We’re a quarter of the way through 2024. When it comes to middle-market mergers and acquisitions (M&A), this is roughly my 40th first quarter in the business. I am thinking about this one more, in part because I think deeper these days and was asked to share my thoughts. Better to know—and refine—my thoughts before I share them.

First, a few perspectives. I am an upbeat guy, and I have ridden the waves of the M&A ocean long enough to know there are rough waters and calm seas, and they often swim next to one another. My middle-market orientation and history are centered on privately held businesses, often founder led. I marvel at some of the businesses that have reached soaring heights through family ownership and entrepreneurial grit. I also have grown up, professionally, from the beginning of the private equity era, and strongly believe the capital and leadership from these purposeful investors have taken our country’s ecosystem to a new plateau. Over the past four decades, quality and innovation have teamed with capital, discipline, and pace to create some remarkable, high-performing enterprises.

Let’s not dwell on the decades of the past when the months ahead are so important. Trust me, reflecting on the past is far easier than assessing the future. I will segment this article along a few topical themes and provide some basic thoughts, observations, and statements regarding those topics.

Some Tough Sledding

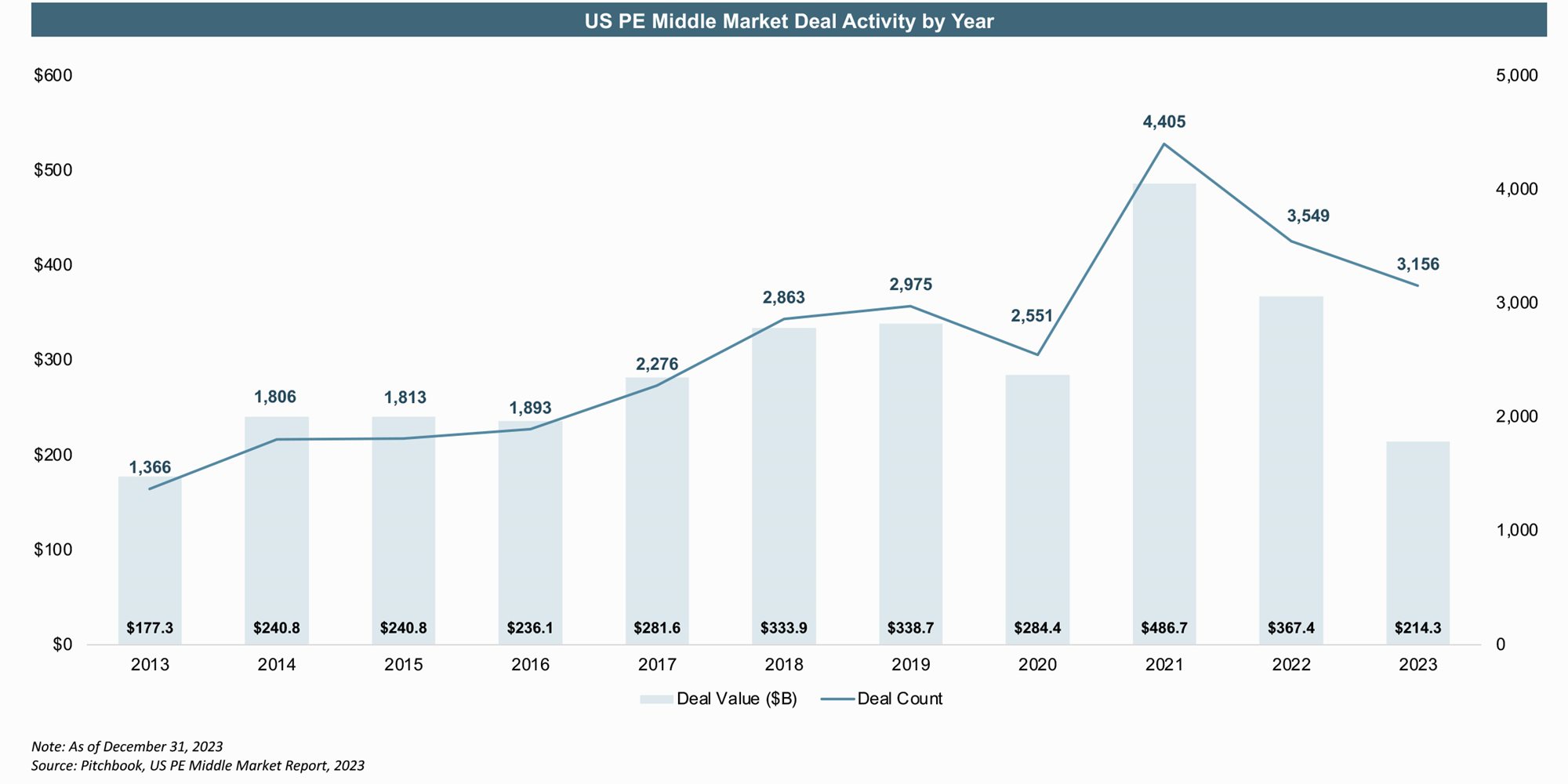

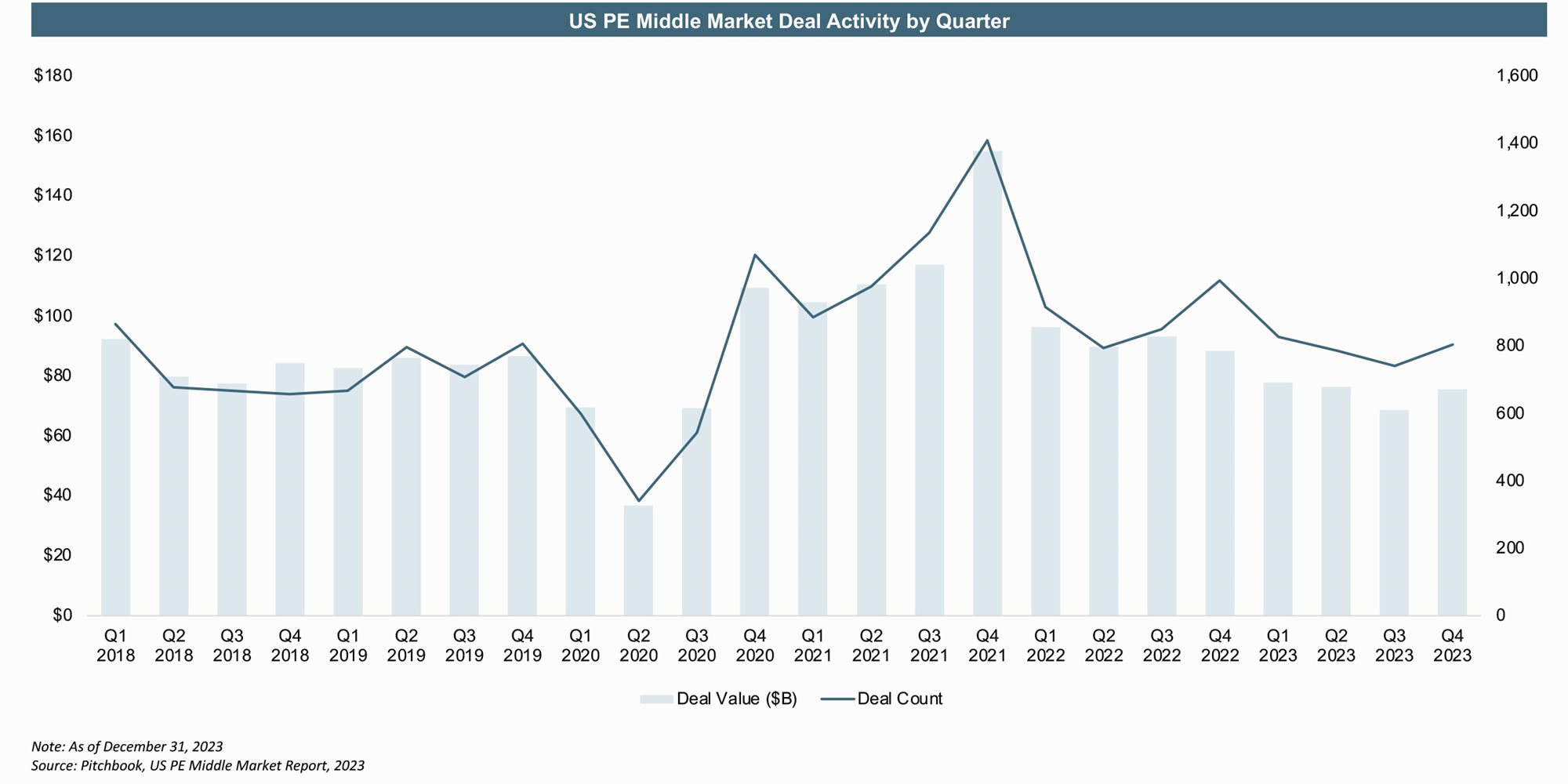

Since the Q1 2024 data releases are generally in process, let’s take a data look at some longer-term trends and some recent quarterly data. As reflected in the charts below, things were trending well until COVID-19 impacted both 2020 and 2021 in meaningful ways. The 2021 spike in deal closings resulted from “inspired” sellers meeting “motivated” buyers. The pandemic was the final straw for many private business owners who thought they had seen it all. Many decided to de-risk their family wealth and sought new capital and strategic partners to affect a monetization strategy.

Our 2024 starting point trended fewer deals and lower valuations. While many envisioned that deal activity would pick up in 2024, the signs aren’t overly encouraging, based upon late 2023 data. As our conversational journey continues, I will share some anecdotal perspectives and data on why I believe we have better days ahead, and soon!

Challenges

M&A transactions need committed buyers and sellers, along with accommodating circumstances that facilitate and reward unions. Today’s prospective middle-market sellers are not feeling much pain, and the deal dynamics are such that investors are finding it difficult to be much more than an average buyer for an average company.

Many sellers are led by accomplished, “in-control” leaders. The good news for many of them is that they have their business “under control” and on a good path. Earnings momentums are generally favorable, and many balance sheets have never been better. It appears that many of the personnel and talent retention issues have normalized, and while regulatory environments are intensifying, they are not overbearing. These sellers, when they gauge their futures, are finding new ways to manage work-life balance, and the impetus to monetize and move on in life is not overwhelming. The above-average performers can continue to grow and enhance their business and many top-quartile owners enjoy the challenge of doing so.

