In the “Quarterly Perspectives: Financial Reporting & Beyond / Q4 2023” webinar from Forvis Mazars, we looked back on what happened in the accounting world for the quarter, discussed what we’re seeing now, and looked ahead to what we may see in the future. Read our webinar recap below and be sure to sign up for our 2024 webinars for more timely insights.

Looking Back

Standard-Setting Activity

The past quarter brought a flurry of activity from standard setters and regulators.

FASB issued several new standards, including those on segment reporting, intangibles (specifically crypto assets), and income tax disclosures—with the last two released in mid-December.

There also was rulemaking activity at the SEC—with new clawback rules and cybersecurity disclosures taking effect in December. In addition, the SEC approved the PCAOB’s budget. Importantly to registrants, the Fifth Circuit Court of Appeals vacated the SEC’s rule on modernizing the reporting on share repurchases after ultimately determining the SEC didn’t address previously raised concerns on the SEC’s procedures issuing that rule.

While the PCAOB has rules in the comment or redeliberation phases, its most public activity this past quarter centered around enforcement activities and contributed to $20 million in fines for 2023, a record that doubled the $10 million in fines from the previous year.

We’re seeing the American Institute of CPAs (AICPA) continue to pay attention to convergence with international standards; risk assessment and estimates standards became effective in December with quality management standards on the horizon.

Economic Outlook

At a recent webinar, the AICPA discussed the results from a survey indicating the largest concern among companies was the uncertainty of the overall economy. People are wondering if the storm has passed or if we’re in a (relative) calm before the storm. The Federal Reserve has intimated that interest rate hikes may not continue, but there’s uncertainty whether that means interest rates will come down. With this uncertainty, projections and fair value calculations tied to projections are going to continue to be potentially challenging and problematic and need robust communication among all involved parties.

Here & Now

ASC 740 Income Tax Accounting

One concept we’ve discussed many times in our Quarterly Perspectives webinars is the collaboration between tax and audit departments. This concept is top of mind this time of year, and we touched on common pitfalls of income tax accounting.

