2023 brought a variety of legislation updates, tax court cases, and more. With the new year upon us, it’s important to be prepared and keep an eye on timely updates that could affect you or your business. Read our Tax Planning Guide to learn about federal, state and local, and international tax matters for businesses, as well as insights for individuals.

Federal Tax Considerations

U.S. federal tax updates seem to be never-ending. The IRA and the looming changes proposed in the three Acts within the American Families and Jobs Act package have many on the edge of their seat. Let’s take a look at the prominent areas of federal tax over the past year and what you may want to keep an eye on for 2024.

- Build it in America Act

- Tax Cuts for Working Families Act

- Small Business Jobs Act

The American Families and Jobs Act is a new tax package introduced by House Republicans on the Ways and Means Committee. The legislation covers a variety of topics and includes three Acts: Build It in America Act, Tax Cuts for Working Families Act, and the Small Business Jobs Act. If passed, there could be some truly significant changes for taxpayers.

Build It in America Act

There are three primary changes in this Act. First, while historically at 100%, bonus depreciation is currently scheduled to phase out over time (for example, in 2023, 80% bonus depreciation is available). The bill would extend 100% bonus depreciation through 2025. Second, Section 163(j) calculations would revert to be more similar to the 2021 formula. Taxpayers would allow for the “addback” of depreciation, amortization, and depletion in calculation of adjusted taxable income (ATI). Essentially, the limit would be on 30% of EBITDA (earnings before interest, taxes, depreciation, and amortization) through 2025 (instead of the current 30% of EBIT (earnings before interest and tax) calculation). The bill text states this seeks to avoid increased financing costs for debt-financed investments.

Third, and possibly the most noteworthy, the bill would allow for §174 expenses to be deducted rather than capitalized and amortized. The change would be retroactively implemented, allowing for taxpayers to either amend their 2022 returns or include a “true-up” adjustment to their 2023 returns to account for capitalized costs in 2022.

To finance these high-impact changes, the bill proposes repeal or modification of some energy-related tax credits (notably the clean electricity investment and production credits, and clean vehicle credits) from the IRA. This may be one of the more pivotal points of conflict in passing the bill into law.

Tax Cuts for Working Families Act

The standard deduction would be renamed the “guaranteed deduction” and be temporarily increased for the 2024 and 2025 tax years. The amount of this “bonus” depends on the filing status of the taxpayer (all amounts subject to inflation):

- Twice the otherwise implemented amount in 3. for joint or surviving spouse, i.e., $4,000

- $3,000 for head of household

- $2,000 in other cases

These amounts are subject to phase out based on modified adjusted gross income ($400,000 for joint filers). This seeks to offset scheduled decreases in the standard deduction amount when provisions of the Tax Cuts and Jobs Act of 2017 (TCJA) expire after 2025.

Small Business Jobs Act

There are a variety of proposals included within this Act, including:

Increased threshold for informational reporting: The 1099 reporting threshold (including 1099-Ks) would rise from $600 to $5,000 (subject to inflation). The bill text states these changes aim to ease compliance burdens on small businesses and contractors.

Increase in §179 limitation: The maximum expense amount would be increased from $1 million (as reduced by the amount placed in service exceeds $2.5 million) to $2.5 million (as reduced by the amount placed in service exceeds $4 million).

Implement Opportunity Zone changes: The bill also would create a new rural Opportunity Zone program, designate new qualifying census tracts, and provide tax incentives for investment similar to the existing Opportunity Zone program. The legislation would establish a new category of rural Opportunity Zones, which are designated census tracts that receive tax incentives for investment. The stated goal is to incentivize long-term investment and economic development in distressed rural areas through these new tax benefits.

The ERC, available for 2020 and most of 2021, is still available for organizations that meet the eligibility criteria and can result in a benefit of up to $26,000 per employee. Organizations that have not yet evaluated ERC applicability, and even some of those that have but originally concluded it was unavailable to them, may want to consider the program. An organization qualifies as an eligible employer by either meeting the gross receipts decline qualification or by experiencing a full or partial suspension of operations due to a COVID-19-related government order limiting commerce, travel, or group meetings. Guidance issued by the IRS and ongoing audits have provided a deeper understanding of relevant government orders and who could be eligible. While the ERC still remains a viable credit opportunity for eligible employers, we also recognize the increased scrutiny ERC has received from the IRS, given the many third-party providers promoting aggressive refund claims. If your organization claimed an ERC refund but you are concerned you do not have sufficient documentation to support it under audit, Forvis Mazars Mazars can help evaluate your claim and advise how it can be strengthened.

ERC Audits

In addition, the IRS announced substantial progress in processing more than 2.5 million ERC claims since the program was enacted. Ninety-nine percent of claims were approximately three months old as of mid-July 2023. IRS auditors have received training in examining ERC claims that pose the greatest risk. The IRS criminal investigation division is working to identify fraud and promoters of fraudulent claims. IRS Commissioner Danny Werfel stated that the IRS has increased audit and criminal investigation work on claims, both on promoters and businesses filing claims.

Effective January 1, 2024, many domestic and foreign entities, including corporations, limited liability companies, and other entities created by the filing of a document with a secretary of state or any similar office under the law of a state or Indian tribe,1 will be required to file beneficial ownership information (BOI) reports with the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN).

