As all entities have adopted CECL or are wrapping up implementation efforts, FASB is addressing the accounting for acquired financial assets that have experienced credit deterioration since origination. Portions of Accounting Standards Update (ASU) 2016-13 were intended to “simplify” this accounting, but stakeholder feedback was mixed. On June 27, 2023, FASB issued an exposure draft addressing updates to accounting for purchased financial assets (PFAs). The proposal would eliminate the credit deterioration criteria that currently limit the use of PCD accounting. All acquired financial assets (except available-for-sale (AFS) debt securities) would use a single model.

Comments are due August 28, 2023.

Background

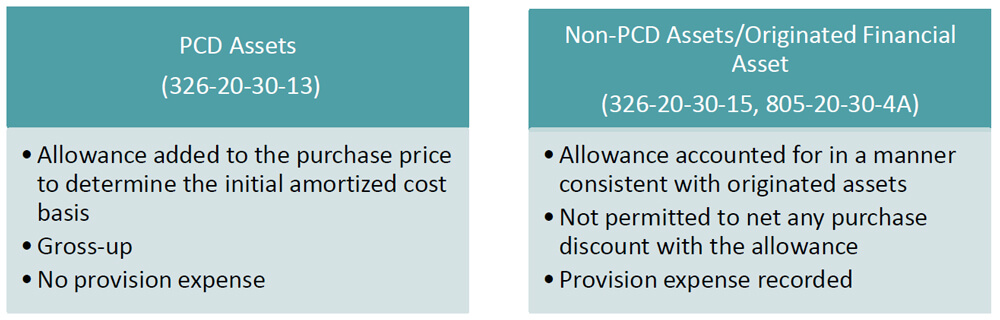

ASU 2016-13 updated the definition and accounting treatment for PFAs with credit impairment (PCI), to be known as PFAs with credit deterioration (PCD). The difference between PCD and non-PCD accounting is the recognition of the day-one provision expense for non-PCD assets versus the day-one adjustment to yield for PCD financial assets.

ASU 2016-13 also updated sections of Accounting Standards Codification (ASC) 805, Business Combinations, to require the recognition of an allowance for credit losses in the period of acquisition for both PCD and non-PCD assets. For PCD assets, the allowance for credit losses is added to the purchase price, i.e., fair value, in determining the amortized cost basis rather than as a charge to earnings. However, for non-PCD assets, the corresponding charge is recorded through provision expense on the acquirer’s books. In addition, the acquisition fair value includes an expectation of credit losses as part of the purchase discount. This results in the perceived double counting of expected credit losses on non-PCD assets.

FASB received feedback that determining if acquired financial assets qualify or do not qualify for PCD accounting treatment remains complex and that the credit discount on certain loans is double counted upon acquisition.

FASB’s original decisions on PCD accounting were one of the most debated and contentious deliberations of the CECL standard-setting process. New FASB members now constitute more than half of the board since the original standard was issued in 2016, which may result in different outcomes.

Scope

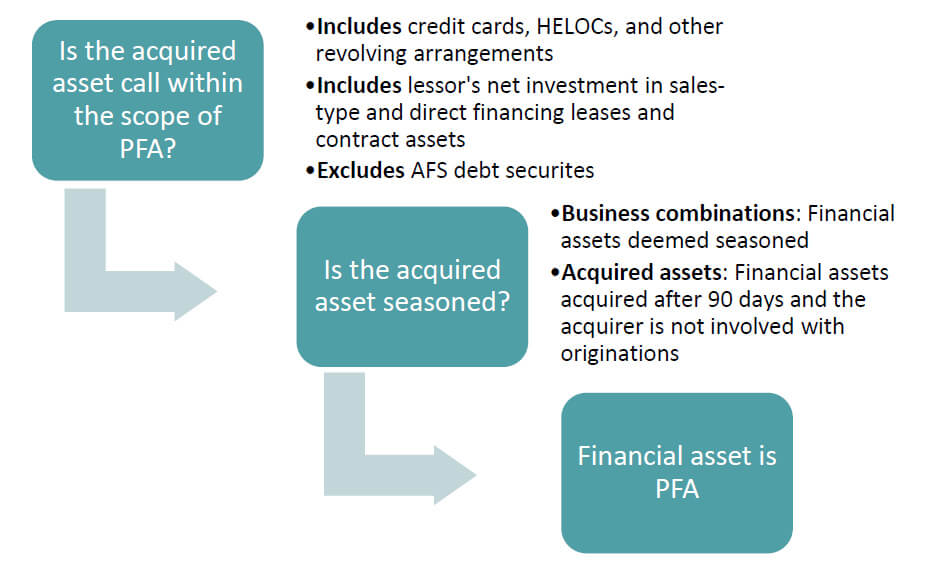

The changes would apply to all entities subject to ASC 326, including public business entities, private companies, and nonprofit entities. Although FASB received feedback that applying a gross-up approach to credit card receivables, other revolving credit instruments, and trade account receivables is operationally challenging, the board explicitly decided not to include a scope exception for these assets. Contract assets and sales-type and direct financing leases also would be within this proposal’s scope.