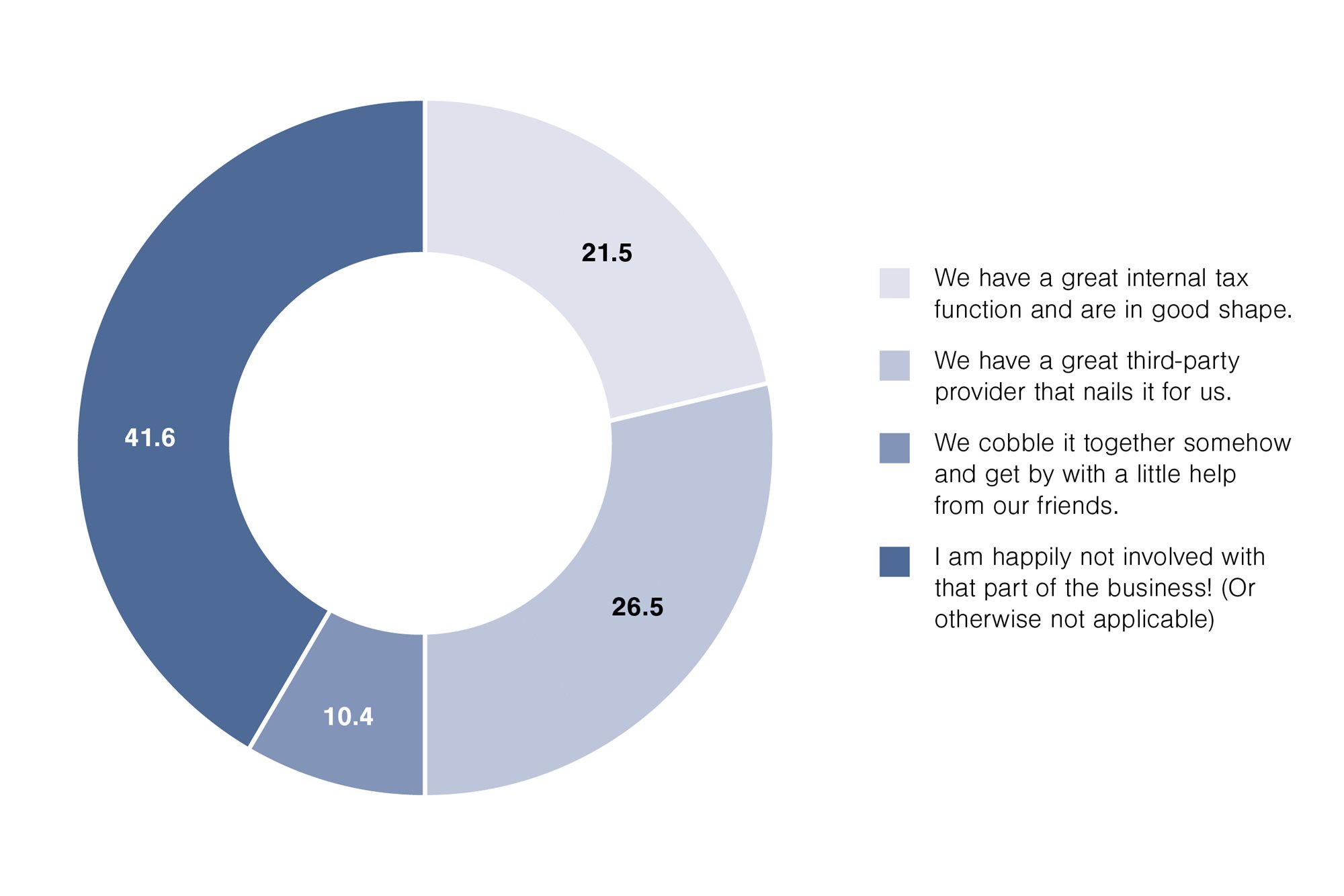

We asked our audience, “Do you have a good handle on the challenges in your tax provision?”

- 21.5%

- We have a great internal tax function and are in good shape.

- 26.5%

- We have a great third-party provider that nails it for us.

- 10.4%

- We cobble it together somehow and get by with a little help from our friends.

- 41.6%

- I am happily not involved with that part of the business! (Or otherwise not applicable)

Of those who are involved in the tax function, most of our audience believed they were in good shape, but it’s always ideal for a refresher on potential pitfalls to be aware of with income tax accounting under Accounting Standards Codification (ASC) 740. We’ve outlined a few of the pitfalls, among those discussed in the webinar, below:

- Intraperiod tax allocation rules

- “Hanging credits” for indefinite-lived intangibles amid valuation allowance

- Jurisdictional netting of deferred tax assets and deferred tax liabilities

See the rest of the common pitfalls in our article, “Common Income Tax Accounting Pitfalls.”

FASB Income Tax Disclosures

FASB finalized new income tax disclosures in December; this is a project FASB started more than 10 years ago. The main focus of the proposal is disaggregation of information presented. There are multiple items that get disclosed in the tax footnote that are currently disclosed on a worldwide basis. The idea with the new income tax disclosure requirements is to disaggregate those items between the relevant jurisdictions, as shareholders would like more information regarding the jurisdictions where the company operates so they know where they might have exposure to different tax law changes. For public companies, the additional disclosure requirements are effective for calendar year 2025, and calendar year 2026 for private companies. While early adoption is permitted, we don’t expect many companies will rush to adopt this early.

Overview of AICPA & CIMA Conference on Current SEC and PCAOB Developments

Also in December, the annual AICPA & CIMA Conference on Current SEC and PCAOB Developments was held. Here’s what caught our eye:

- PCAOB: Earlier in this article, we mentioned the large amount of fines levied by the PCAOB this past year. We’re seeing that the PCAOB is reminding audit firms that it is our regulator and it will be acting accordingly. Audit firms should be aware of activities that could translate as a failure to follow professional standards. It’s important to take note of any PCAOB actions and understand that when the PCAOB is talking about one firm, it’s talking to all firms. A quote from the PCAOB chair encapsulates their focus at the conference: “Public trust is the north star of the profession.”

