It has been a long journey for all entities impacted by COVID-19 and the broader public health emergency (PHE), which officially commenced on January 31, 2020. And while the COVID-19 PHE expired on May 11, 2023, the effect of COVID-19—and, more specifically, the PRF and American Rescue Plan (ARP) Rural Distributions journey—continues.

Organizations first began receiving PRF payments on April 10, 2020 as part of PRF Period 1. To date, the federal government has allocated approximately $180 billion of funding to the U.S. Department of Health & Human Services (HHS) for PRF, and now the federal government has started to examine providers’ uses of these funds. In addition to Single Audits or program-specific audits for organizations that have federal expenditures in excess of $750,000, the Health Resources & Services Administration has a right to audit providers’ use of PRF funds for up to three years after the reporting time period as discussed in further detail below. Further, HHS’ Office of Inspector General (OIG) has a right to audit all HHS programs.

The first wave of government agency audits on PRF funds began in late 2022 by the OIG. Between fall 2022 and spring 2023, the OIG has been reported to have selected 30 hospitals/health systems, 30 home care providers, 30 hospice organizations, 30 Indian Health Service facilities and rural providers, and 30 community health centers (CHCs) for use of PRF—as well as 30 CHCs receiving federally qualified health center-specific COVID-19 grants similar to PRF—for a total of at least 150 organizations as part of their assessment of how organizations have used PRF receipts and complied with the PRF terms and conditions and reporting requirements. The chart below identifies when a government agency audit can transpire based upon which period PRF distributions were received and when organizations had to report how the funds were used. As shown below, PRF receipts can be audited up to three years after the close of the PRF reporting portal period corresponding to when the PRF payments were received.

| Period | Payment Received Period | Period of Eligibility for Eligible Expenses | Period of Availability for Lost Revenues | Reporting Time Period |

|---|---|---|---|---|

| 1 | April 10, 2020 to June 30, 2020 | January 1, 2020 to June 30, 2021 | January 1, 2020 to June 30, 2021 | July 1, 2021 to September 30, 2021 |

| 2 | July 1, 2020 to December 31, 2020 | January 1, 2020 to December 31, 2021 | January 1, 2020 to December 31, 2021 | January 1, 2022 to March 31, 2022 |

| 3 | January 1, 2021 to June 30, 2021 | January 1, 2020 to June 30, 2022 | January 1, 2020 to June 30, 2022 | July 1, 2022 to September 30, 2022 |

| 4 | July 1, 2021 to December 31, 2021 | January 1, 2020 to December 31, 2022 | January 1, 2020 to December 31, 2022 | January 1, 2023 to March 31, 2023 |

| 5 | January 1, 2022 to June 30, 2022 | January 1, 2020 to June 30, 2023 | January 1, 2020 to June 30, 2023 | July 1, 2023 to September 30, 2023 |

| 6 | July 1, 2022 to December 31, 2022 | January 1, 2020 to December 31, 2023 | January 1, 2020 to June 30, 2023 | January 1, 2024 to March 31, 2024 |

| 7 | January 1, 2023 to June 30, 2023 | January 1, 2020 to June 30, 2024 | January 1, 2020 to June 30, 2023 | July 1, 2024 to September 30, 2024 |

So now what?

Well, before you can prepare for a government agency audit, it is important to understand what the government may be looking for. As feedback has trickled in from provider organizations that have already undergone an audit or are currently being audited, it is clear that government agencies are taking a very holistic approach to the audit, in addition to getting into the weeds and auditing individual expenditure details. For example, the OIG has attempted to understand the organizations it is auditing, the makeup and structure of the organization, and how the organization has been impacted by COVID-19 generally. The auditors also are doing a deep dive into understanding the processes and controls organizations employed over their reporting and monitoring of lost revenues and COVID-related expenses. For lost revenue, the OIG is attempting to understand how revenue was recorded and the process around cutoff of revenue for monthly and quarterly reporting, as well as how settlements and other adjustments are recorded. The OIG may ask questions as part of the audit pertaining to the determination of bad debt and contractual allowance calculations, as well as support for settlements or one-time adjustments recorded in a specific month or quarter.

