The Private Company Council (PCC) is a FASB advisory body for private company accounting matters and helps develop GAAP alternatives to meet the unique needs of users of private company financial statements. FASB recently approved the issuance of an exposure draft that would create a private company alternative for the financial statement presentation of retainage.

In the construction industry, contracts often contain retainage provisions that allow a customer to withhold a portion of invoice billings (sometimes in an escrow account) until certain project milestones are met or the project is completed.

Before the adoption of Accounting Standards Codification (ASC) 606, Revenue from Contracts with Customers, industry practice was to present conditional retainage separately from billings in excess of costs (deferred revenue). Under ASC 606, retainage may be classified as a contract asset or as a receivable, depending on whether the payment is conditioned on the entity’s future performance. If the retainage is determined to be a contract asset, it must be netted with contract liabilities within the same contract for financial statement presentation. Some companies are voluntarily disclosing gross amounts in financial statement notes for surety companies, but under ASC 606, they are precluded from breaking out the amounts on the face of the financials. The construction and surety industries, as primary users of construction financial statements, have lobbied for easier-to-find decision-useful information on gross retainage amounts to accurately assess risk.

On October 16, 2024 FASB approved drafting an exposure draft, with a 45-day comment period. Proposal highlights include:

Scope. The accounting alternative would be limited to private construction contractors covered by ASC 910-10, Contractors-Construction.

Private Company Alternative. An in-scope private company would be allowed to separately present contract assets and contract liabilities on a gross basis on the balance sheet for all of a company’s contracts with customers. If elected, it would be applied entity wide to each of the company’s contracts and not on a contract-by-contract basis.

Transition. Adoption would be on a full retrospective basis and a private company would not need to justify preferability when the alternative is initially applied.

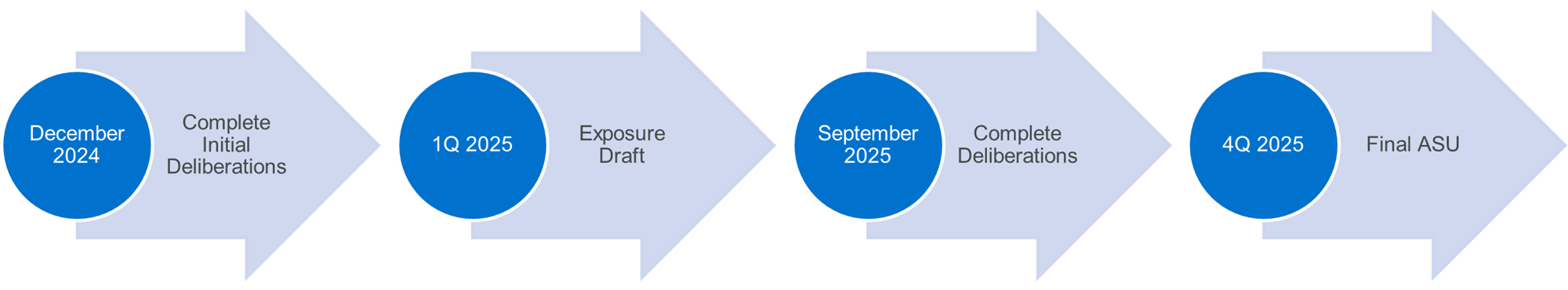

Tentative Project Time Frame

- December 2024: Complete Initial Deliberations

- 1Q 2025: Exposure Draft

- September 2025: Complete Deliberations

- 4Q 2025: Final ASU

Conclusion

We will continue to follow developments on this project. Our construction team at Forvis Mazars combines solid accounting and financial performance with long-range vision to help contractors reach their goals.

Our team of forward-thinking professionals work hard to help contractors improve their bottom line, increase cash flow, and maintain regulatory compliance. We work with all types of contractors, including heavy highway, general and specialty contractors, and specific construction mining. Numerous construction companies have trusted us to address various accounting needs and provide services that help take their organization to the next level.