The Inflation Reduction Act of 2022 (IRA) introduced multiple “bonus credits” that allow taxpayers to increase a “base” clean energy credit by various amounts. Perhaps the most high-impact is the “five times” bonus credit that multiplies the base credit by five. One way to accomplish this multiplier is by meeting the prevailing wage and apprenticeship (PWA) requirements. The IRS and the U.S. Department of the Treasury have released final regulations (T.D. 9998) that largely embraced the proposed regulations while providing additional clarity and addressing several critical issues. While not an exhaustive list of clarifications found in the final regulations, this article highlights key modifications from the proposed regulations and provides insight into essential points to consider.

Market Changes

Correlation? Growth in Clean Energy Jobs & Number of Apprentices

As a saying attributed to investor George Soros goes, “markets can influence the events they anticipate.”1 There is, therefore, a question as to whether the clean energy job market reflects the anticipation of the credits enacted by the IRA. The U.S. Department of Energy’s 2023 USEER shows a 3.9% national increase in the number of clean energy jobs from 2021 to 2022, and found the number of clean energy jobs grew across all 50 states and Washington, D.C.2 With this growth comes the expectation for a correlated increase in demand for qualified apprentices under the PWA guidance. For those credits eligible for the PWA bonus credit, each taxpayer, contractor, or subcontractor who employs four or more workers for construction alteration or repair work must employ one or more qualified apprentices. So, this begs the question—has this correlation proven itself in the U.S. market?

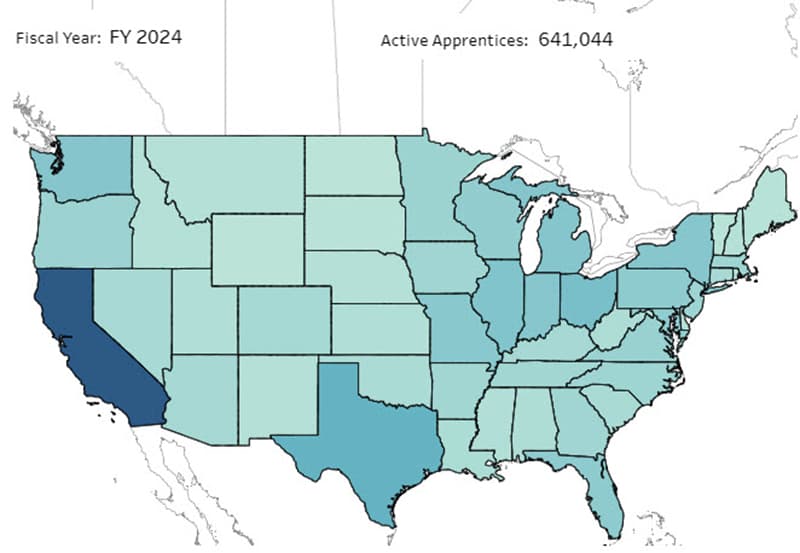

Certainly, there has been an increase since the IRA in the number of apprentices overall. According to apprenticeship.gov, active apprentices in the U.S. have increased from 580,458 in 2021 prior to the IRA to 641,044 in the 2024 post-IRA landscape.3 Interestingly, the map below of active apprentice locations shows some of the greatest concentration in California, Texas, and Ohio.

The USEER 2023 report also shows that these three states are among the country’s leaders in clean energy job growth generally—coming in at 3.6%, 5.5%, and 4.4% growth, respectively.4 Therefore, it seems there is at least some overlap in the two data points, which perhaps points to the conclusion that the IRA and PWA are operating as intended—to motivate the growth of jobs within the clean energy space and include qualified apprentices within those jobs.