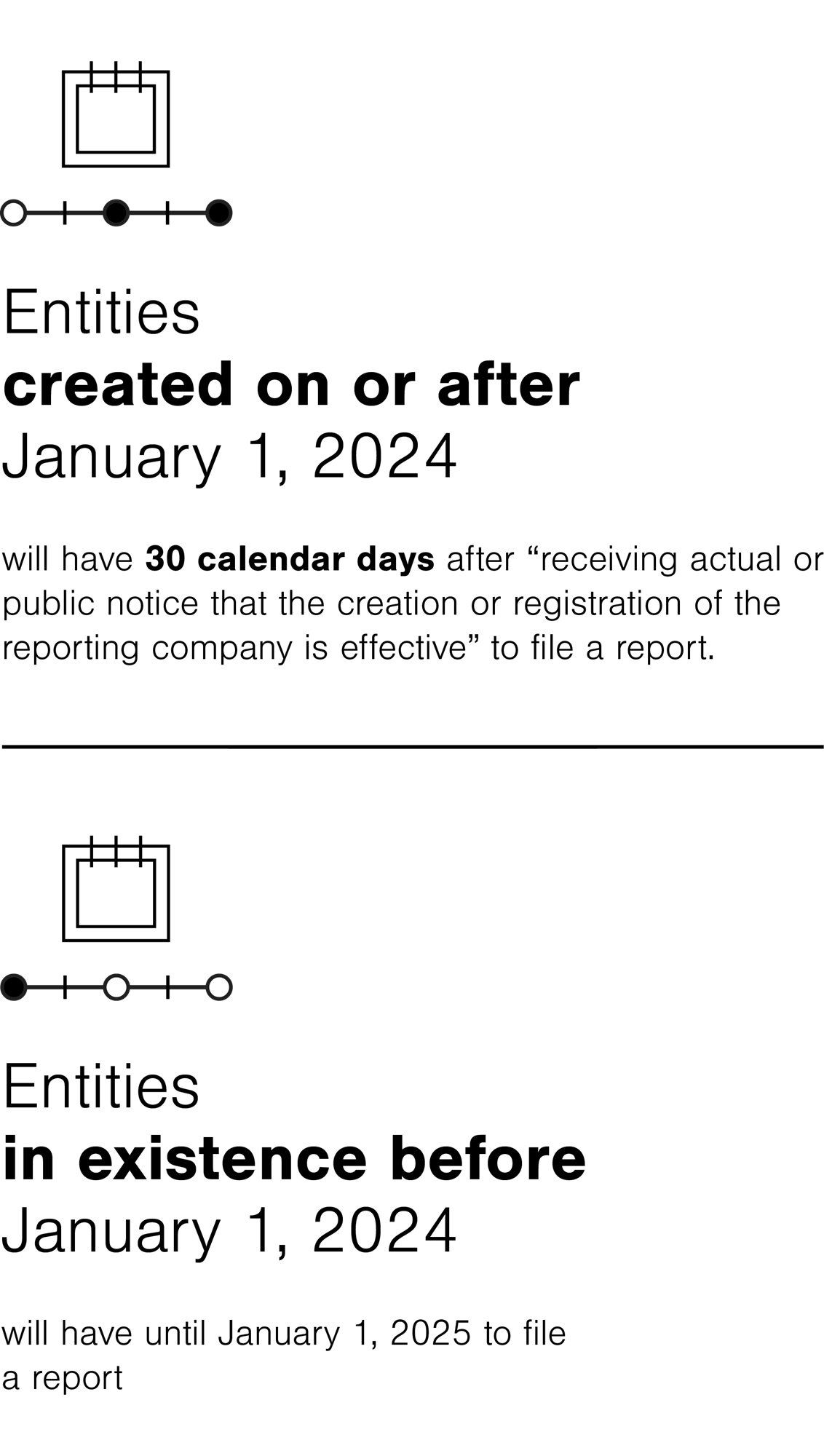

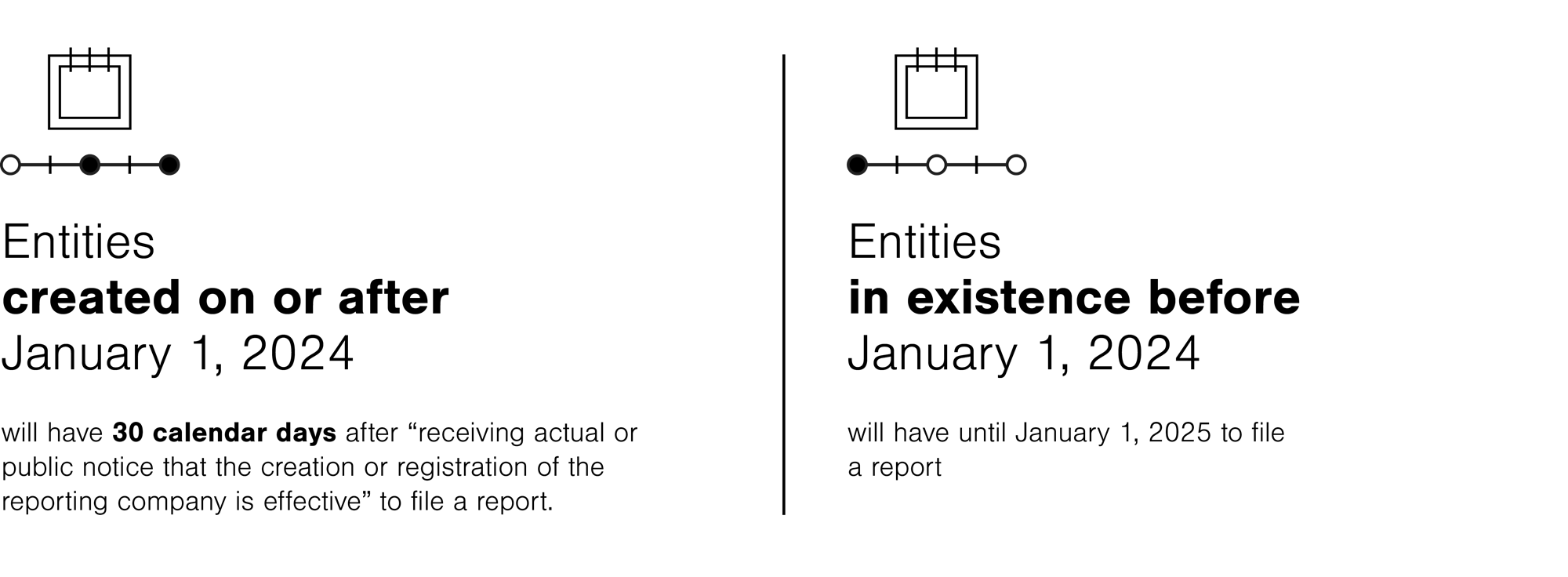

Entities created on or after January 1, 2024 will have 30 calendar days (90 days for 2024 under proposed regulations) after “receiving actual or public notice that the creation or registration of the reporting company is effective”2 to file a report. Entities in existence before January 1, 2024 will have until January 1, 2025 to file a report.

Failure to submit reports or providing false reports may result in civil or criminal penalties (up to $500 per day or a $10,000 fine and/or two years of imprisonment, respectively). “If there is a change [or correction] to previously reported information about the reporting company itself or its beneficial owners, updated [or corrected] reports are due within 30 calendar days after a change occurs” or when “you become aware of, or have reason to know of, inaccurate information.”3

There are 23 exceptions available that can exempt an entity from BOI reporting. Likely one of the most common exceptions will be for large operating companies, defined as an entity that:

- Has 20 full-time employees, and ...

- Has gross receipts or sales in excess of $5 million in the previous tax year, and ...

- Has an operating presence at a physical office in the United States

The following illustrates which parties must report their information, as well as the information required to be submitted:

Reporting Company: A reporting company is defined as a corporation, LLC, or similar entity that is created under the laws of either a U.S. state or foreign country and registered to do business in the United States. This does not typically include entities that are already heavily regulated, such as banks, credit unions, investment funds, and certain types of nonprofit organizations. Reporting companies can be either domestic or foreign (and registered to do business in any U.S. state or tribal jurisdiction4).

Reporting companies are required to provide the following information:

- Full legal name; any trade name or “doing business as” (d/b/a) name; current address; jurisdiction of formation; federal taxpayer ID number

Beneficial Owners & Company Applicants: A beneficial owner is described as any individual who, directly or indirectly, either exercises “substantial control”5 over the company or owns or controls at least 25% of the ownership interests. Company applicants are described as (a) the individual who directly files the document that creates, or first registers, the reporting company (the “direct filer”); and/or (b) the individual who is primarily responsible for directing or controlling the filing of the relevant document. Note that company applicants must only be individuals and may not be entities.

Beneficial owners and company applicants are required to provide the following information:

- Full legal name; date of birth; current address; unique ID and issuing jurisdiction, e.g., U.S. passport or state driver’s license; and image of ID document.

- Domestic entities created prior to January 1, 2024 (or foreign entities registered to do business in the U.S. before January 1, 2024) are not required to include information on company applicants.

Research & Experimentation (R&E) & Software Development

For tax years beginning on or after January 1, 2022, IRC §174(c)(3) requires taxpayers to capitalize any amounts paid or incurred in connection with R&E and also development of any software. Such costs are amortizable over five years (if U.S.-based) or 15 years (if non-U.S.). However, §174 provides no explicit definition of what constitutes “software” or “software development” and the IRS has yet to issue regulations on what R&E costs are required to be capitalized. As such, taxpayers must now navigate both identifying and quantifying any costs incurred as they relate to R&E and software development, and such costs are no longer afforded a current tax deduction. Such costs may not only include wages of employees performing R&E and software development, but also an allocation of certain indirect costs which are incident to development, as well as payments to outside contractors also performing R&E and software development on behalf of the taxpayer.

The IRS is currently working on additional guidance for implementing this new law, which could have an impact on what costs were capitalized for 2022 and what will be capitalized in 2023 and beyond. Additional action—to minimize excessive cost capitalization and comply with the new guidance—may be required when the IRS issues the anticipated guidance.

Implications for Contractors

For tax years beginning on or after January 1, 2022, IRC §174 requires taxpayers to capitalize and amortize R&E expenditures. Many contractors have been greatly impacted by this new requirement to capitalize R&E costs, resulting in significant tax burdens. Forvis Mazars has identified potential positions related to §174 for contractors who perform R&E activities through the fulfillment of a contract. These preferential positions primarily fall under two categories: 1. R&E performed under contract where intellectual property rights are transferred to the taxpayer’s customer, and 2. R&E performed under a long-term contract governed by IRC §460. Taxpayers with the above facts could potentially avoid the consequential impact of §174 capitalization.

The IRS is in the process of developing regulatory guidance regarding IRC §174. In September 2023, the IRS issued Notice 2023-63, which provided interim guidance on proposed rules the IRS intends to include in forthcoming proposed regulations. Final regulations could impact the positions that are currently being considered.

Recent case law related to the R&D tax credit has highlighted the importance of obtaining appropriate documentation in connection with claiming the R&D credit. In several recent cases, the courts have determined that the taxpayer failed to meet its burden of proof of establishing eligibility for the R&D tax credit under IRC §41. The applicable court cases and qualification requirements at issue have included:

- Little Sandy Coal Company, Inc. v. Commissioner of Internal Revenue – Here, the court focused on the requirement to establish that substantially all of a taxpayer’s research activities must constitute elements of a “process of experimentation.”

- Leonard L. Grigsby et al. v. The United States – This case highlighted the importance of clearly identifying the new or improved product or process that is being developed. The court ruled that reference to newly developed “construction processes,” without specific examples, was insufficient evidence.

- Betz v. Commissioner – The taxpayer failed to establish that the research activities were intended to discover information that would eliminate uncertainty concerning the development or improvement of a product and failed to demonstrate that the projects constituted “pilot models.”

In addition, recent case law has focused on the “funded research” exclusion. This continues to be a focus under IRS exams and is a frequent item addressed in IRC §41 case law. Recent cases on this topic have focused on the requirement for the taxpayer to retain a contractual right to exploit the results of the research, which is one of two elements required to avoid the funded research exclusion and include certain R&D costs incurred under customer contracts as qualified research expenses. This topic was addressed in both Grigsby and Betz.

Initially, the Inflation Reduction Act (IRA) left many taxpayers with questions about procedures for claiming credits, transferring credits, or electing direct pay, as well as other important topics such as qualification requirements and bonus credit calculations. Throughout 2023, the Treasury and the IRS issued guidance addressing various taxpayer questions. Proposed regulations, FAQs, and news releases continue to be issued on a variety of IRA topics, which Forvis Mazars continues to monitor and will bring to your attention once available. Click here for a summary of the 2023 guidance and related resources.

IRA Cost Segregation Updates

IRC §179D Energy-Efficient Commercial Building Property

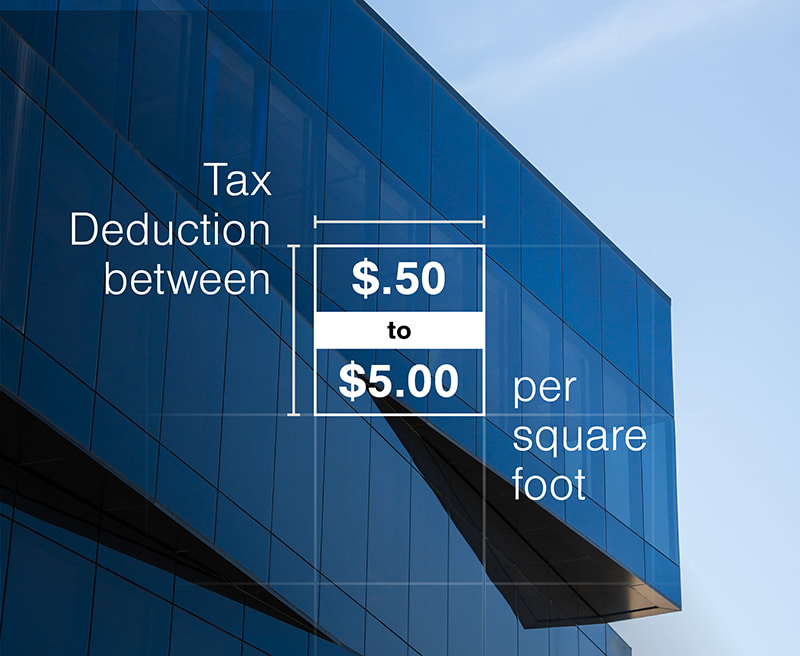

The Energy Policy Act of 2005 (EPAct) established a deduction for energy-efficient commercial building property under §179D of the IRC. This deduction may provide significant value to owners or designers of energy-efficient buildings.

