After a tough start to the fourth quarter, both stocks and bonds staged an impressive rally in the final two months of the year. The surge was sparked by strong third-quarter economic growth, improved inflation readings, and an end to Federal Reserve (Fed) rate hikes.

U.S. Economic Growth Accelerated in 2023.

U.S. economic growth was exceptionally strong in the third quarter, with GDP rising 4.9%. The gain was primarily driven by increases in consumer spending and inventory investment. This was the best quarter of growth in two years. The economy is on track for a full-year gain of about 2.5%, well above the 0.5% consensus forecast at the start of the year.

Consumer spending was supported by strong employment conditions, wage growth above 4%, and declining inflation. Many consumers also benefited from locking in previously low mortgage rates. While current 30-year fixed mortgage rates are above 7%, the average effective rate on outstanding mortgage debt is below 4%.1 Securing lower rates helped keep house payments stable for most families while incomes continue to rise.

Inflation declined in 2023, with the Consumer Price Index dropping from 6.5% at the start of the year to 3.4% in December. A significant decline in energy prices, a drop in new and used vehicle prices, and moderating food costs all contributed to progress.2 Shelter prices have only recently started to fall, which should lead to further improvement in 2024.

The U.S. economy accelerated in 2023. This increases the odds of a “soft landing,” whereby growth slows but recession is avoided. While less probable, the possibility of recession still exists mainly due to the lagged impact of Fed rate hikes. If a recession were to materialize, the Federal Reserve would likely cut rates rapidly to limit the extent of any downturn.

All’s Well That Ends Well.

The start of the fourth quarter was rough for stocks, as the U.S. market completed a 10% correction in late October. But investors were rewarded handsomely for weathering the volatility, as stocks soared to new highs in the final two months of the year. In the end, U.S. stocks posted strong gains of 26% in 2023 while international stocks rose an impressive 18%.

MARKET SCOREBOARD | 4Q 2023 | 2023 |

|---|---|---|

S&P 500 | 11.69% | 26.29% |

MSCI EAFE | 10.42% | 18.24% |

Bloomberg Aggregate Bond | 6.82% | 5.53% |

Bloomberg Municipal Bond | 7.89% | 6.40% |

Wilshire Liquid Alternative | 1.98% | 4.50% |

Source: Morningstar Inc, Tamarac Advisor View as of September 30, 2023.

What caused this significant reversal? The key factor was the Federal Reserve’s pivot from a hawkish stance to a more accommodative mood. Fed guidance in December indicated that not only were rate hikes over, but that they planned to cut rates three times in 2024. Asset prices tend to do well when the Fed stops raising interest rates. As such, the Fed’s policy pivot delivered a healthy dose of holiday cheer to markets!

Strong gains in 2023 completely offset 2022’s stock market losses, leaving index levels roughly where they were two years ago. The largest technology companies, coined the “Magnificent Seven,” drove this year’s rise. These seven stocks, accounting for more than 25% of total stock market capitalization, produced two-thirds of the total market return while the other 493 companies delivered the other third. This resulted in a large performance advantage in favor of growth-over-value stocks in 2023—the complete opposite of the prior year.

As we enter 2024, fundamentals are improving. Corporate profits were weak in the first two quarters of 2023 but posted 5% growth in the third quarter. Consensus analyst estimates indicate earnings growth above 10% in 2024,3 with both revenues and profit margins increasing. The lower interest rate environment planned by the Fed also should be supportive of markets.

The Federal Reserve Will Pivot Toward Rate Cuts in 2024.

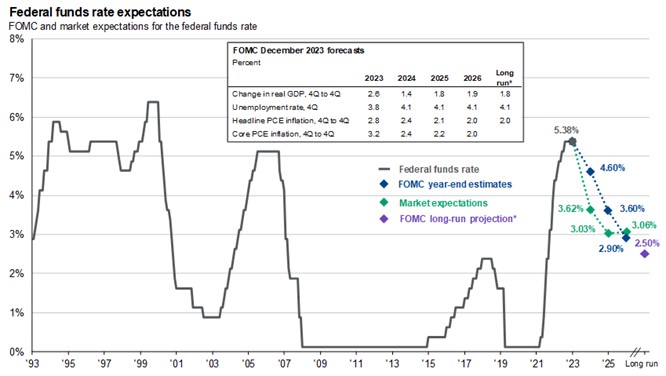

After several false starts, the market finally received guidance from the Fed that its next policy move would be a rate cut. December was the third straight meeting with no change in the Funds rate, effectively ending the hiking cycle. The Fed’s official statement included a notable shift in tone, as did Fed Chair Jerome Powell in his press conference. The Fed is now forecasting three 0.25% cuts in 2024. Fed funds futures imply an even greater decline in rates next year, a total of 1.5%. Powell noted the Fed was pleased with progress in bringing inflation down toward its 2% target. He also noted they were “very focused” on the risk of keeping rates too high for too long.