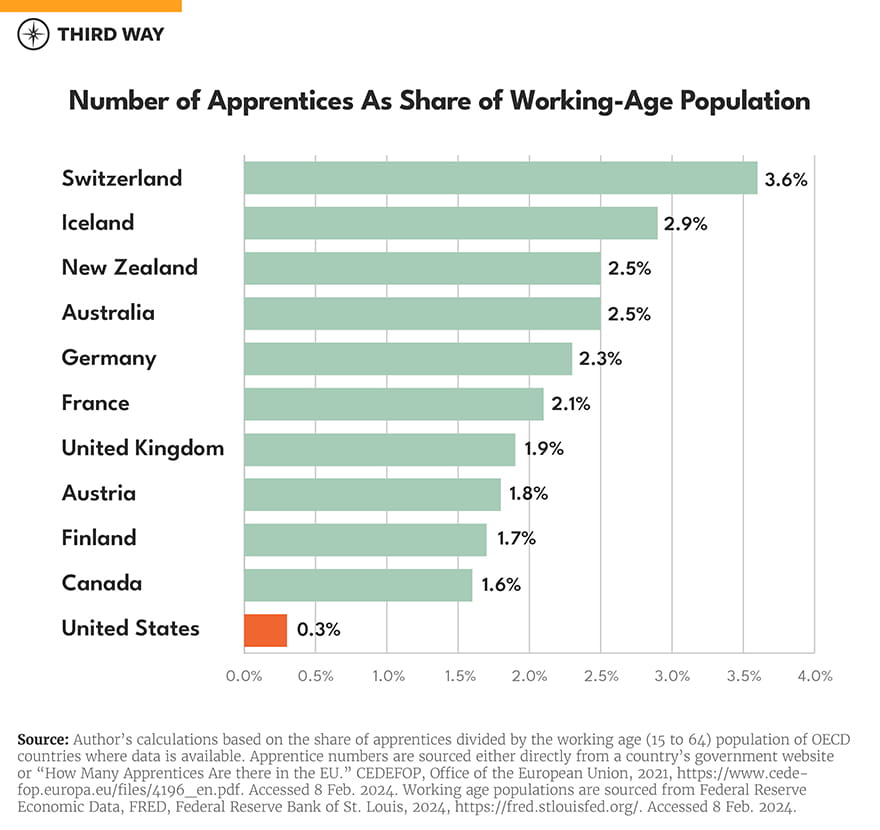

However, even with this increasing trend, as seen in the graph below, the U.S. falls far behind other countries globally in the same effort. Therefore, does this mean that the IRA has done enough to make up ground as a global player in this space? Is the U.S. on track for further improvement or should changes be made to legislation? Both are questions that voters and legislators should keep in mind for the 2024 election and as upcoming policy debates kick off for 2025.

Correlation? PWA Credits & Industry Development

In theory, the PWA “kicker” would incentivize taxpayers to pursue projects that would comply with and could benefit from the increased credit. It would seem that those PWA-friendly credits would motivate growth in certain clean energy industries with new credits enacted for alternative fuel vehicles and advanced energy projects. In 2023, new U.S. energy capacity development is led by the solar and battery storage industries.6 Both of these technologies also happen to have related credits with the potential to qualify for PWA. In this way, it would seem the correlation holds.

New clean energy jobs could be another measure of growth by industry. Further supportive of this correlation, the solar industry saw job gains at 12,256 workers in 2022, followed by land-based wind with 5,238 added jobs. However, electric vehicles (EVs) pose a complication to the soundness of the correlation in question. Clean energy job growth is led by the EV and battery manufacturing industries, with EVs adding more than 28,000 jobs and accounting for 59% of all net new jobs in motor vehicles.7 Certain states across the Southeast have even formed what is colloquially referred to as the “battery belt” as a result. Yet, while the EV charging station credit is eligible for the PWA bonus credit, the vehicle credits themselves are not. Therefore, whether this particular correlation pans out in reality is yet to be seen.

Likely Process Changes Required

The PWA requirements carry significant implications for developers, contractors, subcontractors, project owners, and investors alike. As the first year of the IRA implementation, 2023 saw many parties unaware of PWA requirements. Therefore, without clauses binding contractors, many projects were conducted without paying the prevailing wage or incorporating apprentices. After all, these requirements require potentially higher wage costs for the contractor and undoubtedly more administrative record-keeping. Even if prevailing wages and apprentices were considered, many taxpayers were left scrambling to substantiate their claim for the bonus credit. Therefore, moving forward given the potential monetary value of the clean energy incentives, the PWA requirements are poised to reshape some of the processes of those involved in clean energy projects.