Under this legislation, and the changes within the IRA, building owners may take an immediate tax deduction between $0.50 to $5 per square foot, depending on the criteria that are met. This immediate tax deduction is in lieu of depreciating the property over, generally, a 39-year recovery period. New construction or retrofit projects may qualify for the deduction. Beginning in 2022, this deduction is adjusted annually for inflation.

IRC §45L

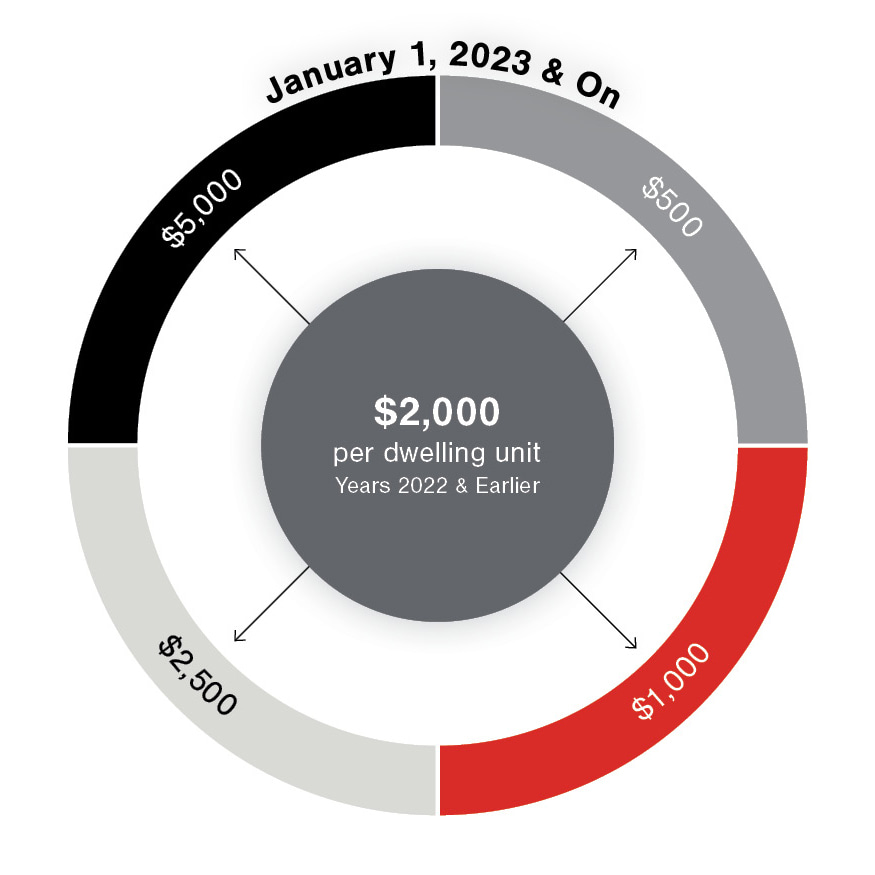

Originally implemented as part of the federal Energy Policy Act of 2005, and recently within the IRA, IRC §45L was extended for an additional 10 years. IRC §45L provides a tax credit for energy-efficient dwelling units based on a 50% energy reduction for units/homes leased or sold in 2022 or earlier or for units/homes meeting Energy Star and DOE Zero Energy Ready Home standards beginning in 2023. The credit is available to an “eligible contractor,” who is a person who has basis in the building during construction. It is no longer based solely on separate unit modeling in the year units/homes are leased/sold. Instead, there is a necessity for planning early in the development process with an intent to obtain certification with Energy Star or the ZERH program to qualify for the credits.

In years 2022 and earlier, the credit was $2,000 per eligible dwelling unit. Starting on January 1, 2023, the credit amounts will adjust to $500; $1,000; $2,500; or $5,000, depending on the criteria met.

Engineering and tax professionals at Forvis Mazars can help you obtain the various certifications required to claim the 179D deduction or 45L credit. Our turnkey approach to the 179D and 45L study can provide you with a single report designed to help you meet the documentation requirements outlined in 179D and 45L and related IRS guidance.

Improved R&D Tax Credit Benefits

The IRA (P.L. 117-169) doubled the maximum amount of §41 research credit that a qualified small business (QSB) can use to offset payroll tax liabilities from $250,000 to $500,000. This change is effective for tax years beginning after December 31, 2022 and can be a powerful mechanism for early-stage and startup businesses with less than $5 million of annual gross receipts in the current year, no gross receipts outside of the five-year period ending with the current year, and little to no tax liability in the current year, to monetize the credit. Prior to the enactment of this change, under the Protecting Americans From Tax Hikes (PATH) Act of 2015 (P.L. 114-113), QSB taxpayers were only permitted to use research credits to offset the 6.2% employer portion of the Social Security payroll tax liability, up to $250,000. The expansion provided by the IRA now provides taxpayers with an additional $250,000 that can be used to offset the 1.45% employer portion of the Medicare payroll tax liability. It is important to note that this payroll tax election must be made on a taxpayer’s timely, originally filed return.

Stock Repurchase Excise Tax

To help pay for the tax benefits included in the IRA, Congress included a new nondeductible excise tax for tax years beginning after December 31, 2022. Newly enacted §4501 imposes a buyback excise tax on “covered corporations” that repurchase more than $1 million of their stock during the taxable year.6 A covered corporation is any domestic corporation whose stock is traded on an established securities market (§7704(b)(1)). A covered corporation also includes a 50% or greater owned (by vote or value, directly or indirectly) U.S. subsidiary of a publicly traded foreign corporation that is subject to the tax on purchases of foreign parent stock. The excise tax equals 1% of the fair market value of any stock repurchased during the taxable year netted against the value of any new stock issuances in such year. Although a few exceptions to the excise tax exist (such as repurchases as part of a reorganization under §368(a) and no gain or loss is recognized by the shareholder, repurchases treated as dividends, regulated investment companies (RICs) or real estate investment trusts (REITs), dealers in securities, and proceeds from a contribution plan made to a qualified plan), the excise tax currently under IRS guidance captures a few surprising redemptions.7 For example, acquisitive tax-free reorganizations that involve cash or other property may be subject to the new excise tax.

Corporate Alternative Minimum Tax (CAMT)

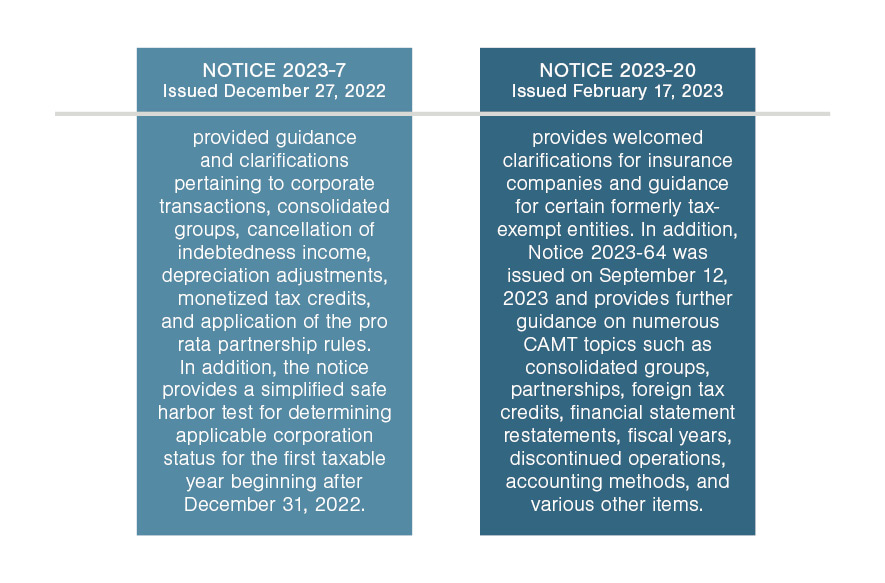

The CAMT also was enacted under the IRA and imposes a 15% tax on the adjusted financial statement income (AFSI) of an applicable corporation. The CAMT applies to tax years that begin after December 31, 2022 and can impact both public and private corporations. The starting point for AFSI is financial statement income, which is then modified with various adjustments to arrive at AFSI. An applicable corporation is generally one with AFSI in excess of $1 billion, or in the case of foreign-parented multinational groups, worldwide AFSI in excess of $1 billion and U.S. AFSI in excess of $100 million. The text of the law included in the IRA left many unanswered questions. Since the initial legislation was enacted, two additional pieces of guidance have been issued.

Notice 2023-7, issued on December 27, 2022, provided guidance and clarifications pertaining to corporate transactions, consolidated groups, cancellation of indebtedness income, depreciation adjustments, monetized tax credits, and application of the pro rata partnership rules. In addition, the notice provides a simplified safe harbor test for determining applicable corporation status for the first taxable year beginning after December 31, 2022. Issued on February 17, 2023, Notice 2023-20 provides welcomed clarifications for insurance companies and guidance for certain formerly tax-exempt entities. In addition, Notice 2023-64 was issued on September 12, 2023 and provides further guidance on numerous CAMT topics such as consolidated groups, partnerships, foreign tax credits, financial statement restatements, fiscal years, discontinued operations, accounting methods, and various other items.

