A surprisingly resilient economy and the Fed’s bias toward “higher for longer” caused interest rates to rise during the quarter. As a result, asset prices fell across most investment categories. Both stocks and bonds posted negative returns for the period.

Still No Recession?

The U.S. economy grew 2.1% in the second quarter, building on a similar gain in the prior three-month period. The recent increase was fueled by business investment, personal consumption, and state and local government spending. Expectations for third-quarter growth are even stronger at 3.5% to 4%.

Consumer spending has been the key driver of better-than-expected economic results in 2023. New jobs growth surged in September, with non-farm payrolls increasing by twice the forecasted amount. Unemployment held steady at 3.8%, hovering just above a 50-year low. While wage growth has moderated, the September reading was still up a healthy 4.2% from a year ago. Strong employment conditions, solid income growth, and declining inflation have supported consumer spending and overall economic activity.

The decline in the Consumer Price Index (CPI) from 6.5% at the start of the year to 3.7% currently allowed the Federal Reserve to pause rate hikes in September. The Fed’s preferred “core” measure of inflation also declined to 4.1%, a trend that is likely to continue as rents adjust lower. While the Fed hasn’t officially declared this tightening cycle over, the end appears to be near.

What Caused Stocks & Bonds to Pare Gains?

Interest rates rose during the third quarter, with the benchmark 10-year Treasury note climbing from 3.82% to 4.57%. This reset in rates was due to stronger-than-expected economic growth and an unexpectedly “hawkish” tone from the Federal Reserve at its September meeting.

The rise in interest rates caused asset prices to fall during the period. Returns were -3% to -4% across major stock and bond indexes, pushing bonds into negative return territory for the year. While the short-term market response was negative, solid economic growth is a positive for markets over the long run, particularly when accompanied by declining inflation.

MARKET SCOREBOARD | 3Q 2023 | 2023 YTD |

|---|---|---|

S&P 500 | (3.27%) | 13.07% |

MSCI EAFE | (4.11%) | 7.08% |

Bloomberg Aggregate Bond | (3.23%) | (1.21%) |

Bloomberg Municipal Bond | (3.95%) | (1.38%) |

Wilshire Liquid Alternative | (0.20%) | 2.47% |

Source: Morningstar Inc, Tamarac Advisor View as of September 30, 2023.

Despite third-quarter weakness, global stocks have maintained solid returns for the year. In the U.S., the dominance of growth stocks over value continued, mainly due to the contribution of the largest technology companies. Through September, growth stocks were up 25% year to date, while value stocks gained just 2%.1

Is the Federal Reserve Done Hiking Rates?