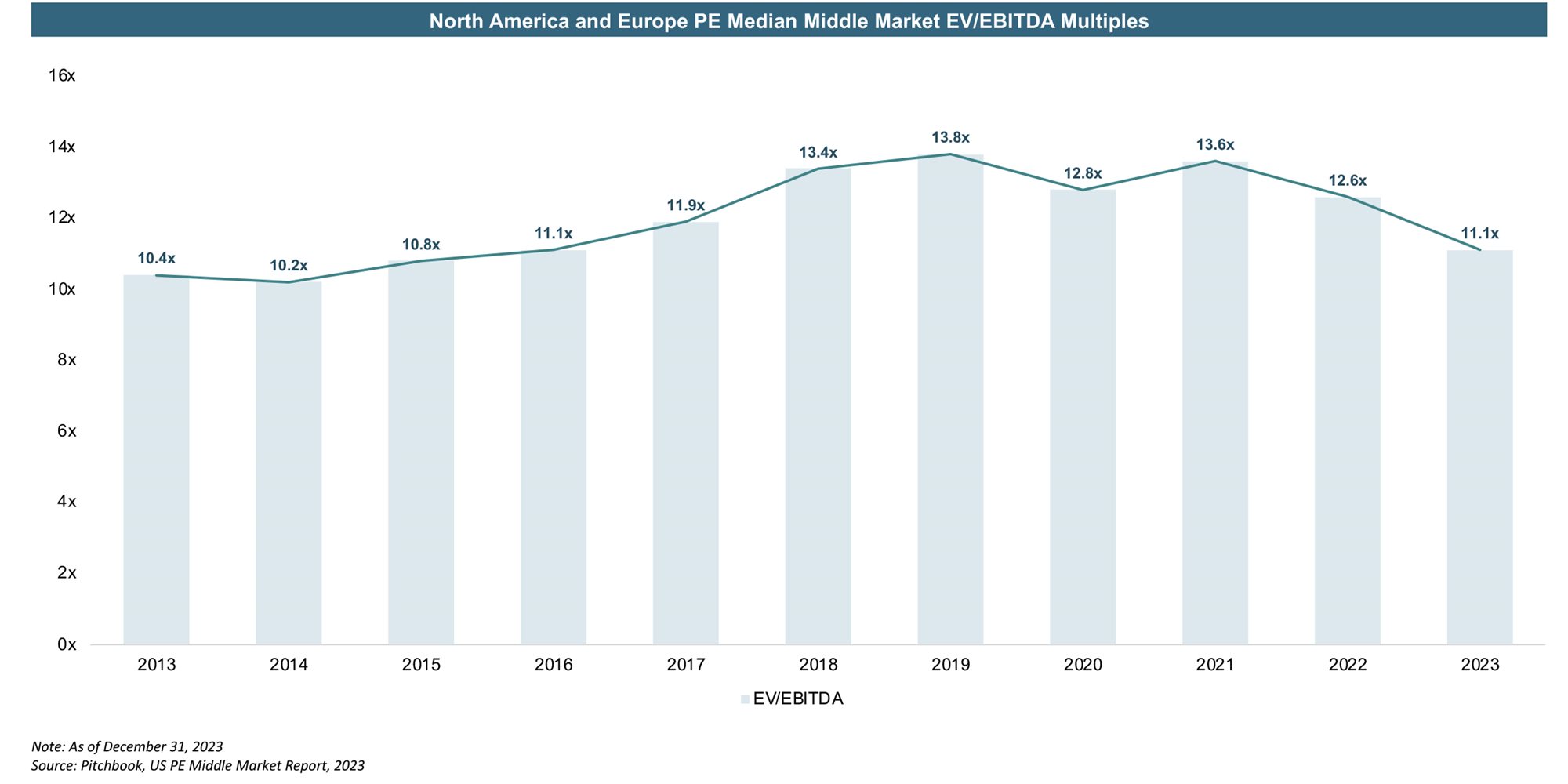

Buyers are still challenged to buy elite companies at lower valuations. Top-performing companies continue to “earn” higher valuations. As we say often, we are in the business of “monetizing excellence,” and top-performing companies remarkably have a lot of strategic, operational, and marketplace excellence under their umbrella. However, these same buyers (who favor and pay for brand and performance prowess) are equally disciplined on not overpaying for more “normal” businesses.

The marketplace has gotten addicted over the past decade to cheap and available senior debt. Today’s lending environment is muddying a controllable and probable path to the promised land, where capital deployment can predictably and reliably support promising growth strategies and rewarding internal rates of return. When will we see a more consistent alignment of buyer expectations and seller aspirations? Possibly, now.

Celebrations

While the world has plenty of challenges and there is far too much global suffering, the U.S. remains a beacon of freedom, innovation, and prosperity. Business owners are tested daily, yet they are more resourcefully enriched to make themselves better. For 40-plus years, I have seen many advancements in the way we do business and the tools we use to make our enterprises better. Today’s business leaders are driven to succeed and, daily, I get exposed to a business owner who cares and leads. They accept challenges, and they have never been better equipped with near-time or real-time data. Today’s executives and managers surround themselves with elite talents and service providers, positioning them to make more informed and better decisions.

