbursement for current or future RHCs.

If you have any questions about the impacts of the 2025 Medicare Physician Fee Schedule Final Rule to RHCs or would like assistance in understanding the impacts, please contact your advisor at Forvis Mazars.