- SEC: There are a few areas to highlight from the SEC:

- FASB’s new segment disclosures (ASU 2023-07) allow for more than one measure of profitability for segment reporting. If a registrant chooses to provide more than one (which is allowed, but not required), the one closest to GAAP will be the required measure, and the one optionally provided is non-GAAP (as not required by GAAP) and thus subject to the SEC’s various non-GAAP rules and interpretations.

- Regarding the newly effective clawback rules, the SEC emphasized that any changes to prior year financial statements will “check the box” for correction of an error in previously issued financial statements found on the cover of the Form 10-K—even if it was a voluntary correction of an immaterial error in the prior year.

- Financial reporting is a communication tool externally, and not just a GAAP compliance exercise. Many registrants critically evaluate what they are disclosing yet aren’t critically evaluating what they aren’t disclosing. As a financial reporter, be very purposeful about seeing what could possibly be missing in the financial communication you’re making to your stakeholder.

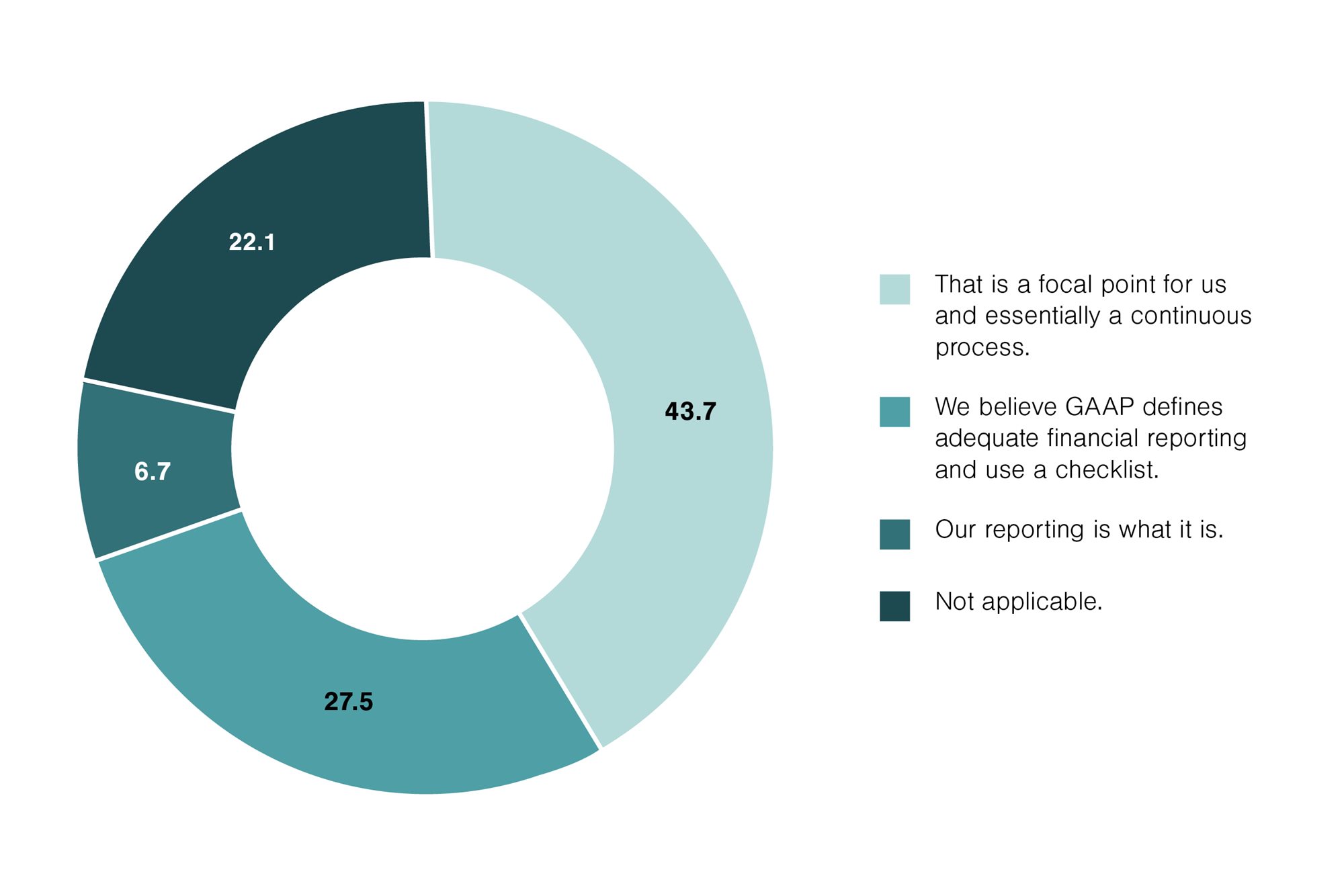

We asked our audience, “How does your company critically evaluate its external financial reporting?”

- 43.7%

- That is a focal point for us and essentially a continuous process.

- 27.5%

- We believe GAAP defines adequate financial reporting and use a checklist.

- 6.7%

- Our reporting is what it is.

- 22.1%

- Not applicable.

Financial Communications

As we view financial reporting as a means of communication and not as a check-the-box activity, take a step back and evaluate what might be missing from your communication.

- Disclosures:

- Do you have all the disclosures that will tell the appropriate story?

- For example, risks and uncertainties

- Concentrations of risk

- Do you have impairments that have not been recorded or addressed in the footnotes?

- Do you have estimates that are subject to material change in the near term?

- Are you thinking about covenant compliance?

- Overall, are you looking forward and considering how covenant compliance impacts your financial statements and disclosures?