Powell did not seem overly concerned with the drop in market rates and easing of financial conditions since the end of October. The Fed clearly believes the current 5.5% Fed funds rate is highly restrictive and that cooling inflation will allow for rate cuts soon. So how low will the Fed funds rate go in 2024? While no one knows for sure, inflation trends will be key. The Fed’s preferred inflation measure, the Personal Consumption Expenditures (PCE) index, fell to 3.2% year over year in November. The most recent three-month PCE reading was roughly 2% annualized, matching the Fed’s inflation goal. If inflation stays on the current trajectory, the Fed may adopt a path closer to the market’s expectations in 2024.

After a Strong Finish to 2023, What’s Next for Bonds?

By mid-October, bonds appeared to be headed toward an unprecedented third straight year of losses. The yield on the 10-year Treasury note had reached 5%, the highest in 17 years. Our third-quarter commentary urged clients not to give up on bonds. While high bond yields typically presage solid forward returns, the magnitude of the rally at the end of the year was unexpectedly strong.

Softening inflation data coupled with a rapid change in Fed policy resulted in the 10-year Treasury yield plunging from 5% to below 4% by year-end. The sharp drop in yields propelled price gains across the entire spectrum of fixed income. In some cases, the gains in November alone were remarkable. Municipal bonds, for example, posted their best single month since the early 1980s!

With such strong gains to end the year, does opportunity still exist in the bond market? Despite the recent rally, yields are still close to 4% for municipals (tax-free) and over 5% for taxable bonds. Current yield levels offer a good estimate of expected total return for bonds over the next few years. With Fed policy still evolving, the possibility of higher-than-normal bond market volatility remains. However, long-term investors should not fret short-term changes in rates, but instead focus on the improved return contribution bonds are likely to make going forward.

Market & Economic Outlook

At the end of last year, our commentary highlighted the likelihood of a volatile start to 2023 followed by improved returns later in the year. That outlook was based on the expected peaking of the Fed funds rate, continued progress on the inflation front, and attractive valuation levels for both stocks and bonds after a difficult 2022. While market volatility lasted further into the year than thought, the final investment outcome was largely consistent with expectations.

After a solid recovery year for both stocks and bonds, where do we go from here? Let us start with the most significant factor of the past two years—Federal Reserve policy. While the expected pace of cuts differs between the two, both the Fed and the markets expect rates to fall in 2024. The change in Fed policy has been facilitated by a significant improvement in inflation. The Fed’s stated long-run equilibrium funds rate is 2.5%, versus the current level of 5.5%. While the path from current rates to equilibrium is unpredictable, the beginning of the stairstep downward should start by mid-2024. This is good news for both stocks and bonds, as declining interest rate environments have historically proven positive for investments.

U.S. economic growth is expected to slow from the above-average pace of 2023, with pandemic-era anomalies continuing to drop out of the data. While the economic environment should support reasonably good consumer spending, the tailwinds won’t be as strong in the new year. Government spending, the number two category of GDP contribution, also is set to moderate. While the probability of a “soft landing” has increased, a mild recession is still possible given the lagged impact of rising interest rates.

Stocks will look to build on the momentum of last year. Whereas earnings growth was relatively flat last year, consensus expectations call for low double-digit gains in 2024. This, along with the expected decline in interest rates, should allow stock prices to move higher. Look for a broadening of participation beyond the handful of stocks that drove markets higher in 2023 as an indication of a more lasting rally.

Despite movement within the year, bond yields ended about where they started across most maturities. This point-to-point stabilization in rates allowed bonds to post returns of 5% to 6% across investment grade sectors. Given the expectation of declining rates in 2024, bonds are positioned for another year of solid returns.

Uncertainty around the timing of Fed rate cuts, the ramping up of the presidential election season, and rising geopolitical tensions make more market volatility likely. While unpleasant, corrections are a normal part of the investment experience. But investors should take solace in this quote from legendary investor Peter Lynch:

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in the corrections themselves.”

Know that our diversified portfolios are built to withstand these inevitable periods of market turmoil. To achieve long-term success, maintaining investment discipline through good times and bad is key. Given higher starting bond yields and the prospect for broadening return contribution in the stock market, 2024 should prove to be a productive year for investors despite the challenges that may arise!

On behalf of the entire Forvis Mazars Private Client™ team, thank you for your confidence and best wishes for a happy and prosperous 2024!