Other Federal Tax Considerations

Rising interest rates, economic headwinds, and a change in how the interest deduction limit is computed are converging to limit the deduction of interest expense for many businesses. Previously, the amount of deductible business interest expense was calculated from a higher base similar to earnings before interest, taxes, depreciation, and amortization (EBITDA), but starting in 2022 and for later tax years, the interest deduction limit shifted to an EBIT base, which results in a lower interest deduction limit for many businesses. The accounting methods group at Forvis Mazars can help explain the impact of these changes to future taxable income, walk through strategies that could lead to additional interest expense deductions, and provide details on why some positions may prove to be a risky pursuit. Given the right fact patterns, businesses may be allowed to capitalize interest deductions previously limited and claim the deductions through other cost recovery deductions, e.g., through depreciation deductions on constructed property.

As the year-end approaches, businesses should consider accounting method reviews as a proactive way to manage tax savings. An accounting method determines the year in which a taxpayer’s revenue, prepaids, accruals, and deductions are recognized. A review of current accounting methods could lead to opportunities for taxpayers to defer income, accelerate deductions, and identify areas of exposure to mitigate taxpayer risk. Timing is essential and identified accounting method opportunities may require action before year-end. Please contact the accounting methods group at Forvis Mazars to discuss planning considerations that may help businesses with effective tax planning.

The cost recovery rules are often changing. For example, many businesses were required in 2022 to begin capitalizing and amortizing their R&D expenses, and bonus depreciation has begun phasing out. The largest asset on the balance sheet is often fixed assets. Given resource constraints and the changing and complex capitalization rules, costs are often capitalized that aren’t required to be—such as significant, deductible repair and maintenance expenditures—or the most optimal depreciation methods are not selected. Consider a review of all capitalized costs to help identify expenditures that could be eligible for an accounting method change to accelerate eligible deductions to the current tax year.

Producers, resellers, and producer-resellers were generally required to adopt the final uniform capitalization (UNICAP) regulations in prior years, requiring them to capitalize additional costs to ending inventory for tax purposes, generally deferring deductions. The final UNICAP regulations are often complex, burdensome, and time-consuming computations. Once a taxpayer subject to UNICAP has utilized a permissible UNICAP method consecutively for three years, they may be eligible to make the HAR election. The HAR allows taxpayers to average prior permissible UNICAP ratios and apply that ratio for the next five years, thus saving the time and effort of performing these costs annually, until the next test period. The accounting methods group at Forvis Mazars can help evaluate whether a taxpayer is on a permissible method and meets the remaining requirements to adopt the HAR method.

Distributors and manufacturers may have an opportunity to receive a deduction for a change in their value of inventory. In general, taxpayers can adopt a method to value closing inventory using the cost method, lower of cost or market (LCM) method, or other reasonable method based on facts and circumstances. Under the cost method, taxpayers generally must value their inventory at invoiced price, with certain adjustments, until sold to customers. The LCM method may be a more favorable tax valuation method as taxpayers are able to recognize a deduction for items of inventory with a market value lower than the original cost. The accounting methods group at Forvis Mazars can aid businesses in considering an effective inventory valuation method and how businesses that have adopted the LCM method may be missing the opportunity to account for market adjustments and write-downs.

The IRS Large Business & International (LB&I) Division announced a new compliance campaign on August 8, 2023 that will focus on large businesses suspected of “inflating” their cost of goods sold (COGS). Compliance campaigns use data to select returns with the highest impact on tax administration for examination. Clients within the LB&I population (assets exceeding $10 million) that report substantial COGS should review current practices for determining inventory balances. Adjustments to inventory pursuant to IRC §263A and §471 should be reviewed to confirm COGS is accurately reflected on the tax return.

Beginning January 1, 2024, businesses are required to e-file Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business. Businesses that receive cash of more than $10,000 must report the transaction to the IRS. The new requirement for e-filing Form 8300 applies to businesses mandated to e-file other information returns following final information return regulations. A business is required to e-file Form 8300 if it's required to file at least 10 information returns other than Form 8300. For example, if a business files 10 Forms W-2, then the business must e-file Form 8300.

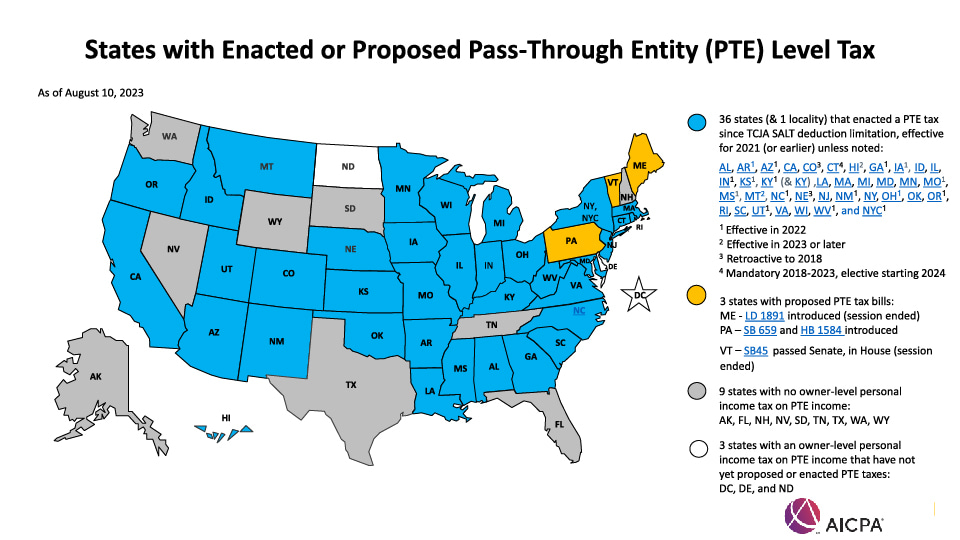

With more than 30 states having now enacted a pass-through entity tax (PTET) regime and taxpayers still in a holding pattern for the proposed regulations that were mentioned as forthcoming in Notice 2020-75, taxpayers are left with many unanswered questions. Four of the main areas of uncertainty are:

- When is the appropriate timing for the deduction of any PTET specified income tax payment (SITP)?

- Do SITPs only provide a federal tax deduction if they relate to trade or business income?

- How is the deduction from a SITP treated for purposes of passive versus nonpassive income and interest tracing rules?

- How is any income tax refund related to a SITP taxed?

The state and local tax (SALT) deduction “cap” introduced by the TCJA went into effect for tax years beginning on or after January 1, 2018 and currently is set to sunset for tax years beginning after December 31, 2025. On May 31, 2018, Connecticut was the first state to enact a workaround to the SALT cap, which has come to be known as a PTET regime. States have chosen different approaches. Currently, Connecticut is the only state that makes the PTET regime mandatory while others have chosen to make it either a yearly election or an election that once made is generally irrevocable; however, to add further complexity, some states allow for revocation in various ways and at different times. All of this would generally cause enough confusion for one area of tax compliance and planning, but four other main areas of uncertainty have been identified on which taxpayers would gladly welcome additional guidance.

Notice 2020-75 seems to generally provide for a deduction related to an SITP in the year the SITP is made. However, the guidance does not seem to contemplate the fact that many taxpayers utilize the accrual method of accounting. This method could allow for the taxpayer to deduct certain taxes for year-end without the actual payment being made if certain requirements are met: 1) the all-events test has been met, 2) the liability can be reasonably determined, and 3) economic performance has occurred. When combined with the recurring item exception, the taxpayer’s payments made after the end of the tax year could give rise to a deduction in the immediately preceding tax year under the accrual method of accounting. Regardless of when the deduction is allowed, the guidance goes on to provide that the deduction is taken into account in computing the taxpayer’s non-separately stated income or loss (aka ordinary trade or business income). Absent from the guidance, though, is clarity surrounding the potential application to a taxpayer who has both nonseparately stated income from a trade or business as well as separately stated income such as portfolio interest, dividends, and capital gains. With the potential for multiple sources of income, under the rules guiding classification of income or loss as passive or nonpassive, there is uncertainty about whether any SITP should be separately stated. In addition, interest expense may need to be allocated to one or more SITPs if interest is either paid on an underpayment or debt is used to pay the SITP (under “interest tracing rules”). If this is the case, this portion of interest expense may need to be separately stated and treated as personal interest expense, which would be nondeductible.

States also have taken different approaches to not only how any current year SITP is handled, but also how overpayments are treated. Some states treat these SITPs as either refundable or nonrefundable state income tax credits. Some states allow for a dollar-for-dollar credit for any SITP made while other states limit these credits to various percentages. Other states require owners of electing PTEs to exclude the income on their tax return that was subject to a PTET. This variety in treatment requires taxpayers to determine on a state-by-state basis the proper reporting of any income and credit related to an entity that made a PTET election and paid one or more SITPs. Taxpayers—whether they are the pass-through entity or owners of a pass-through entity—also must determine the proper treatment of any refund received related to an SITP or a credit generated from an SITP that led to a refund. States may approach the ordering of various tax payments or credits differently and, thus, the tax-benefit rule (the rule that if a tax deduction for the SITP was taken in a prior year, then a refund could require income recognition) may need to be considered.

Uncertainty and lack of guidance have not stopped nearly all states that have a personal income tax from either having enacted a pass-through entity tax regime or from proposing one. Accordingly, taxpayers can work with professionals at Forvis Mazars to both model the potential benefits from and help navigate the uncertainties associated with electing to participate in one or more PTET regimes.