The final regulations continually emphasize the significance of maintaining comprehensive records demonstrating compliance with the PWA requirements. Depending on their existing systems, project owners, contractors, subcontractors, and developers may need to enhance documentation of standard construction processes. This could involve, for example, any of the following:

- Incorporating additional clauses requiring compliance and substantiation in contracts

- Conducting more frequent and detailed reviews of payroll reports for laborers and mechanics, including those of contractors and subcontractors

- Developing and implementing an apprenticeship utilization plan

- Record-keeping of daily labor hours categorized by location, construction type, and labor classification

- Monitoring requests for qualified apprentices

- Diligent tracking of curing time frames and payments

For investors, adherence to these requirements should be incorporated into the due diligence process if purchasing a transferred credit or buying into a development entity.

Most High-Impact Changes

Prevailing Wage Date Determination: The final regulations were revised to specify that for those projects in which the taxpayer engages a contractor or subcontractor, prevailing rates are determined at the time of the contract’s execution rather than at the beginning of construction. These rates are applicable to all subcontractors and the contractor.

In cases where a taxpayer (or the taxpayer’s designee, assignee, or agent) executes multiple contractors through separate contracts, the prevailing wage rates for each contract—covering work performed by the contractor and subcontractors—are determined at the time of contract execution by the taxpayer or their representative.

If a contract is absent (aka the taxpayer performs the work themselves) or the date of contract execution cannot be ascertained, the final regulations stipulate applicable wage determinations are those in effect at the time construction starts.

Intentional Disregard: If the IRS determines that the failure to satisfy prevailing wage requirements is due to “intentional disregard,” the resulting correction payment increases substantially. In essence, the increased penalty is attempting to dissuade taxpayers from avoiding compliance with PWA rules and “taking the hit” of a correction payment in the effort of claiming the credit. Mathematically, it is simply not worth it to do so. Instead, regulations encourage taxpayer practices such as quarterly compliance reviews and flow-down contract provisions, which will assist taxpayers in complying with the prevailing wage requirements.

Good Faith Effort Exception: If a taxpayer meets the prevailing wage requirement and is deemed to have satisfied the apprenticeship requirements by the good faith effort exception, the “5 times” bonus credit is available to the taxpayer.

- A huge change from proposed regulations, final regulations stipulate that “automated or other non-substantive responses” are not in fact considered responses for the Good Faith Effort Exception. For example, sending a legitimate attempt to satisfy the apprenticeship requirements and getting an out-of-office message or automatic acknowledgment that the request was received with no other detail relating to the apprenticeship request submitted would not be considered a reply and would not preclude a taxpayer from relying on the Good Faith Effort Exception.

- Partial responses qualify for the exception to the extent the request was denied, as long as the taxpayer hires those qualified apprentices who were in fact available within the partial denial.

- The exception is met if there are no registered apprenticeship programs within a geographic area of the project.

- The exception now remains in effect for 365 days (up from 120 days) from the originally denied request or lack of response.

Qualifying Project Labor Agreement: While the IRS and Treasury do not require any taxpayer to sign a project labor agreement (PLA), they provide that if a taxpayer uses a qualifying PLA and any correction payments are made in a timely manner, no penalty payments are required. The final regulations clarify that qualifying PLAs must contain provisions to pay prevailing wage rates in accordance with the Davis-Bacon Act (DBA), which may require the payment of wages at rates higher than the wage rates required by the Internal Revenue Code (IRC).

Apprenticeship Requirements: Apprenticeship requirements apply only to the construction of the qualified facility, and not to alteration or repair work occurring after the facility is placed in service. The Labor Hours Requirement ceases to apply once the qualified facility is placed in service and the final regulations include illustrative examples to clarify this provision.

Comparison to the Davis-Bacon Act

The DBA has been followed by those contractors with projects for the federal or D.C. contracts. The requirements are, in fact, similar between DBA and PWA; however, they are not the same. As enacted, the statute does not indicate that the regulations setting forth the PWA requirements must mirror the DBA in every instance. See the chart below to highlight the differences between the IRS and Treasury and the DBA.

