Is there a story behind the reported levels of confidence on the part of college and university chief business officers (CBOs) and presidents?

Our 2023 Annual Higher Education Outlook surveyed more than 200 institutions of higher education. We found the level of confidence among a group of administrative leaders in colleges and universities was high this past year. Nearly 70% were confident in their financial stability over a five-year period and 75% were confident over a 10-year period.

In support of our survey results, we compared our results with two similar-sized surveys that have been taken since at least 2014 asking the same questions about confidence to both college CBOs and presidents. Those surveys showed a rising level of confidence since 2014. Presidential confidence came in around the 80% mark for both five years and 10 years in 2022, up from about the 60% level in 2014. CBO confidence came in under presidential confidence at around 65% over 10 years and 70% over five years in 2022. This was up from the 2014 levels, which were between 40% to 50%.

It has been satisfying to see the levels of confidence rise. But with the multiple headwinds of demographic change impacting enrollment, inflation running much higher than it has for decades, volatile investment markets, the specter of high interest rates for a long time, and societal attitude shifts lowering trust in the value of higher education, the obvious question is what exactly is driving this increase in confidence?

Will the level of confidence stay at roughly the present levels? Only time will tell.

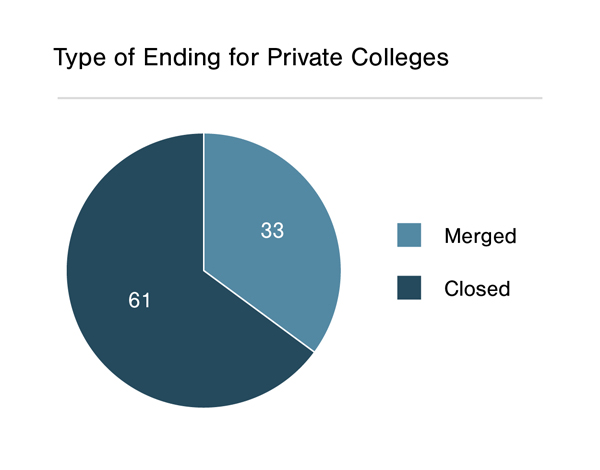

One thing that can be objectively observed is the number of schools announcing consolidations, mergers, significant campus or curricular changes or, lastly, closures. So far (early 2023), that list includes nine schools. According to our annual tracking of schools, the annual average since 2016 is 10 schools per year.

In addition to the closures and mergers of private colleges, there also have been significant changes announced, including one private four-year school closing its residential undergraduate campus and moving the entire undergraduate academic operation to a virtual platform. There also has been at least one larger single campus closure (exceeding 800 students) at a private college.

In the world of public four-year and community colleges, there have been no less than five states (Georgia, Maine, Pennsylvania, Alaska, and Connecticut) that have either executed consolidation plans or seriously discussed them.

While the annual closures, mergers, consolidations, and campus closures tend to make headlines and upend the lives of students, faculty, and administrators, in the big picture the average annual closure rate for private colleges is just over half of 1% (0.006). The public university consolidations represent a smaller percentage of the population of public universities on an annual basis.

So, amid the media discussing closures, mergers, and consolidation, there is confidence. The majority of schools that have strong confidence know they have a job to do, and they appear to understand and embrace the courage required to take seriously the task of maintaining financial equilibrium while fighting headwinds in the economy and the unchangeable demographics.

The next installment of our Outlook articles will review our observations and data collected on change management. The article will include a review of five ideas to help manage change. For more insight, download your complimentary copy of the 2023 Annual Higher Education Outlook. If you have questions or need assistance, please reach out to a professional at Forvis Mazars or use the Contact Us form below.