The IRS issued several pieces of digital asset tax guidance in 2023.

Staking Decision (Revenue Ruling 2023-14)

Revenue Ruling 2023-14 states that cash-basis taxpayers who stake their cryptocurrency must recognize the fair market value of their staking rewards at the time they gain dominion and control. One couple in particular has argued and litigated that staking rewards are more akin to a baker baking a cake—a transaction that is not generally included in income. In this analogy, they argue that staking rewards should not be includable in gross income until they are converted. The IRS seems to disagree. Read our FORsights™ article, “IRS Clarifies Timing of Staking Rewards Included as Gross Income,” for more details on this revenue ruling.

NFT Guidance (Notice 2023-27)

On March 21, 2023, the IRS released Notice 2023-27 showcasing how the IRS intends to treat nonfungible tokens (NFTs). The IRS suggests that some NFTs are truly collectibles under §408(m). IRC §408(m) collectibles, such as art, antiques, stamps, gems, musical instruments, etc., are taxed at a maximum rate of 28% versus other general capital gain rates of 0/15/20%. According to the notice, to determine whether your NFT is subject to Section 408(m), a “look through analysis” is needed. This analysis attempts to look at the NFT’s underlying associated right/asset. If the underlying associated right/asset is deemed a collectible under §408(m), a higher maximum tax rate may apply. The notice suggests that when an NFT represents a physical asset, such as a diamond, then the NFT could be deemed a collectible. To learn more about this notice, read our FORsights article, “IRS Guidance: Nonfungible Tokens as Collectibles.”

Broker Reporting Rules

In late August 2023, Treasury and the IRS issued proposed regulations for digital asset brokers to furnish informational forms and payee statements. A digital asset broker is somewhat loosely defined to include U.S. brokers that, in the ordinary course of business, stand ready to effect sales to be made by others. Treasury and the IRS further expand that this definition would ordinarily include digital asset trading platforms, digital asset payment processors, certain digital asset hosted wallet providers, and persons who regularly offer to redeem digital assets that were created or issued by that person. Treasury and the IRS also clarify that these broker rules will not ordinarily apply to validators, whether through proof of work or proof of stake. The rules are expected to be effective for transactions beginning January 1, 2025.

Still Some Ambiguity

While the IRS did issue several new pieces of guidance for digital asset transactions in 2023, there remains some ambiguity. Areas where the IRS could still provide more guidance to taxpayers include:

- Do wash sales rules (IRC §1091) apply to digital assets?

- Does the IRC §475 mark-to-market election apply to digital assets?

- Does the IRC §864(b)(2) trading safe harbor apply to digital assets?

- Does IRC §1058 apply to digital asset loans?

- Do the constructive sale rules of IRC §1259 apply to digital assets?

- Should a de minimis nonrecognition rule similar to IRC §988(e) apply to digital assets?

- When do taxpayers report digital assets or digital asset transactions on FATCA forms, e.g., Form 8938; FBAR FinCEN Form 114; and/or Form 8300?

- Should there be a qualified appraisal exemption for digital asset donations in excess of $5,000 under IRC §170(f)(11)?

Expect more guidance to come in these areas, as the Senate Finance Committee has similar questions in a letter dated July 11, 2023.

As the new year approaches, taxpayers considering an exchange of real property should be aware of the benefits, requirements, and options available with §1031 like-kind exchanges (1031s).

What Can Be Included in a Tax-Free Swap?

Ultimately, 1031s allow taxpayers to avoid gain recognition if like-kind real property is swapped. Until the TCJA scaled back eligible property types, tangible personal property (things like vehicles, equipment, etc.) also was eligible for these swaps. What is less known is that nonrecognition can be accomplished if the following are exchanged within the 1031 guidelines as well: land improvements that are “inherently permanent structures,” e.g., fences; items “affixed to land” (things like crops or timber); easements on land; and options to buy real property. Incidental property also qualifies, which is essentially property that is a small relative value to the property overall (15%) or property that would logically be included in the swap of the properties, e.g., furniture and machinery within the property itself. Knowing what property is eligible can play an important part in deciding 1) whether to carry through with an exchange at all, and 2) whether a cost segregation study might be warranted to allow for the least gain recognition possible.

What Are Some Common Timing & Identification Errors?

Two of the most common errors made when planning for a 1031 are:

- Not meeting the timing requirements

- Not identifying a qualified intermediary (QI) or other arrangement for the deal

To satisfy the timing requirements, the identification period and the acquisition period must be satisfied. More specifically, the replacement property needs to be identified within 45 days (the identification period). If the taxpayer meets either the “three property rule”8 or the “200% rule”9 within this 45-day window, then the identification period is met.10 The acquisition period is met if property is acquired before the earlier of:

- 180 days after the transfer of the relinquished property; and

- The due date (with consideration of extensions) of the tax return for the year the transfer occurs.11

Many times, there will be “boot”—including cash or excess debt—involved in the transaction that does not qualify for a §1031. Further, deferred 1031 transactions might require properties to be swapped at different times. For both of these reasons, if a QI is not identified and used in the transaction, the desired gain deferral might not be possible. A QI constructively or actually holds cash or property during a 1031 to help ensure the integrity of the transaction within the 1031 framework. Confirming that a QI is part of your transaction could be critical to its success.

What Types of 1031s Are Available to Taxpayers?

Other than the traditional 1031 like-kind exchange, deferred exchanges also are a common approach to 1031s. In deferred exchanges, the swap is not simultaneous. Instead, the taxpayer often owns property they want to swap, and then takes time to identify property for the exchange. The following briefly examines additional options to consider when planning these transactions:

- Reverse exchanges: Replacement property is transferred to the exchange accommodations titleholder (EAT) prior to the relinquished property in a qualified exchange accommodation arrangement (QEAA). The EAT acts as a QI and facilitates the transaction.

- Three-party exchanges: If the party receiving the relinquished property does not have like-kind property to swap, they can buy replacement property from a third party to then involve in the transaction.

- Straw-man exchange: If an unrelated contractor is willing to own the property during construction, the taxpayer can effectively build or improve upon the replacement property themselves. Then, the taxpayer conducts the 1031 with the contractor to avoid gain.

Before any of these transactions are considered, we recommend reaching out to a tax professional at Forvis Mazars to help consider that the appropriate steps and considerations are made to accomplish a §1031 exchange.

International Tax Considerations

International taxation continues to evolve. Although there has been no major U.S. international tax legislation as of November 2023, there have been IRS regulation changes and tax cases that have significant importance. In addition, there is ongoing concern about the potential impact of Pillar Two to U.S. taxpayers. The following developments promise to loom large in the coming years.

In 2017, the TCJA imposed a one-time transition tax on all offshore untaxed earnings and profits for certain U.S. taxpayers with ownership in foreign corporations. This was codified under the IRC as §965. Affected taxpayers would be taxed as if they had received a dividend from the foreign corporation, even if earnings had never been distributed.

Charles and Kathleen Moore owned 13% of an Indian corporation starting in 2006 and never realized earnings from this investment. In 2017, they received a $15,000 tax bill for unrealized earnings going back to 2006. The Moore family took their case to court, arguing that because the tax was imposed on accumulated foreign earnings, it was not a tax on income and is, therefore, unconstitutional under the 16th Amendment. In June 2022, the Ninth Circuit Court of Appeals affirmed a district court’s decision rejecting the challenge. In its decision, the court held that whether income is realized is not a determinative factor regarding the validity of the transition tax.

Following this decision, the U.S. Supreme Court granted writ of certiorari and will now rule on the validity of the transition tax imposed under §965 with regard to any 16th Amendment concerns.

The taxpayers argued the lower courts’ decisions departed from a century of legal precedent set by earlier cases, which have held income realization is a necessary requirement under the U.S. Constitution. The results of the U.S. Supreme Court’s opinion carry significant implications since the transition tax under §965 builds on concepts imposed by the Subpart F regime under §951, a regime that has been long in place prior to enactment of the TCJA, as well as the current global intangible low-taxed income (GILTI) regime created by the TCJA. A February 2020 estimate by the IRS’ Statistics of Income Division stated that the net §965 liability for 2017 was $141 billion, with $127 million being deferred.

The stakes are high. U.S. taxpayers and the IRS should stay tuned.

On July 21, 2023, the IRS issued Notice 2023-55, delaying the application of the new final foreign tax credit (FTC) regulations under IRC §901 and §903 issued on January 4, 2022. The final regulations substantially revised the requirements for foreign taxes to be claimed as an FTC. The regulations generally required detailed analysis of foreign local country law to determine if the foreign taxes were imposed on a tax base that substantially conformed with U.S. tax principles. The IRS had received extensive comments on the FTC regulations, which taxpayers viewed as difficult to apply and burdensome.

Notice 2023-55 provides relief. The Notice permits taxpayers to use the former §901 and §903 regulations during a relief period for the 2022 and 2023 taxable years. During this time, the IRS is continuing to analyze the final 2022 regulations and is considering proposing amendments.

However, the Notice specifically retains FTC limitations related to taxes based on digital services, which are imposed on gross receipts or gross income, and the Notice adds language aimed at digital services taxes (DSTs):

“No foreign tax whose base is gross receipts or gross income satisfies the net income requirement, except in the case of a foreign tax whose base consists solely of investment income that is not derived from a trade or business, or wage income (or both).”

Since a DST is a tax based on gross income and does not consist solely of investment income not derived from a trade or business, a DST is not creditable under Notice 2023-55.