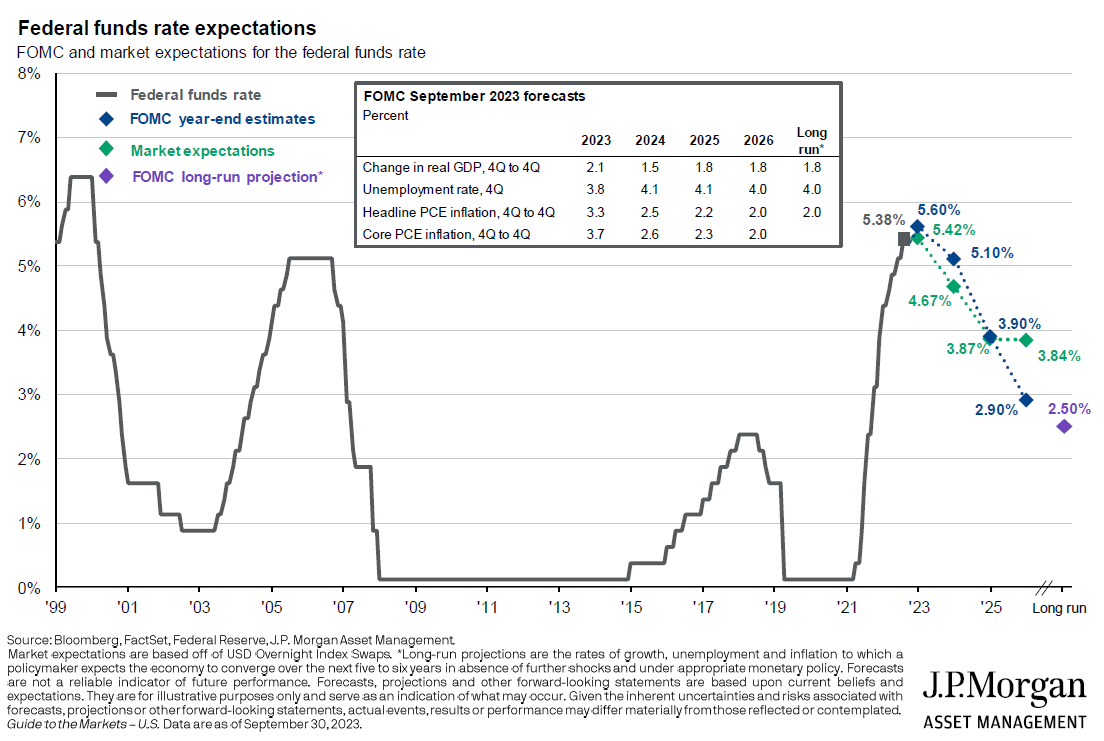

The Fed raised its short-term funds rate 0.25% in July and then held rates steady in September. This was widely anticipated by markets. What wasn’t expected was the post-September meeting reveal of a higher expected path for rates in 2024 and beyond. While the Fed is still signaling one more hike in 2023 to 5.75%, the change to 2024 expectations was the shocker. The Fed removed 0.5% of forecasted rate cuts for next year. This surprised markets that had been anticipating an end to the Fed’s hiking cycle most of this year.

The silver lining is that an additional 0.25% hike is not a sure thing. Looking at the Fed member’s individual forecasts, 12 participants expect one more hike, while seven forecast rates remaining unchanged. One way or the other, barring a significant reacceleration in inflation, we are near the end of this cycle. The debate will soon move to the timing of the Fed’s first rate cut. The Fed forecasts 0.5% of cuts in 2024, while the market expects a quicker decline of 0.75%. Although the Fed has stuck with its bias toward “higher for longer” this year, the plate is set for rates to start dropping in 2024.

Is It Safe to Invest in Bonds?

One of the most notable features of the recent market environment has been the unprecedented decline in bond values. As of September 30, the Bloomberg US Aggregate index of high-quality taxable bonds is down an annualized -5.21% for the past three years. To put this in context, in the previous 45 years ending in 2020, the Aggregate experienced a negative calendar year return just three other times total! The worst of those years was -2.9% in 1994. Importantly, the recent decline in bond prices was not caused by credit concerns or rising default risk; it was purely the result of the spike in interest rates.

With cash yields now above 5%, some investors may wonder if it even makes sense to own bonds anymore. The answer is a resounding yes; now is not the time to lose faith! For investors, this is an opportunity to lock in attractive rates. Current yields across most bond segments are the highest in 15 years. While bonds don’t offer a stable value like cash does, they provide two very important long-term portfolio benefits that cash doesn’t: stable cash flow and the potential for price appreciation.

Recent bond market losses will take time to heal, but banking on cash returns to recover value is a risky bet. Once the Federal Reserve begins to cut rates, cash yields will follow suit. The result will be a declining stream of income and a missed opportunity to experience bond price appreciation as rates fall.

Market & Economic Outlook

Interest rates rose in the third quarter, causing asset prices to drop. This took the wind out of the sails of stock and bond markets after a strong start to the year. While this is similar to what happened in the first three quarters of 2022, the backdrop is much different today.

First, Fed rate hikes are largely behind us and the trend in 2024 should be lower. Second, the starting level of bond yields is roughly 5% now versus less than 2% in early 2022. This is important because higher coupon yields reduce the price impact on bonds if rates notch higher in the near term. Finally, stocks are maintaining healthy gains this year, whereas at this time last year they were trading at bear market lows.

While bonds had a difficult quarter, this is one of the highest conviction areas for future returns. Historically, starting bond yields have provided a good proxy for forward five-year returns. With current yields near 5% for 10-year Treasuries, 5.5% to 6% for high-quality corporate bonds, and north of 4% for tax-free municipals, bonds are positioned to make a much greater contribution to balanced portfolio returns going forward. And with Fed rate hikes largely in the rear view, investment risk for bonds should return to a more normal, conservative level.