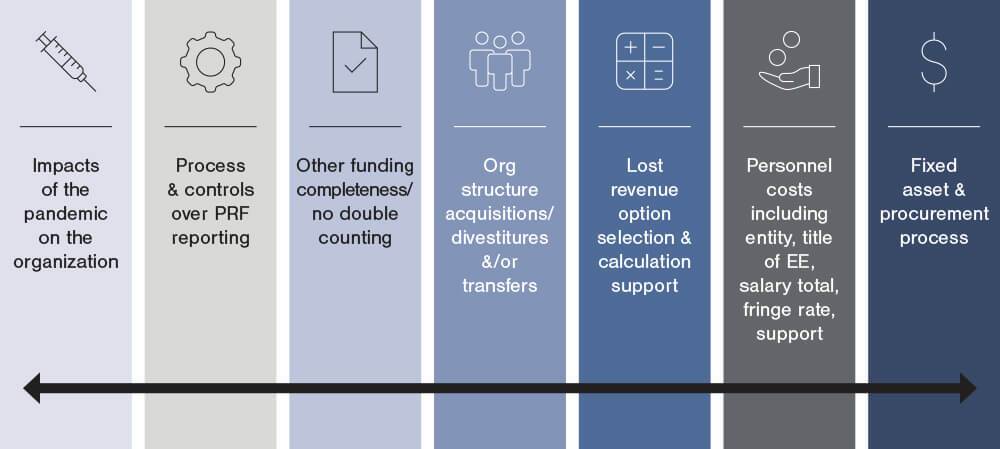

There also are questions around the lost revenue calculation methodology selected by organizations, with higher scrutiny around organizations selecting option iii for calculating lost revenues. When testing expenses, the OIG is challenging that entities have met the following two required criteria to use PRF funds: A. The reported expenses were incremental expenses as a result of COVID-19, and B. There is no double-dipping of these expenses, i.e., an entity did not report these expenses for other COVID-19-related fundings such as Paycheck Protection Program (PPP) funding, FEMA funding, Employee Retention Credit (ERC) funding, insurance proceeds, or the expenses weren’t reimbursed from any other source. The OIG also is delving into the internal controls organizations had in place to prevent non-incremental expenses or expenses already reimbursed from other sources from being applied to PRF receipts and reported as being applied to the PRF in the PRF reporting portal. The graphic below provides a visual into many of the key OIG audit focus areas.

Whether or not your organization has received a notice for an OIG audit, we recommend that you be prepared in case you do get a notice for an audit. Organizations that have been selected for an audit have received an email or other notice and generally are given a 14-day window to provide the OIG with a significant amount of information pertaining to the organization and the use of the funds received from the PRF. If organizations are not prepared in advance of a notice, it is likely to cause team members to scramble during the 14-day window, and that is far from an ideal position to be in if you don’t have to. We offer some suggestions to help you prepare for a successful OIG audit before you receive a notice, if the organization receives one in the future:

- Assemble a PRF task force. Identifying the correct individuals who managed the use of PRF funds—that is, helped ensure funds were used for qualifying expenses, and properly reported the use of the funds—from the very beginning is essential if you want the OIG audit process to go smoothly. Hopefully, you already have the people and the process in place from the time you received the monies, but even if you do, it’s important for this group of individuals to come together and game plan for a potential OIG audit. This group of employees will likely include members from the finance department, an HR/payroll representative if you applied payroll expenditures for PRF funding reimbursement, perhaps AP or procurement individuals, and, for larger organizations, employees from your internal audit, compliance, and/or general counsel departments.

- For all PRF reporting portal submissions that you have not already made, review the submission closely to help ensure the information is accurate before you submit.

- Prepare for upcoming Single Audits or program-specific audits. While the Single Audits are conducted by your accounting firm and not the OIG, many of the requests for the two audits will be comparable, so a Single Audit or program-specific audit can be an effective practice run prior to an OIG audit.

- Retain all PRF-related documentation!

In addition to the aforementioned tips, if you receive notice of an OIG audit, the following two steps are critical to follow during the 14-day notice window.

- Manage the process of submitting all the requested data to the OIG. Have one individual from your task force preparing the answers and another individual reviewing the answers. Input will likely come from various individuals on your task force.

- As part of the preparation and review process for the audit, review the data you are giving the auditors in your response closely and be ready for anticipated questions, including thoughts around internal controls, specific uses of the funds, and available supporting documentation.

Although going through another audit may seem daunting, if you are able to successfully implement some or all of the tips that we recommended above, the audit should be much more manageable. If you have any questions or need assistance, please reach out to a professional at Forvis Mazars.