Proposal

The proposal expands the population of financial assets subject to ASC 326’s gross-up approach currently applied to PCD assets. An acquirer would not have to determine if an acquired financial asset is a PCD or non-PCD asset at acquisition based on the degree of credit deterioration since origination. Under the proposal, for financial assets recognized through an asset acquisition or the consolidation of a variable interest entity (VIE) that is not a business, the acquirer would identify PFAs based on seasoning and the asset originator’s involvement. When a financial asset is “seasoned” and the acquirer was not involved with the origination, the acquired asset would be accounted for using the gross-up approach.

The proposal does not change measurement, presentation, or disclosure requirements.

Source: FASB

The proposal includes two detailed examples to determine the allowance for PFAs with no change in credit conditions and after a change in credit conditions.

Seasoning

FASB acknowledged that a gross-up approach may not reflect the economics of newly originated instruments; therefore, acquired financial assets using the gross-up model must be “seasoned” when either of the following criteria is met:

- The financial asset is part of a business and is acquired through a business combination accounted for under ASC 805.

- The financial asset was acquired more than 90 days after its origination date and the acquirer did not have involvement with the asset origination. (See next section for examples of involvement.) In addition, for groups of acquired assets:

- A group of financial assets acquired in an asset acquisition or recognized through the consolidation of a VIE that is not a business must be assessed on the age—together with other relevant characteristics—of substantially all of the group’s individual financial assets covered by this proposal’s scope. A group of acquired financial assets shall be deemed seasoned only if substantially all of the group’s individual financial assets are seasoned and the acquirer does not have involvement with those assets.

- Line-of-credit or other revolving arrangements must be assessed in a manner consistent with the entity’s policy for measuring expected credit losses on similar financial assets.

A financial asset acquired that does not meet either criterion will be deemed an originated financial asset and would follow guidance in 326-20-30-15 or 805-20-30-4A summarized in the background table above.

Involvement

An acquirer’s assessment of involvement with the origination of a financial asset would consider qualitative characteristics that, if present, indicate that the transaction is economically similar to the acquirer originating the financial asset and should be accounted for by the acquirer consistent with other originated financial assets. FASB chose not to be prescriptive in determining “involvement” but rather provided a list of common arrangements that are not intended to be all inclusive. An entity should consider all relevant facts and circumstances and also consider the following:

- The acquirer’s exposure—either directly or indirectly—to the economic risks and rewards of ownership before obtaining control of the financial asset

- The nature of the relationship between the transacting entities, including arrangements made in contemplation of recurring transfers of similar financial assets and the acquirer’s ability to influence the originator’s underwriting standards

- The contractual terms of the transaction (including forward purchase commitments written by the acquirer to the originator or call options written by the originator to the acquirer)

- The existence of funding arrangements between the acquirer and the originator, or conveyance of a put option or similar contract from the acquirer to the originator

- The existence of a loss-sharing arrangement in which the acquirer has an obligation to reimburse an originator for an amount of principal loss incurred by the originator prior to the transfer of the financial asset

- The existence of a make-whole arrangement in which the acquirer has an obligation to reimburse the originator upon termination of the purchase transaction by the acquirer

Effective Date & Transition

FASB will determine an effective date and early adoption after review of comment letter feedback. If approved, the changes would be applied on a modified retrospective basis to the beginning of the fiscal year an entity adopted ASU 2016-13. Any cumulative effect adjustment would be reported as of the later of the beginning of that reporting period or the beginning of the earliest period presented.

Conclusion

Forvis Mazars will continue to follow developments on this project. Offering an array of services—including audit and tax, internal audit, regulatory compliance, loan review, CECL consulting, cybersecurity, M&A consulting, FDICIA consulting, and strategic planning—Forvis Mazars assists institutions like yours as they work to mitigate risk, keep compliant, and reach shareholder goals. If you have questions or need assistance, please reach out to a professional at Forvis Mazars.