Notice 2023-55 provides welcome relief to U.S. taxpayers for 2022 and 2023, while the IRS considers further modifications for the FTC regulations. However, the Notice also makes clear that the IRS is not considering changing its position on DSTs based on gross income. Taxpayers who already filed their 2022 returns and had FTC limitations due to the new regulations may want to consider amending their returns.

In October 2021, more than 140 member countries (including the U.S.) agreed to worldwide adoption of the Global Anti Base-Erosion model rules (Pillar Two) developed by the Organisation for Economic Co-operation and Development (OECD). Pursuant to this agreement, countries in the European Union (EU) will aim to enact Pillar Two by the end of the 2023 calendar year, conforming to an EU directive agreed to in December 2022. In addition, in 2022 and 2023, Japan, South Korea, the United Kingdom, and other foreign countries have already enacted legislation implementing the Pillar Two rules.

The Pillar Two rules developed by the OECD propose a system of global taxation based on financial accounts applied using a minimum rate of 15% (which is set to rise to 17% by 2026) on a country-by-country basis. These rules are designed to target multinational enterprise groups (MNE Groups) with average annual global revenues of at least 750 million euros.

By design, the Pillar Two rules are expected to raise worldwide effective tax rates by using charging provisions such as:

- Qualified Domestic Minimum Top-Up Tax (QDMTT): A minimum tax that is imposed by the domestic law of a jurisdiction that computes its own top-up tax following the Pillar Two rules;

- Income Inclusion Rule (IIR): A minimum standard that imposes top-up tax at the highest level of an MNE Group with respect to low-taxed income at its constituent entities; and

- Undertaxed Profits Rule (UTPR): A rule that allows a jurisdiction to deny deductions in its own jurisdiction to top up any low-taxed jurisdictions of an MNE Group not brought into charge under the IIR or QDMTT.

While the U.S. has not enacted—and does not appear close to enacting—Pillar Two legislation, transitional safe harbors gradually implementing the charging mechanisms contemplated in the Pillar Two rules allow the U.S. to remain compliant with the Pillar Two rules at least into 2027 regardless of whether formal adoption is made in the United States.

On June 19, 2023, the U.S. Joint Committee on Taxation released commentary (the JCT Commentary) regarding the potential effects of worldwide adoption of the Pillar Two rules developed by the OECD. The JCT Commentary asserts that the implementation of Pillar Two will affect the current U.S. federal tax system regardless of whether the U.S. enacts legislation. This assertion is highlighted in the JCT Commentary through a revenue projection range that predicts a revenue loss of approximately 174.5 billion USD up to a revenue gain of up to approximately 224.2 billion USD over a 10-year period. While the impact to Treasury is highly uncertain at this point, it is largely expected that the global enactment of Pillar Two will result in more administrative costs to MNE Groups with average annual global revenues of at least 750 million euros.

To comply with the Pillar Two rules, affected taxpayers should adopt internal protocols to evaluate their internal tax function to confirm that Pillar Two provision and compliance requirements can be met starting in the first quarter of 2024.

In a big win for taxpayers, a recent Tax Court ruling gave taxpayers a new opportunity to challenge IRS penalty notices for late filing of Form 5471 for foreign corporations and Form 8865 for foreign partnerships.

On April 3, 2023, the Tax Court decided Alon Farhy v. Commissioner (160 TC No. 6), which held that the IRS does not have the administrative authority to levy penalties for late filing of Form 5471 under IRC §§6038(b)(1) and (2).

Under IRC §6038, U.S. shareholders are required to file information regarding ownership of controlled foreign corporations on Form 5471. The Form 5471 filing requirements are wide ranging and often burdensome to taxpayers. Form 5471 is required to be attached to the taxpayer’s timely filed U.S. income tax return. IRC §6038(b)(1) imposes a $10,000 penalty for failure to file the 5471 timely. The IRS has followed a policy of using its administrative authority to send notices assessing $10,000 penalties for delinquent filing of Forms 5471. The statute of limitation on IRS assessment remains open for all years for which there is a failure to file.

In Farhy, the taxpayer challenged the IRS’ authority to assess penalties using administrative procedures. The Tax Court held that the penalty provisions in IRC §§6038(b)(1) and (2) did not expressly authorize the IRS to assess the penalty. The Tax Court ruled there is no explicit statutory authority for the IRS to make administrative penalty assessments for Form 5471. To the extent the Tax Court’s decision is upheld, the IRS still has the option of opening a civil case against taxpayers under 28 USC 2461 to pursue 5471 penalties. Such a civil action may be subject to the five-year period of limitations set forth in 28 USC 2462. Moreover, in the case of any information required to be reported on a 5471 (and certain other international tax forms), the time for assessment of any tax imposed with respect to such information shall not expire until three years after the information is reported, if the taxpayer has reasonable cause for such delayed reporting (and an unlimited period of limitation applies generally to any relevant tax return or period in the absence of reasonable cause) (IRC §6501(c)(8)).

To the extent the Farhy decision is upheld, it gives taxpayers an important argument to mitigate Form 5471 late filing penalties. Although the IRS has the option to pursue a legal remedy, an administrative notice would be contrary to the holding of the case. Taxpayers who receive Form 5471 late filing penalty notices or who have such paid penalties in the past should carefully consider the impact of this ruling on their fact situation. Going forward, the IRS will now have to consider the cost of bringing a civil suit as well as the hazards of litigation when faced with taxpayer challenges.

There have been many significant transfer pricing developments over the past year that deserve taxpayer attention. At the global level, the OECD’s Pillar One and Two initiatives have ramifications that transfer pricing practitioners should be closely watching. At the local level, countries continue to modify their transfer pricing rules and requirements, leading to continued challenges from a transfer pricing compliance perspective for MNE clients.

A consultation document12 has been issued by the OECD under its broad Base Erosion and Profit Shifting (BEPS) project with respect to Amount B under Pillar One, which aims to provide a consistent approach for identifying and establishing a transfer pricing method for “in-scope baseline distribution activities.” Unlike Amount A, which will only apply to a small group of the largest MNEs due to revenue ($20 billion) and profit-before-tax margin (10%) thresholds, Amount B carries no similar limits. On the one hand, the final guidance, set to make its way into the OECD Guidelines by January 2024, may provide a safe harbor (of sorts) for local baseline distribution activities. However, there is still much disagreement between OECD members on how to treat non-baseline distribution activities (possibly including digital services), and the final pricing matrix may end up being complex and open to dispute. Taxpayers will soon have to make decisions about how best to comply with the new guidance when it makes its way into local country tax law of the inclusive framework member countries. Pillar Two has been grabbing all the international tax headlines and for good reason. Taxpayers (initially those taxpayers with consolidated group revenues of at least 750 million euros) will have to determine how best to comply with new complicated global tax rules. The introduction of transition rules and safe harbor guidance has brought Country-by-Country Reporting (CbCR) back to the forefront of international tax compliance, a tax/data requirement that is commonly the responsibility of transfer pricing departments. Taxpayers who may not be able to cleanly tie their CbCR data to auditable financial statements (as this was not a requirement) may have to refocus their efforts given the use of CbCR data for Pillar Two safe harbor testing. Not to mention the advent of public CbCR in Europe, for which the first year of reporting for most taxpayers would be 2025. Taxpayers will need to confirm that they have a sound process to gather and report the data and that it “qualifies” for Pillar Two purposes. The transitional safe harbor is active for fiscal years beginning on or before December 31, 2026.

Turning to major country-specific transfer pricing developments, the most notable news pertains to Brazil passing a law in June that establishes a new transfer pricing framework, beginning on January 1, 2024, embracing the OECD Guidelines.13 Brazil has long been a difficult country for MNEs to operate in, given its prescriptive transfer pricing rules, punitive withholding tax, and the risk of double taxation. The new framework, which adopts the arm’s-length principle, aims to eliminate double taxation and should remove obstacles necessary to receive foreign tax credit recognition in the United States. MNEs may begin to re-evaluate their commercial operations in Latin America with the passing of these new rules.

In Europe, the major news pertains to changes to U.K. transfer pricing documentation requirements. Effective for accounting periods beginning on or after April 1, 2023, companies of a certain global size operating in the U.K. will be obligated to produce a Master File, Local File, and Summary Audit Trail.14 Further guidance is expected with respect to the Summary Audit Trail this coming year. In the Netherlands, a new Transfer Pricing Decree mainly includes new guidance on financial services companies and brings the Dutch guidance in line with the OECD’s Chapter X on financial transactions.15

Primarily relevant to U.S. operating companies, on February 9, 2023, the IRS contested that 3M Brazil reported excess profits due to a non-arm’s-length licensing fee. The IRS issued a transfer pricing adjustment in the amount of $23.5 million. This case was important given its broader impact on transfer pricing allocations and uncertain tax positions (UTPs) with respect to countries that impose foreign restrictions on payments. Shortly after coming away with a decisive win against the IRS, Eaton Corp was back in tax court challenging the IRS on various related matters (allocations concerning interest payments, guarantee fees, and royalty charges) but for different years. In general, this case and other recent cases, such as Coca-Cola v. Commissioner, have reminded taxpayers that they should not rely on historical IRS decisions or advanced pricing agreements (APAs) when trying to defend transfer pricing policies of later years. In other news, the IRS has been active around its captive services provider campaign and taxpayers should expect IRS scrutiny should they have material captive services transactions.

Note that in a post-pandemic economy where government spending was exacerbated, it is inevitable that fiscal authorities seek to raise tax revenue and will continue to look to transfer pricing to do so. New global tax rules also will put pressure on the transfer pricing of MNEs as tax authorities seek to ensure that they are receiving their fair share of global profits and attempt to continue to minimize profit shifting. This comes at a time when global transfer pricing compliance is as complex as it has ever been; the path to compliance has become more difficult and burdensome for taxpayers and, for some of the reasons summarized herein, this is not likely to change anytime soon.

