Well and pipeline operators in Texas have a new opportunity to apply for a severance tax exemption on otherwise vented or flared gas.

Texas House Bill 591 (HB 591)

HB 591 was signed by Gov. Greg Abbott on June 2, 2023 with an effective date of September 1, 2023. This bill allows for an exemption of severance taxes on natural gas wells that would have legally vented or flared gas. HB 591 may be specifically of interest to those diverting flared gas for use in on-site consumption in mobile centers for bitcoin mining and other mobile or modular data centers. Data center demand continues to rise, especially as artificial intelligence (AI) gains steam.1

Eligibility

- The gas must be consumed “near” the qualifying well, which has been defined as 1,000 feet.

- A qualifying well is one that:

- Is connected to a pipeline whose capacity is not expected to meet the demand for gas produced from the well, or

- Is not connected to a pipeline and would be economically unfeasible to connect to a pipeline, but is operated by a well operator that has contracted the produced gas to a pipeline operator, or

- Is not connected to a pipeline and is operated by a well operator that has not contractually dedicated the well, the gas produced by the well, or the land or lease on which the well is located to a pipeline operator.

Application

- The well operator—and pipeline operator, if applicable—may apply to the Texas Railroad Commission (the TX-RRC) for a severance tax exemption with the following:

- Attestation of pipeline takeaway capacity not expected to meet the demand for gas produced from the well, and

- Certification of TX-RRC authorization for gas from that well to be flared for at least 30 days during the preceding year in which the application is filed.

- Once the certification of the well is approved by the TX-RRC, the operator of the well will receive a certificate from the TX-RRC.

- Upon TX-RRC certification of the application, a separate application must be filed with the Texas Comptroller.

- This is an annual application process.

Quantifying the Opportunity

A report published in the July 2022 issue of NAPE magazine helps quantify the opportunity well and pipeline operators may have.2 The publication looked at 185 wells in Reeves County, Texas, that are estimated to be flaring 275,000 Mcf per month. The report estimates that selling this vented or flared gas to data centers would generate about $3.4 million in monthly revenue. This does not consider the additional severance tax that could be saved if the well is a certified HB 591 well.

ESG & SEC Reporting Implications

Environmental, social, and governance (ESG) goals and targets are commonly discussed in many boardrooms today. HB 591 creates additional opportunities for operators in Texas to improve ESG performance, while potentially saving on taxes and generating additional revenues.

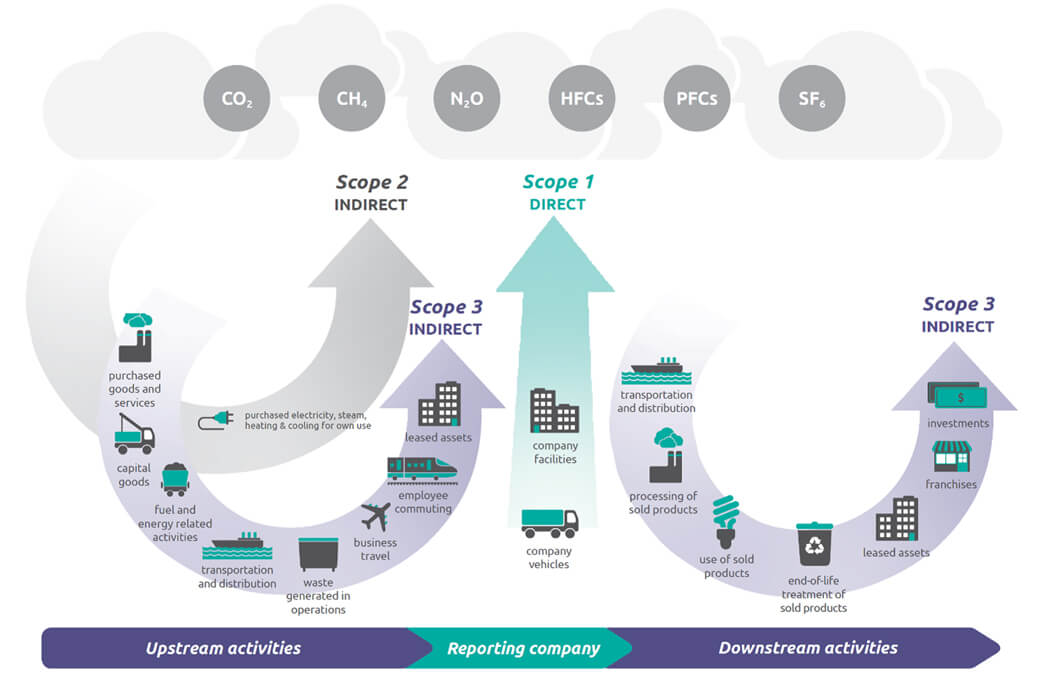

The SEC has signaled it will be requiring new climate-related disclosures.3 However, the timing of when this rule will go into effect is still uncertain.4 Recent SEC commissioner comments continue to indicate that Scope 1 disclosures will be a key component of the finalized rule.5 Often, a firm’s flared gas is captured under Scope 1 emissions; therefore, reducing flaring could lead to a reduction in a company’s overall greenhouse gas emissions profile.

Source: WRI/WBCSD Corporate Value Chain (Scope 3) Accounting and Reporting Standard (PDF), page 5.

Conclusion

HB 591 solidifies the severance tax exemption in Texas. Lee Bratcher, president of the Texas Blockchain Council, said, “Many oil and gas operators have not seriously considered partnering with a bitcoin miner to help mitigate and monetize their flared gas. This bill will act as a signal to them that they should consider it more seriously.”

The eligibility requirements and application process are complex and nuanced. If you have questions or need assistance with your application to the TX-RRC and Texas Comptroller or are searching for holistic tax planning and compliance strategies, please reach out to a professional at Forvis Mazars or submit the Contact Us form below.

- Guidance from other states:

- North Dakota provides for similar exemption

- Colorado infers that it is not subject to severance taxes (Page 61)

- Other states that allow for exemption from severance taxes for gas that is flared:

- Louisiana

- Mississippi6

- New Mexico

- Wyoming

- 1“Generative AI Breaks the Data Center: Data Center Infrastructure and Operating Costs Projected to Increase to Over $76 Billion by 2028,” forbes.com, May 12, 2023.

- 2“Bitcoin Mining Unearths New Opportunities for Energy Producers,” napeexpo.com, July 2022.

- 3“SEC Proposes Rules to Enhance and Standardize Climate-Related Disclosures for Investors,” sec.gov, March 21, 2022.

- 4“SEC Delays Climate Change Disclosure Rulemaking,” tax.thomsonreuters.com, June 15, 2023.

- 5“Remarks before the Financial Stability Oversight Council: Climate Risk Disclosure,” sec.gov, July 28, 2023.

- 62013 Mississippi Code, Title 27 – Taxation and Finance, Chapter 25 – Severance Taxes, Article 7 – Natural Gas Severed or Produced in State, §27-25-703 – Privilege Tax Levied; Exemptions.