- Based on your financial results and financial condition, should you be disclosing liquidity concerns or measures?

- Do you have all the disclosures that will tell the appropriate story?

- New disclosures that could have impact:

- CECL – Disclosing the allowance on the face of the balance sheet and its roll forward in footnotes

- Is this material enough to matter to you?

- CECL – Disclosing the allowance on the face of the balance sheet and its roll forward in footnotes

- Guarantees – We’re seeing companies that have stand-ready obligations to other entities

- Asset retirement obligations – Do you need to return an asset to a predetermined condition?

- Possible impairment consideration examples:

- Employee retention credits

- Goodwill

- Right-of-use assets

- Fixed assets

- Inventory

- Accounts receivable

- Data disaggregation trend – Do you have what you need as reporting and disclosure moves toward being more detailed?

Conversations You Should Be Having

Throughout the article, we’ve discussed new standards coming. Below are a few to keep top of mind; while they aren’t effective now, we’ll want to keep an eye on what information we may need to identify now to adopt them in the future.

- ASU 2023-07 – Improvements to Reportable Segment Disclosures

- ASU 2023-08 – Accounting for and Disclosure of Crypto Assets

- ASU 2023-09 – Improvements to Income Tax Disclosures

As of the start of 2024, we’ve seen FASB work through agenda items from its 2022 agenda-setting activities. In nearly completing these items, we can now wonder what’s next on its agenda. Will there be another consultation across constituents to populate its agenda? Will there be large standards that have heavy implications in one grand sweep, or will we see multiple, smaller standards that impact more financial reporting areas in smaller increments over time?

Overall, it will be interesting to see what will happen in the future and how FASB replenishes its agenda.

Forvis Mazars will continue to cover the latest in the accounting profession at our next Quarterly Perspectives webinar. Register now!

If you have any questions or need assistance, please reach out to a professional at Forvis Mazars.