It is important to clarify that DBA Guidelines that are not required to be followed under PWA regulations could help to prove a lack of intentional disregard if present.

| Davis-Bacon Act Guidelines | Applicability to PWA |

|---|---|

| General wage determinations | Y |

| Supplemental wage determination submissions | Y* |

| Definitions: “secondary construction site,” “laborer,” “mechanic,” “construction, alteration, or repair,” “wages,” and “employed” | Y |

| Review and appeal procedures for wage determinations | Y |

| Indefinite operation and maintenance repair contracts requirement to update applicable wage rates on an annual basis | Y** |

| Types of construction for wage determinations and flexibility of the U.S. Department of Labor (DOL) to add or modify categories | Y |

| 30-day period for the DOL to resolve requests for prevailing wage rate for additional classification or advise otherwise | Y |

| Apprentice performing work in excess of ratio permitted must be paid full applicable prevailing wage rate | Y |

| “30-percent rule” | N*** |

| Certified weekly payroll and requirement to pay on weekly cadence | N**** |

| Required contract language and provisions | N |

| Public notice of wage classifications and wage rates | N |

| Pre-filing requirements | N |

| $2,000 monetary coverage threshold for federally funded or assisted contracts | N |

| Various enforcement processes available to the DOL and contracting agencies to address DBA noncompliance | N |

| Definition: “physical work test” | N***** |

| Definition of qualified facility under the “site of work” rule | N****** |

| *Final regulations update to require supplemental wage determinations to be incorporated into the contract within 180 days of issuance to provide consistency with DBA rules (previously 90 days under proposed regulations). | |

| **Under DBA, certain contracts require the applicable wage rates to be updated annually. These contracts are for alteration or repair work, but over an indefinite period of time and not tied to the completion of any specific work. The final regulations adopt this as well and further clarify that the requirement to update the wage determination does not apply if the contractor is simply given more time to complete its original commitment or if the additional work is merely incidental. | |

| ***The DBA uses the “30-percent rule” to determine the prevailing wage rate. The DBA defines this rate as the rate paid to the greatest number or laborers or mechanics in the classification on similar projects in the area during the period in question, provided that the wage is paid to at least 30% of those employed in the classification. | |

| ****Final regulations state must be paid “in the time and manner consistent with the regular payroll practices of the taxpayer, contractor, or subcontractor.” In addition, PWA requirements do not include certifying payroll. | |

| *****While the definitions are similar, there are slight differences in the treatment of preliminary activities. For PWA, the demolition and removal of an existing structure is a preliminary activity, not the “beginning of construction.” However, under the DBA definition, the same activity would constitute construction. | |

| ******Section 45(b)(7) and (8) limit the scope of construction, alteration, or repair to those activities occurring with respect to a qualified facility. The term qualified facility (as described in §45 and guidance thereunder) has specific meaning for tax purposes. Construction of a facility is interpreted as consistent with the underlying definition of a facility for tax purposes rather than the DBA. | |

FAQ

Now that we are past January 29, 2023, why does the construction date matter?

The beginning-of-construction (BOC) exception can still apply to projects that began construction before January 29, 2023, even if they are placed in service in 2024, 2025, and beyond. In addition, the beginning of construction will be important to determine whether §48E and §45Y apply or if the original production tax credit (PTC) in §45 and investment tax credit (ITC) in §48 could apply. Section 45 and §48 apply to facilities beginning construction before January 1, 2025, while §48E and §45Y apply to facilities placed in service after December 31, 2024. Therefore, there could be projects where owners have the option to choose between §45/§48 versus §45Y/§48E credits.

Furthermore, despite the transition rule exempting contracts from PWA requirements for any work that took place before January 29, 2023, the beginning of construction date is still important in determining the start of the obligation to comply with PWA requirements. Unless an exception applies, taxpayers claiming the increased credit are required to comply with the PWA requirements once a laborer or mechanic performs any work that is considered construction, alteration, or repair of the qualified facility (including work that occurs on a secondary site).

Will I still get the five times bonus and need to worry about PWA when §48E and §45Y go into effect next year? Are the PWA rules different for them?

Even though the requirements for the §48E ITC and §45Y PTC are not finalized, there is still the opportunity for the up to “five times” bonus credit under PWA. Although the base requirements for qualifying for the ITC and PTC credits will change in 2025, PWA is still a component of the “new” credits. Until released, taxpayers may rely on the proposed regulations issued under §48E and §45Y published in the Federal Register.