The case for stocks is less clear in the near term. The 13% rise in prices so far in 2023 has taken the forward price-to-earnings multiple up to 18, which is above the long-run average. Earnings have contracted slightly this year, meaning that increased valuation is the sole factor responsible for the market’s rise. But as we enter the final quarter of the year, investor focus is shifting toward profit expectations for 2024. Current consensus estimates suggest earnings will rise by more than 10% next year, which should support stock prices as we transition to the new year.

Another interesting characteristic of the U.S. stock market in 2023 is its “top heaviness.” The top 10 stocks in the S&P 500 index now account for more than 30% of total market capitalization and have contributed most of the market’s return in 2023.2 Take these 10 stocks out of the 500-stock index, and market returns shrink to barely positive for the year, and valuation drops below the long-run average. History shows that broad-based market rallies tend to be more sustainable than narrow advances. Therefore, an expanded contribution from the other 490 stocks will be important to future progress.

The Long View

As markets entered a new period of volatility in early fall, investors are left wondering what is next. The recent round of turmoil in the stock market was tame by historical standards but coincided with more pronounced volatility in the bond market. The surprising strength of the economy has caused concern that the Federal Reserve may be forced to fight inflation more vigilantly. For now, we are in a “good news is bad news” cycle where economic strength can cause markets to fall. While long-term economic strength is what investment returns are built on, currently investors are evaluating how that strength affects other aspects of the economy, such as inflation.

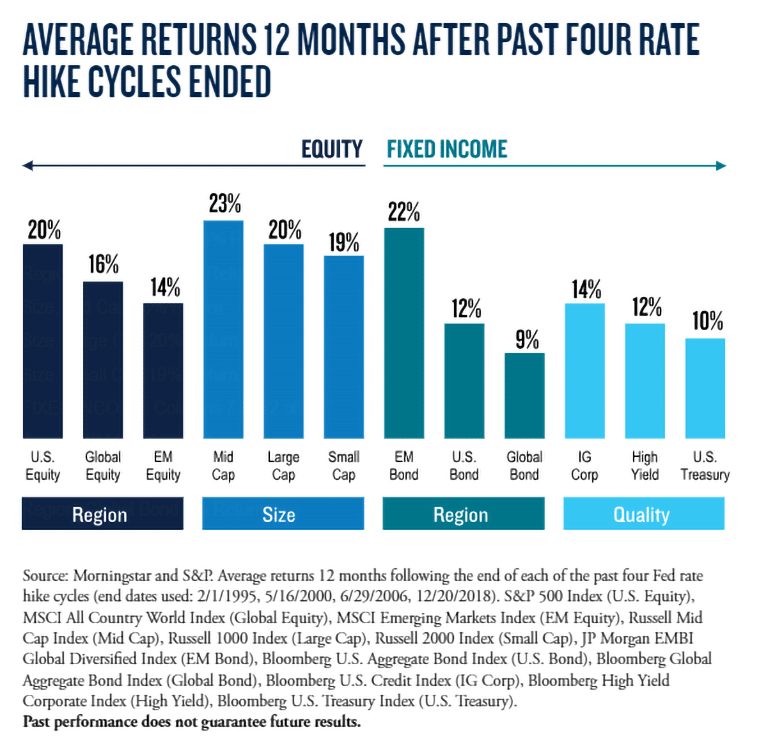

As mentioned above, the Fed may have one more rate hike in mind. If that is the case, what is in store for stock and bond markets? While one can never know with certainty, looking at similar periods in the past proves instructive. As outlined in the exhibit below, both bond and stock markets have advanced nicely during past periods following the end of a rate hike cycle. Stocks benefit from easier economic conditions and cheaper financing that allow for a lower cost of doing business. Bonds benefit from both high absolute yields at the end of the hiking cycle and positive price movement as interest rates fall from their peak. Investors who maintain a disciplined and diversified approach should benefit from taking the long view in this environment, including maintaining duration in bond portfolios.

Please contact your Forvis Mazars Private Client team for more information regarding your specific circumstances and portfolio design!