I entered the workforce the same time as the computer and, shortly thereafter, the internet. And I can’t overstate how significant the emergence of private equity has been to inspire business owners to think bigger, run faster, and pursue strategies they would have never imagined. I am bullish on America, its people, and their ability to address challenges and better serve mankind. We have had societal challenges before, and I believe—yet again—we will find common ground and strengthen our nation. Our business leaders are among the champions who persevere and thrive … and they will continue to lead us. This is worth celebrating.

Innovations

Our world is being transformed in many ways. Whether it’s artificial intelligence (AI), electric vehicles, the Internet of Things, digitalization, or factory automation, there are many innovative and powerful tools being developed that will require significant research and development and capital investment. Literally billions of dollars are being spent on new factories and all the accompanying infrastructure, including STEM talent, to support this technological evolution. We are onshoring many of these disciplines … and everyone can have a contributory opportunity to build and support this great national expansion. The middle-market entrepreneurs will—as always—find niches where they can play meaningful roles in this vibrancy.

What’s Next?

There are many facets that drive middle-market M&A activity: some strategic, some socioeconomic, some financial, and some personal. Buyers favor certainty, particularly around growth, earnings, and returns on investments (ROIs). We are entering—in my opinion—a period where growth is likely. The economy has a good foundational setting, and all of the important sectors … consumer, private, and public … seem poised for ongoing and higher levels of spending and investment. Much of this environment is being fueled by the innovations mentioned above. There are hundreds of billions of dollars committed for announced and near-term new factory builds related to mobile power and semiconductors alone. Throw in the intensified public spending on infrastructure and defense, and you can easily see a solid runway for economic stability and vitality. And the growth goes beyond constructing and equipping these new facilities and the infrastructures that support them. It will filter its way directly into the service economy for things like AI advancement, cybersecurity, and training and development. High employment needs should keep consumer confidence and spending elevated.

In this transitional environment, eventually the “haves” and the “have nots” will likely get bifurcated. Either you invest and win, or you lag and flirt with danger. Business owners have a new round of assessment. Are they capitalized and energized enough to be a thriver? Or, simply a survivor or—even worse—a diver? These reviews and decisions are further compounded by the stage of life of the business owner and the preparedness of their company. Mother Nature will not allow us to overlook age and vibrancy. We are—with greater regularity—participating in or observing more of these discussions. Today’s M&A environment is much more planning centric, and preparation for and timing a monetization event is garnering significantly more attention today than it did 10 years ago.

On the buy side, the capital is flowing, and investors are focused on identifying the optimal next-level strategic hotspots; those packed with both opportunity and need. In each of the past three years, more than $1.7 trillion of private capital has been raised globally, and the momentum has meaningfully favored North American buyout funds. We see great equilibrium developing between the buyer and seller universe, and the prospects of declining interest rates should prove positive.

We are feeling this positive energy—now. Our firm’s active engagement profile is near record levels and our submissions to our Engagement Committee have doubled in Q1 2024, compared to the quarterly results in the second half of 2023. Deals are closing, and we have a record number of deals under letter of intent. Top performers in attractive industries are consistently garnering high valuations. Based upon total transaction data reported by GF Data, the comprehensive 2023 earnings before interest, taxes, depreciation, and amortization (EBITDA) multiples were down by roughly three-tenths of a turn from the 2021 and 2022 highs. This 2023 performance is higher than the EBITDA multiple achievement in the years immediately preceding COVID-19. Hence, while there has been valuation compression, it has been modest. I envision that the company wrapped in excellence will be rewarded, while the balance of sellers will be fairly compensated.

These are clear signs—in my eyes—that the industry is gaining renewed momentum, and we are excited about the prospects for the balance of 2024. In interactions with others in our profession, we hear that they, too, at various levels, are encountering elevated activity. We are excited to see our economy and country flourish, for we know many of our clients will be rewarded in this environment. They should be … many, for decades, have led this window of growth and prosperity.

If you have any questions or need assistance, please reach out to a professional at Forvis Mazars.