For those considering purchasing credits, what risks are involved with PWA? Do I need to purchase insurance if they include PWA or require additional due diligence or contract terms?

The obligation to make correction and penalty payments (or the burden of cure) remains with the “eligible taxpayer” or transferor. Even so, the increased tax credit cannot be claimed by the transferee (or party purchasing the credit) if the IRS later determines the requirements of the PWA are not met. Furthermore, recapture risk of the credit in general is shifted to the transferee and the credit purchaser is typically liable for the recapture amount. For those purchasing credits, it is important to make sure proper transfer election statements are filed, perform requisite due diligence, and include provisions for the considerations above in sale agreements. Tax credit insurance can help mitigate risk of PWA noncompliance for an added level of comfort.

Planning Tips

Construction Contracts: While PLAs are not required to maintain compliance with PWA regulations, these agreements can be used to avoid penalties if appropriately executed and should be considered when planning expenses and wage structuring.

Get Organized: As detailed above, record-keeping is huge in meeting the PWA requirements and Forvis Mazars can help you streamline and simplify tracking for your business. Consider implementing software options for tracking wage, apprenticeship, and potential penalty requirements specific to PWA regulations.

Stay Compliant When Hiring: Take time to analyze the available contractors and subcontractors in the project’s area and whether they have experience and are familiar with PWA requirements. Likely contractors will require a higher fee to comply, and there may be a shortage of contractors with the willingness or ability to meet the PWA requirements.

Locate a Registered Apprenticeship Program: While not all IRA credits provide the opportunity for PWA, it is important to familiarize yourself with the local and state qualified apprenticeship programs in your area. Helpful places to start are apprenticeship.gov and Office of Apprenticeship online. Exceptions do apply if there is no program in the geographic area or if no apprentices are available; however, the regulations have requirements that must be met to qualify for a Good Faith Effort Exception.

Be Mindful of Time Frames: Tracking timelines of requests, especially around payments and apprenticeship requests, will be essential to maintaining PWA compliance and eligibility for the increased credit.

- Requesting Apprentice(s): An initial request for qualified apprentice(s) from a registered apprenticeship program must be made at least 45 days before work on the facility begins. To satisfy the Good Faith Effort Exception, any further requests to the same registered apprenticeship program must be made no later than 14 days before qualified apprentices are to begin work on the facility.

- Curing Time Frames: Taxpayers are permitted to make correction and penalty payments up to 180 days after the final determination of a failure by the IRS and remain eligible for the increased credit amount. Further clarity is provided below for those returns claiming the increased credit and curing with the filing rather than upon IRS determination.

- Penalty Waiver: According to the final regulations, the penalty payment requirement may be waived if the correction payment is made “by the earlier of 1) 30 days after the taxpayer became aware of the error or 2) the date on which the increased credit is claimed.” In addition, each laborer must not be underpaid for more than 10% of all pay periods, or the shortfall in wages must not comprise more than 5% (previously 2.5% in proposed regulations) of the prevailing wage requirement.

Conclusion

Although navigating the administrative complexities of PWA compliance can be challenging, Forvis Mazars is ready to support you. Specific to PWA, Forvis Mazars is prepared to help further educate you on the requirements, plan with you ahead of construction, and track compliance along your project’s timeline. This can take the confusion out of the process and help to avoid penalties and interest by keeping up with what is happening at your job site.

If you have any questions or need assistance, please reach out to a professional at Forvis Mazars.

- 1“21 Powerful George Soros Quotes Every Trader Must Read,” analyzingalpha.com, updated on October 13, 2023.

- 2“United States Energy & Employment Report 2023: Executive Summary,” energy.gov, 2023.

- 3“Apprentices By State,” apprenticeship.gov, June 4, 2024.

- 4“United States Energy & Employment Report 2023: Executive Summary,” energy.gov, 2023.

- 5“America’s Apprenticeship Gap in Two Charts,” thirdway.org, February 23, 2024.

- 6“Green investment boom and electric car sales: six key things about Biden’s climate bill,” theguardian.com, August 11, 2023.

- 7https://www.energy.gov/media/299600