State & Local Tax Considerations

State tax treatment of gain from the sale of goodwill and going concern value is often overlooked by taxpayers and tax practitioners, but recent state tax cases highlight the importance and complexities of this issue. Over the course of the last several years, most states have adopted very broad definitions of business income. Business income generally is apportioned to the taxing state by a formula that compares the business’s in-state activities to its total activities, while nonbusiness income is allocated to the specific state from which the income presumably arises. Gain from goodwill and going concern value will be included in most states’ definitions of business income and will, therefore, be subject to apportionment. However, many states provide limited guidance regarding the sourcing of gain from the sale of goodwill and going concern value, which can lead to significant uncertainty regarding the extent to which gain should be included in the numerator and denominator of the sales factor.

The 2009 Metropoulos Family Trust, et al. v. Franchise Tax Bd.

The 2009 Metropoulos Family Trust, et al. v. Franchise Tax Bd.,16 a 2022 decision of the California Court of Appeal, illustrates the potential complexities involved with state taxation of income from the sale of goodwill. The plaintiff shareholders, the 2009 Metropoulos Family Trust and the Evan D. Metropoulos 2009 Trust (the Metropoulos Trusts), received income from an S corp, the Pabst Corporate Holdings, Inc. (Pabst), related to goodwill from the sale of a subsidiary of Pabst. Pabst initially reported the income from the sale as apportionable business income on its return for the 2014 tax year. The Metropoulos Trusts reported the income on their fiduciary income tax returns as apportionable to California and made corresponding tax payments totaling more than $3.5 million. However, the Metropoulos Trusts filed an amended return seeking a refund for the amount paid, which was subsequently denied by the California Franchise Tax Board (the FTB). The Metropoulos Trusts then filed an appeal with the Office of Tax Appeals, which also was unsuccessful. The Metropoulos Trusts then brought an action in the Superior Court of San Diego, where the court granted a motion for summary judgment in the FTB’s favor, which the Metropoulos Trusts appealed to the California Court of Appeal.

The Metropoulos Trusts argued that Cal. Rev. & Tax. Cd. §17952, which applies to the taxation of nonresident’s income derived from intangible personal property, should apply to the income from the sale of goodwill. The application of §17952 would have resulted in 0% allocation of the income to California. The FTB argued that the income from the sale of goodwill was business income of the S corp and “retained that character when passed to the trusts.” The California Court of Appeal agreed with the FTB’s argument and found that the income from the sale of goodwill remained business income subject to apportionment when received by the Metropoulos Trusts. Interestingly, in coming to this conclusion, the court found that a regulation that is issued pursuant to statutorily provided rulemaking authority is to be “accorded the same dignity” as a statute.

Although the court agreed with the FTB that the income from the sale of goodwill should be apportionable business income, it went on to clarify that even if the income had been allocated pursuant to §17952 (and the regulations thereunder), the goodwill had acquired business situs in California. The Metropoulos Trusts argued that the rule from §17952 was a rule of 100% allocation. The court went on to note “[n]or do we glean a 100 percent allocation rule from regulation 17952… [which provides] that where intangible property has a business situs in this state, the ‘entire income from the property’ is income from sources within this state.” The court clarified that the regulation addresses “the entirety of the income, not the entirety of the goodwill.” Therefore, the business situs of goodwill could then be partially allocated to California. The California Supreme Court declined to hear the case on appeal.

Metropoulos illustrates the potential complexities involved with the application of allocation and apportionment provisions to the sale of a business (and the corresponding sale of goodwill) in the context of a tiered business structure involving pass-through entities.

Vectren Infrastructure Services Corp, v. Department of Treasury

In Vectren Infrastructure Services Corp, v. Department of Treasury,17 the Supreme Court of Michigan recently addressed the constitutionality of the apportionment formula as applied under the now repealed Michigan Business Tax to the gain from the sale of a business that was treated as an asset sale. Minnesota Limited, Inc. (MLI), an S corp headquartered in Minnesota, provided services related to the construction, maintenance, and repair of oil and gas pipelines. In addition, MLI provided related environmental cleanup services. MLI operated in a 24-state territory, which included Michigan. The owners of MLI agreed to sell the business in 2010. During the period that MLI was seeking a buyer, MLI was hired to assist in the cleanup of a severe oil pipeline spill in Michigan. In 2011, while the Michigan cleanup project was ongoing, MLI’s owners sold its stock to Vectren Infrastructure Services Corporation (Vectren), which they elected to treat as an asset sale by MLI (including MLI’s intangible assets of receivables, cash, and goodwill) under IRC §338(h)(10).

MLI’s short year return for the tax year ending on the date of the sale included the gain from the sale of the business in the company’s apportionable tax base and the sales factor denominator. The Michigan Department of Treasury (the Department) subsequently audited the return and determined that the gain should be included in the company’s apportionable tax base but excluded from the sales factor denominator. The consequence of this determination was an increase in the Michigan sales factor from roughly 15% to roughly 70%. As the purchaser, Vectren was responsible for taxes and ultimately was the plaintiff in the lawsuit filed against the Department. After a number of appeals, the Supreme Court of Michigan considered Vectren’s arguments concerning the constitutionality of the apportionment formula as applied.18

Despite the extraordinary facts, the Supreme Court of Michigan found that the apportionment of MLI’s income from the short year return did not violate the Commerce Clause or Due Process Clause of the United States Constitution. The court provided a survey of U.S. Supreme Court decisions addressing both constitutional arguments, along with a few additional state cases, and leaned heavily on the unitary business principle to reject Vectren’s argument. Interestingly, the court pointed to several definitions of goodwill and how it could be sourced, including IRC §865(d)(3).

Vectren illustrates the challenges presented by the apportionment of goodwill and going concern because their value is created over time, but states’ application of apportionment provisions typically only look to the most recent tax year to apportion the gain. Vectren also illustrates the difficulties involved in showing that apportionment is unconstitutional as applied when the income is derived from a unitary business.

Tax-Exempt

Explore newly available renewable energy tax credits for nonprofit organizations.

Read MoreNow that 2024 is here, tax-exempt organizations may need to brush up on charitable receipt reminders.

Read MoreSee the updates for organizations subject to Form 8300 filing requirements.

Read MoreLearn about international tax challenges for nonprofit organizations with global reach.

Read MoreSee our strategies for nonprofits facing Employee Retention Credit scrutiny.

Read MoreIndividual Taxpayer Considerations

Now that we’ve explored tax considerations for businesses, let’s look at what we’ve seen over the past year for individual, gift, and estate tax purposes, and what we can look ahead to in 2024.

This year brought about numerous changes to employer-sponsored retirement plans and IRAs with the passage of the SECURE 2.0 Act of 2022, with additional provisions set to take effect in 2024 and beyond. Below are a few highlights from the 91 provisions within the legislation.

| Changes in 2023 | Changes in 2024 & Later |

|---|---|

| Required Beginning Date (RBD) for Retirement Accounts – Previously, IRA and 401(k) account holders were obligated to begin taking required minimum distributions (RMDs) annually beginning in the year they turn 72. SECURE 2.0 delayed the RBD to age 73 as of January 1, 2023 (and age 75 in 2033). | Elimination of RMDs for Roth 401(k) Plans – The Act eliminates the requirement for Roth 401(k) owners to take RMDs, beginning in 2024. |

| Reduction in Penalty for Failure to Take RMD – The penalty for the failure to take an RMD is reduced from 50% to 25%. Further, if this mistake is corrected in a timely manner, this penalty can be reduced to 10%. | Qualified Charitable Distributions (QCDs) Indexed for Inflation – Beginning in 2024, the annual QCD limit of $100,000 will be indexed for inflation. |

| SEP and SIMPLE IRAs – SEP and SIMPLE IRA owners are now permitted to make Roth contributions for their retirement accounts. | Catch-Up Provisions – Beginning in 2024, IRA owners’ annual catch-up contributions from age 50 onward will be indexed for inflation from a starting amount of $1,000. In addition, in 2025 and after, 403(b) and 401(k) account owners ages 60 through 63 will have an expanded catch-up contribution limit equal to the greater of $10,000 or 150% of the previous year’s catch-up amount, indexed for inflation. |

| Catch-Up Provision Delay – Beginning in 2026, those earning more than $145,000 annually must make their catch-up contributions on a Roth basis. This provision was supposed to begin in 2024, but a delay has been issued to allow employers more time to update their plan documents. | |

| Transfer From 529 Plan to Roth IRA – Transfers from 529 Plan accounts to Roth IRAs will be permissible, beginning in 2024. The law allows a lifetime maximum of $35,000 to be transferred, without taxation or penalty, from a 529 account that has been open for at least 15 years to a Roth IRA owned by the 529 account beneficiary. This transfer will be subject to annual IRA contribution limits and an earned income requirement. | |

| Student Loan Payments and Matching Contributions – In an effort to allow those paying down student debt to also save for retirement, the Act allows employers, beginning in 2024, to make matching contributions into retirement plans for employees making qualified student loan payments. |

We are still waiting for necessary details from the IRS and the U.S. Department of Labor regarding how many of the provisions will be implemented, and it may still be some time before we have clarity. We do know that the Act provides new planning opportunities for individuals and businesses alike. Please reach out to a professional at Forvis Mazars for a detailed conversation to assist you in meeting your goals.

