The positive momentum for stocks continued in the first quarter, with both U.S. and international markets delivering above-average results. Better-than-expected economic growth was the primary catalyst for the strong returns. Interest rates rose during the period, resulting in slight losses for bonds.

U.S. economic growth stronger than expected.

Fourth quarter 2023 economic growth of 3.3% was stronger than anticipated. This followed an exceptional third quarter and resulted in a 3.1% expansion in the U.S. economy for the full year. This is well above the 2% trend of the last 25 years. Strong consumer spending was the primary driver of better-than-expected results. Acknowledging the recent strength, the Federal Reserve increased its 2024 economic growth projection from 1.4% to 2.1%.

Improvement in inflation stalled during the first quarter. After peaking at more than 9% in summer 2022, Consumer Price Index inflation fell to 3.4% by year-end 2023. But little progress has been made since then, with March data showing an increase of 3.5%. This rise was largely due to higher gasoline prices and shelter costs.1

While wages have been increasing at an annualized rate of more than 4%, the impact on inflation has been muted. This is because productivity growth (the increase in output per labor hour) also is rising. According to the U.S. Bureau of Labor Statistics, labor productivity grew 3.2% in the nonfarm sector in the fourth quarter of 2023. Productivity gains have minimized the impact of labor costs on inflation.

With the economy performing well and inflation leveling out, forecasts for 2024 Fed interest rate cuts have moderated. Whereas markets expected roughly 1.5% of cuts entering the year, those expectations have recently fallen in line with the most recent Fed guidance of just three 0.25% reductions.

Positive stock market momentum continues.

The U.S. stock market climbed to an all-time high in the first quarter, with the benchmark S&P 500 index surpassing 5,000 for the first time. U.S. stocks rose more than 10% to start the year while international stocks posted returns of nearly 6%.

| MARKET SCOREBOARD | 1Q 2024 | 2023 |

|---|---|---|

| S&P 500 (Large U.S. stocks) | 10.56% | 26.29% |

| MSCI EAFE (Developed international stocks) | 5.78% | 18.24% |

| Bloomberg Aggregate Bond (U.S. taxable bonds) | (.78%) | 5.53% |

| Bloomberg Municipal Bond (U.S. tax-free bonds) | (.39%) | 6.40% |

| Wilshire Liquid Alternative (Alternative investments) | 3.16% | 6.28% |

Source: Morningstar Inc, Tamarac Advisor View as of March 31, 2024.

These gains came despite a rise in interest rates during the period. Normally, rising rates are a headwind for stocks. However, the recent upward drift in rates was primarily due to stronger-than-expected economic growth. This economic strength has increased optimism around corporate profit growth in 2024, overpowering rate concerns.

The “Magnificent Seven” group of large technology stocks continues to lead the market higher with one exception: Tesla. Tesla is among the worst-performing stocks in the S&P 500 index so far in 2024, as weak sales have hindered profits and sparked another round of price discounts to clear excess electric vehicle (EV) inventory. This rational market response to weakening fundamentals is encouraging, a sign that investors aren’t blindly chasing this group of stocks. While the technology leaders have been on an impressive run since the beginning of 2023, the gains have been driven by profit growth rather than an expansion of the price-to-earnings multiple (P/E).2 Currently, the “Magnificent Seven” have an average forward P/E of about 30 times earnings versus 18 times for the other 493 stocks in the S&P 500 index. However, expected earnings growth is 20% for these tech leaders, nearly double the 12% average growth expected for the rest of the index. The current market concentration is much better supported by both profits and growth, differentiating this rally from the “tech bubble” burst in 2000.

When will the Federal Reserve start cutting rates?

Ever since the Fed signaled the end of rate hikes in December, markets have been trying to decipher when the first cut would occur. In the initial euphoria surrounding the Fed’s policy pivot, markets were anticipating the first 0.25% rate cut in March and six cuts total for the year. But the Fed has steadily pushed back against these expectations, sticking to its forecast of three rate cuts “later in the year.”

With recent inflation readings coming in higher than expected, markets have gradually fallen into alignment with the Fed’s forecast of three cuts. But when will the first cut happen? At this juncture, the most likely scenario is during the Fed’s meeting in July.

