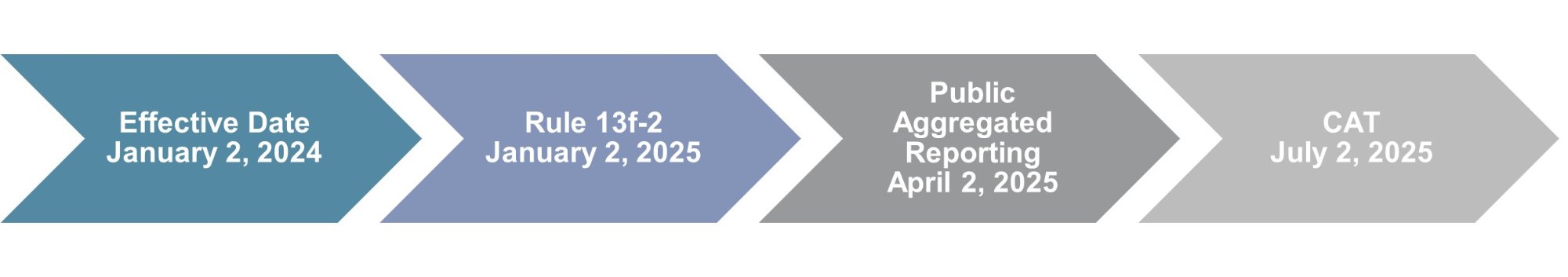

On October 13, 2023, the SEC voted three to two to create new Rule 13f-2 and update the consolidated audit trail (CAT) to increase market transparency on short activity on equity securities. Institutional investment managers will be required to report certain short sale-related data to the SEC on a monthly basis, 14 days after month-end. At the end of the following month, the SEC would publicly report aggregate data about large short positions, including daily short sale activity for each individual security.

Background

A short sale involves a trader borrowing a company’s shares from a broker-dealer and then selling the borrowed securities with the hopes of buying them back at a lower price in the future. In a “naked” short sale, the seller does not borrow or arrange to borrow the securities in time to make delivery to the buyer within the standard three-day settlement period.

Current short sale regulations are generally found in Regulation SHO, which became effective in 2005. Regulation SHO imposes four general requirements for equity short sales:

- Rule 200 – Marking Requirements. Broker-dealers must flag sale orders as long, short, or short exempt.

- Rule 201 – Short Sale Price Test Circuit Breaker. Trading centers must establish, maintain, and enforce written policies and procedures that are reasonably designed to prevent the execution or display of a short sale at an impermissible price when a stock has triggered a circuit breaker—a price decline of at least 10% in one day. Once triggered, the price test restriction will apply to short sale orders in that security for the remainder of the day and the following day, unless an exception applies.

- Rule 203(b)(1) and (2) – Locate Requirement. Before a short sale, a broker-dealer must reasonably believe the security can be borrowed and delivered on the delivery date. This assessment must be made and documented prior to the short sale.

- Rule 204 – Close-Out Requirement. This rule includes detailed procedures to close out failures to deliver that result from long or short sales.

Currently, Financial Industry Regulatory Authority (FINRA) short reporting is applicable only to broker-dealers that are FINRA members.

The Dodd-Frank Act required the SEC to prescribe rules for the monthly public disclosure of certain short sale information.

Rule 13f-2

The rule will require an institutional investment manager1 (which includes brokers and dealers, investment advisers, banks, insurance companies, and pension funds) to electronically file a confidential Form SHO within 14 calendar days after calendar month-end for each equity security and all accounts over which the manager meets or exceeds either of the following thresholds:

- For any equity security of a registered issuer (or an issuer required to file SEC reports) in which the manager has a monthly average of daily gross short position of $10 million or more at the end of the calendar month, or a monthly average gross short position of 2.5% or more of equity shares outstanding

- For any equity security of an issuer that is not a reporting company issuer in which the manager meets or exceeds a gross short position in the equity security of $500,000 or more at the close of any settlement date during the calendar month

The scope covers both exchange-listed, over-the-counter equity securities and exchange-traded funds (ETFs) (consistent with Rules 200, 203, and 204). Fixed-income securities are not in scope.

Information would be reported in Form SHO in two tables:

Table 1 – Manager’s Monthly Gross Short Position

- Security name, CUSIP, LEI, FIGI, and class

- End-of-month gross short position information. The gross short position is defined as the number of shares of the equity security that are held short, without inclusion of any offsetting economic positions, including shares of the equity security or derivatives. A manager also must account for and report a gross short position in an ETF, and activity that results in the acquisition or sale of shares of the ETF resulting from call options exercises or assignments, put options exercises or assignments, tendered conversions, or secondary offering transactions

- U.S. dollar value of the shares calculated

Table 2 – Daily Activity Affecting Manager’s Gross Short Position During the Reporting Period

- For each individual settlement date during the calendar month, the manager’s net activity in the reported equity security, including:

- Sold short

- Purchased to cover, in whole or in part, an existing short position in the security

- Acquired through the exercise or assignment of an option, through a tendered conversion or a secondary offering transaction, that reduces or closes a short position on the (underlying) security

- Sold through the exercise or assignment of an option that creates or increases a short position on the (underlying) security

- Resulted from other activity not previously reported

A manager who makes an error on Form SHO that affects accuracy must file an amended Form SHO within 10 calendar days of the error and provide a written description of the revision being made, explain the reason for the revision, and indicate whether data from any additional calendar-month reporting period(s) (up to the past 12 calendar months) is affected by the amendment.

The SEC will publish the following aggregated information across all managers based on data reported in Form SHO, one month after the reporting calendar month-end:

- The issuer’s name and other identifying information related to the issuer

- The aggregated gross short position across all reporting managers in the reported security at the close of the last settlement date of the calendar month-end and the total dollar value

- The percentage of the reported aggregate gross short position that is fully hedged, partially hedged, or not hedged

- For each settlement date during the calendar-month reporting period, the net activity in the reported security, aggregated across all reporting managers

The identity of money managers and individual short positions would be kept confidential.

CAT Updates

The amendments update Rule 613, which established a CAT. As of 2016, any broker-dealer that is a national securities exchange member or a national securities association member must report the order life cycle from original receipt, modification, cancellation, routing, execution and order allocation, and receipt of a routed order to the CAT. Under the final rule, a broker-dealer also would be required to disclose if a market participant is relying on the bona fide market-making exception of Rule 203.

The SEC estimates that the aggregate industry costs associated with implementing Form SHO and CAT changes will be $119 million for initial costs and $72 million in ongoing annual costs.

Conclusion

Forvis Mazars has experience providing services to fund complexes with net assets ranging from a couple million to several billion dollars. Our experience allows us to provide tailored services to help meet your unique needs. If you have questions or need assistance, please reach out to a professional at Forvis Mazars.

- 1Includes any person, other than a natural person, investing in or buying and selling securities for their own account, and any person exercising investment discretion with respect to the account of any other person.