The IRA provides renewable energy credits for businesses and individuals alike. Here are some of the ways individuals can benefit from certain clean energy credits under the IRA:

25D Residential Clean Energy Credit

This credit applies to individuals who install qualified energy property for use in a dwelling unit located in the U.S. and used as a residence (not necessarily the primary residence) by the taxpayer. The credit percentage rate is 30% for property placed in service in tax year 2022 through 2032, 26% for 2033, and 22% for 2034. No credit is available for property placed in service after December 31, 2034. Qualifying clean energy expenditures:

- Qualified solar electric and water heating property

- Qualified fuel cell property expenditures

- Qualified small wind energy property

- Qualified battery storage technology

- Qualified geothermal heat pump property

Note: The credit can be claimed in the year the installation is completed. If the equipment is installed in a newly constructed or reconstructed home, the credit is claimed when the taxpayer moves in. The credit is allowed against both regular income tax liability and alternative minimum tax (AMT). If the credit exceeds the tax liability, such unused credits may be carried forward to the next year.

25C Energy-Efficient Home Improvement Credit

The nonbusiness energy-efficient home improvement credit provides homeowners with a tax credit for investments in certain high-efficiency heating, cooling, and water-heating appliances, as well as tax credits for energy-efficient windows and doors. Previously limited to a $500 lifetime credit, the §25C credit has been amended to provide for up to an aggregate of $3,200 annually for years after 2022 (depending on the type of property). Qualifying expenditures include qualifying improvements (insulation, exterior, and doors), residential energy property expenditures as listed below, and home energy audits. The credit is allowed for qualifying property placed in service on or after January 1, 2023 and before January 1, 2033. Qualifying residential energy property expenditures include:

- Electric or natural gas heat pumps or heat pump water heaters;

- Central air conditioners;

- Certain water heaters, hot water boilers, furnaces, and stoves; and

- Any improvement to or replacement of a panelboard, sub-panelboard, branch circuits, or feeders meeting specific standards.

Electric Vehicle (Related) Opportunities

The IRA provides taxpayers with a credit for clean energy vehicles and related charging stations.

30C Alternative Fuel Vehicle Refueling Property Credit

Alternative fuel vehicle refueling property (most likely, but not limited to, electric charging stations) placed in service by a taxpayer during the tax year may qualify for a tax credit under IRC §30C. Starting in 2023, qualifying property will be limited to property placed in service within low-income communities or non-urban census tracts. The credit is 30% of cost for charging stations not used in a trade or business and shall not exceed $1,000 per any single item of qualified property. Beginning in 2023, the credit for qualified refueling property subject to depreciation equals 6% of cost with a maximum credit of $100,000 for each single item of property. The applicable percentage increases to 30% if the prevailing wage and apprenticeship requirements are met.

30D Clean Vehicle Credit

If you’ve been thinking of buying a new hybrid or electric car, truck, or van, you could be eligible for a tax credit of up to $7,500. A credit is available under §30D for a “new clean vehicle” placed in service by the taxpayer during the taxable year. A "new clean vehicle" is defined by eight key factors in the law. First, the vehicle’s first use should be by the person claiming the credit. Second, the vehicle should be bought for personal use or leasing—not for resale. Third, it should be made by a manufacturer that meets specific standards. Fourth, it has to comply with certain environmental regulations. Fifth, the vehicle’s weight should be less than 14,000 pounds. Sixth, the car should be mostly powered by an electric motor that uses a battery of at least seven kilowatt-hours, which can be recharged externally. Seventh, the final assembly of the car must take place in North America. Lastly, the seller should provide a report to the buyer and to the government containing specific information about the vehicle.

Starting from January 1, 2023, each vehicle identification number (VIN) can only be used to claim the §30D credit once. Think of it as a one-time coupon for each unique VIN. When you file your tax return for the year you’re claiming the credit, you need to include the VIN of the vehicle. It’s like a proof of purchase you need to show when you want to claim a rebate.

Section 30D limits the credit for high-income taxpayers. When taxpayers with an adjusted gross income (AGI) for the current or previous year cross a certain limit, they cannot claim the credit. The limit is $300,000 for joint filers or surviving spouses, $225,000 for heads of households, and $150,000 for any other taxpayers.

Finally, the credit is disallowed for vehicles that cost more than a set price. This limit is $80,000 for vans, SUVs, and pickup trucks, and $55,000 for all other vehicles.

There also are some future rules to be aware of. For instance, from 2024, the credit can be transferred from the taxpayer to certain registered dealers. However, the credit will not be available for any vehicle put to use after December 31, 2032.

25E

Dealers may claim a credit for previously owned clean vehicles subject to certain limitations.

Summary

Depending on your location, state and local incentives also may be available to you. Clean energy credits present an exciting opportunity for individuals who are interested in new clean energy technologies.

In 2017, Congress passed the TCJA. A major provision of the TCJA was the increase of the lifetime gift and estate exemption amount from approximately $5,490,000 to $11,180,000. As a result, an individual could give $11,180,000 either during life or at death with no transfer tax consequences (almost double what they could give in the year prior). This amount has since increased to $12,920,000 per individual as the amount has been annually adjusted for inflation.

This major change in the wealth transfer planning landscape allows wealthy individuals to take advantage of the increased exemption to preserve wealth for future generations.

The TCJA includes a “sunset provision” with an expiration date of December 31, 2025. On January 1, 2026, the available gift and estate tax exemption will revert to pre-2018 levels, which is expected to be approximately $7 million.

While this is not to say that Congress will not change this in the future, persons with taxable estates over the exemption amounts noted above should consider using this exemption prior to January 1, 2026, as it is a “use it or lose it” proposition.

As an example, a married couple can enjoy the advantages of transferring $25,840,000 ($12,920,000 per individual) gift and estate tax-free should they choose to implement a gifting strategy prior to 2026. That same married couple could lose the ability to transfer $11,840,000 ($5,920,000 per individual) in wealth to their heirs if they don’t take action prior to the expiration of the TCJA. In addition, it is exponentially beneficial to remove any subsequent growth on those assets from their estate.

Individuals also should consider making gifts under the annual gift tax exclusion, which is $17,000 per person in 2023. What this means is that you can give up to $17,000 to as many people as you would like—and so can your spouse if you are married. This is an excellent technique to help reduce your taxable estate without using your federal estate tax exemption.

With the sunsetting provision of the TCJA looming, now is the time to work with your planning team to evaluate your existing plan and contemplate making changes. As prospective clients find themselves with asset values near the taxable estate thresholds, Forvis Mazars Private Client™ can help with discussions on how to create a customized approach for each person. Through the Estate Mapping deliverable, the Forvis Mazars Private Client team can assist a client in evaluating whether action should be taken prior to January 1, 2026.

With the end of each calendar year comes checklists: holiday travel plans, gifts to purchase, meals to plan, and our personal favorite, year-end charitable gifting to complete. This year, Forvis Mazars Private Client would like to provide some guidance on how to allocate your charitable gifting in a tax-efficient manner.

Many individuals who gift to charity do so by writing a check or making a cash donation. These types of donations may qualify for a charitable deduction, typically up to 60% of AGI. However, after the TCJA essentially doubled the standard deduction, most Americans no longer have enough itemized deductions to write off their charitable gifting. Listed below are some strategies that may create greater tax efficiencies than gifting cash.

QCDs

One of the great advantages of investing into an IRA is the tax-deferred savings that can be accumulated over many decades. Of course, eventually the free ride ends and the IRS forces individuals to start taking required minimum distributions (RMDs) from these accounts. The current RMD age is 73, with a scheduled increase to age 75 in 2033.

Typically, all distributions from a Traditional IRA are taxed as ordinary income. One exception is the QCD, which allows individuals to make a gift directly from their IRA to charities of their choice. These charitable distributions are not included in taxable income and count toward an individual’s RMD. The annual limit on QCDs is $100,000 per person, and beginning in 2024, this amount will be adjusted annually for inflation.

It’s important to let your CPA know about any QCDs you make, as typically 1099s do not list which IRA distributions qualify for preferential tax treatment. In addition, while the RMD age has been steadily increasing, the age at which an individual can begin utilizing QCDs has remained at 70.5.

Gifting of Appreciated Securities

When an investor purchases a security, they establish cost basis in that asset. If the security appreciates over time, unrealized gains become embedded. If the security were to be sold, the gain would be taxed at capital gains rates. By gifting, rather than selling, appreciated securities held for more than a year, an investor can avoid paying tax on the capital gains while potentially receiving a charitable deduction equal to the fair market value of the security. Non-cash gifts typically qualify for a deduction up to 30% of AGI, with any unused portion carrying forward for up to five years.

“Bunching” of Charitable Contributions

In 2023, the standard deduction is $13,850 for a single filer or $27,700 for a married couple filing jointly, with a slight increase for individuals who are blind or over age 65. If your itemized deductions do not exceed this amount, your cash or security donations will not result in an actual tax deduction. One strategy to overcome this barrier is to “bunch” charitable gifts. Instead of gifting annually, you may choose to bunch two or more years of gifting into a single year to be above the standard deduction. This strategy works particularly well with a donor-advised fund (DAF), whereby an individual can receive a tax deduction in the year of the gift, avoid paying capital gains on the gifted securities, and then have flexibility over when to distribute funds from the DAF to the charitable organization.

Whatever your philanthropic goals may be, we’re here to help. If you have further questions, please reach out to a professional with Forvis Mazars Private Client for guidance.

Conclusion

Navigating individual, federal, state and local, and international taxes can present a myriad of challenges and considerations. We hope this Tax Planning Guide helped you understand what topics you should keep in mind as you prepare for a new calendar year. If you’d like to learn more, please reach out to your Forvis Mazars trusted advisor, or submit a Contact Us form.

- 1“Beneficial Ownership Information Reporting,” fincen.gov., September 29, 2023.