Recently, the Fed raised its 2024 economic growth forecast from 1.4% to 2.1% and its inflation projection from 2.4% to 2.6%. Fed Chair Jerome Powell noted that growth is expected to be higher because of the increase in available workers, while inflation is being boosted by seasonal issues. Powell’s interpretation of recent data indicates the Fed should still be on track to deliver a summer rate cut.

How will the presidential election affect markets?

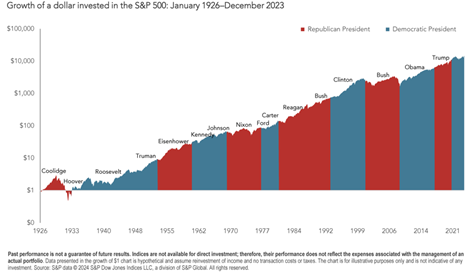

Presidential election years tend to be volatile for the stock market. Recent elections have been rancorous, with the major parties as polarized as ever. Negativity reigns as politicians pull out all the stops to win. As uncertainty builds over the summer months, investors tend to get nervous, and markets often decline. But do politics really matter to your portfolio in the long run?

The short answer is no. Election years typically prompt fear that a certain candidate’s victory will spell doom for the economy and markets. However, these doomsday forecasts are as old as American politics themselves. Thankfully, market history shows a more favorable outcome. Since 1928, the U.S. has had 24 four-year presidential terms (including the current). The annualized return of the S&P 500 has been positive during 20 of those 24 terms. The four occasions where performance was negative occurred during the Great Depression (twice), the tech bubble collapse in the early 2000s, and the global financial crisis in the late 2000s.

The U.S. economy is a large, dynamic system that has adapted to many different political ideologies. Fortunately for investors, the factors that matter most to portfolio performance are economic and profit growth, not who resides in the White House. One of our key investment tenets is, “Avoiding emotional decision making improves investment results.” As the above long-run market history shows, staying disciplined is the best course of action to take no matter who wins in November!

Market & Economic Outlook

A key reason the market is off to a strong start in 2024 is that “positives” currently outweigh “negatives.” The positives include a resilient labor market, strong consumer spending, above-average economic growth, improving profit expectations, and the likelihood of rate cuts later this year. The list of negatives is much shorter, consisting primarily of modest stock market overvaluation and a potential lagged impact of higher interest rates. Certainly, extraneous geopolitical risks abound and have the potential to affect markets as well.

Some investors are concerned that now might not be a good time to invest, given that stocks are at all-time highs. But from a historical standpoint, all-time highs are more often followed by new all-time highs than a market crash! If the economy and corporate profits continue to grow (as is currently the case), markets should be expected to reach successive new highs over time.

While the stock market’s P/E is elevated compared to historical norms, this may be warranted considering the changes in the U.S. economy over time. Over the past 50 years, our economy has transitioned from an asset-intensive manufacturing focus toward an “asset-light” information and service-based system. This has helped improve market fundamentals in several ways, including:3

- 50% reduction in the average S&P 500 company’s leverage

- Doubling of profit margins from 6% to 12%

- Decrease in the variability of corporate earnings

While starting valuations are a key factor to consider when investing, today’s modestly elevated P/E multiples are not too concerning given the above dynamics.

Bond returns weakened in the quarter, as the 10-year Treasury yield rose from 3.88% to 4.20%. The rise in rates was largely in response to stronger economic data and an expected delay in Fed rate cuts. Given high current yield levels and the likelihood of Fed rate cuts later this year, bonds are still on track to deliver solid returns going forward.

Looking back over the last five years, staying invested has required fortitude. Since 2019, investors have endured two bear markets: a 35% decline in 2020 and a 25% decline in 2022. And during the 2022 bear market for stocks, bonds also posted double-digit losses, one of the worst years ever for this asset class. Despite these challenges, trailing five-year returns for diversified portfolios are above average. Investors have been rewarded for staying engaged through these periods of significant market turmoil.

While markets are off to a great start in 2024, remember that portfolio gains rarely occur in a straight line. Ten percent corrections are normal and happen most years. This sort of volatility is expected and considered in our financial planning assumptions, and our investment portfolios are designed to withstand those periods of turbulence.

If you have questions regarding your investments or any aspect of your financial situation, please contact your local Forvis Mazars Private Client team!