Markets were resilient in the first quarter despite turmoil in the banking sector. Both stocks and bonds posted above average gains during the period. The U.S. economy likely posted another quarter of decent growth, but the outlook for the remainder of the year is less certain.

What Is the Current State of the Economy?

Economic forecasts changed significantly during the quarter. The U.S. economy entered 2023 with momentum, posting real growth of 3.2% and 2.6% respectively during the final two quarters of 2022. That momentum continued through February, with strong consumer spending data setting the plate for another robust period of growth.

But serious issues developed in the banking industry in March. As regulators and financial institutions assess the fallout from two regional bank failures, one likely outcome is the tightening of credit. This could compound the drag of higher interest rates engineered by the Fed over the past year, resulting in slower economic growth and increased chance of recession. Signs of deceleration have already begun to emerge, with March readings for both the ISM manufacturing and services indexes falling to their lowest levels since the start of the pandemic.

Despite these challenges, the unemployment rate held steady in March at 3.5%, hovering near a 50-year low. Job openings remain plentiful. Importantly, wage growth has fallen from a peak of nearly 6% to just over 4% currently. This helped lower inflation, with the Consumer Price Index falling from 6.5% in December to 5% in March, well below the peak of 9.1% last summer. Current estimates of first quarter GDP growth are in the range of 1.5% to 2%, with weakening trends as we enter the second quarter.

What Were the Key Factors Driving Investment Returns in the First Quarter?

Returns were positive across most asset classes to start the year, continuing the rebound that began last October. Markets celebrated better-than-expected economic readings in the first two months of the year and later in the quarter rallied on expectations that Fed rate hikes will soon end. Stocks largely shrugged off banking industry woes, considering these issues to be isolated.

International stocks led the way during the first three months of the year, rising more than 8%. U.S. stocks were a close second at 7.5%. Earnings projections for 2023 have been ratcheting downward though, which may impede further short-run gains. However, the end of Fed rate hikes has historically been good for stocks, which may support returns in the second half of the year. Stocks also tend to perform well when growth is weak but getting better, which could align with expectations for 2024 and beyond.

Bonds gained nearly 3% during the quarter, and importantly resumed their role as portfolio diversifier. During the banking industry turmoil in March, bond prices rose while stock volatility spiked, providing stability to balanced portfolios. With most bond segments offering attractive starting yields, future returns from this asset class should improve going forward.

| Market Scoreboard | 1Q 2023 | 2022 |

|---|---|---|

| S&P 500 (Large U.S. stocks) | 7.50% | (18.11%) |

| MSCI EAFE (Developed international stocks) | 8.47% | (14.45%) |

| Bloomberg Aggregate Bond (U.S. taxable bonds) | 2.96% | (13.01%) |

| Bloomberg Municipal Bond (U.S. tax-free bonds) | 2.78% | (8.53%) |

| Wilshire Liquid Alternative (Alternative investments) | 1.28% | (5.65%) |

Source: Morningstar Inc, Tamarac Advisor View as of March 31, 20231

What Happened in the Banking Industry?

Two large U.S. regional banks failed in March, igniting concerns that trouble could spread across the banking industry. The root cause of the stress is a mismatch between a bank’s short-term liabilities (deposits) and long-term assets (loans and bonds). When the Federal Reserve aggressively hiked rates last year, bank bond portfolios dropped in value. These bond losses, coupled with the unique business models of the two banks, led to their closures. Silicon Valley Bank was a niche bank serving tech startups and venture capital firms. Signature Bank was active in the cryptocurrency market. Downturns in these businesses led to depositor withdrawals and heightened concerns regarding bond portfolio losses. This resulted in a classic “bank run” on both institutions. Then a large European bank, Credit Suisse, entered the news. Years of scandal and bad investments came to a head during the recent banking turmoil, escalating the bank’s downfall.

Responses to the crisis were swift. The FDIC agreed to back all deposits at the failed banks. The Federal Reserve launched the Bank Term Funding Program, allowing banks to offer their bonds at par value for collateral against loans. This means banks will not need to sell bonds at losses to satisfy withdrawals. The Swiss National Bank arranged for Credit Suisse to be purchased by competitor UBS, providing a range of guarantees to get the deal done.

Small and midsize banks have been steadily losing deposits over the past year, and the recent bank failures have exacerbated the withdrawals. Fewer deposits may mean tighter credit conditions going forward, which could slow the pace of economic growth.

How Will the Banking Crisis Impact Federal Reserve Policy?

The banking crisis had an immediate impact on monetary policy. Pre-crisis, the debate was whether the Fed would hike by 0.25% or 0.50% at its March meeting. Economic activity had been surprisingly strong, and inflation stubbornly high. Just weeks before the bank failures, Fed Chair Jerome Powell was bracing the market for a higher Fed funds rate. Markets reflected a terminal rate of 5.50% with some expecting 6% by mid-year. The Fed ultimately delivered a 0.25% hike in March and maintained its terminal rate projection (5.25%). Powell noted the uncertainty facing the economy and stressed that policy would be data dependent going forward.

While the Fed stayed its course, markets pivoted aggressively. Fed Funds futures now imply an interest rate cut by September and 0.75% of cuts by January 2024. The Fed and other central banks are in a tough spot, caught between turmoil in the banking industry and persistently high inflation. The most likely scenario is that the Fed raises rates slowly to combat inflation, trusting its new programs to diffuse stress in the banking sector. If the situation worsens, the Fed will likely pause. Although futures markets are now anticipating rate cuts, this should only occur if the economy enters recession.

Market & Economic Outlook

The first quarter of 2023 provided an example of how rapidly conditions and expectations can change. At the start of the quarter, economic data was strong and the Fed was guiding interest rate expectations higher. But two bank failures dealt an unexpected shock, renewing recession fears and causing interest rates and rate futures to decline significantly.

As of this writing, the recent bank failures appear to be isolated instances related to the unique circumstances of each institution. The initial fear that other banks might follow in a downward spiral has subsided. But the potential fallout in lending, combined with the lagged impact of Fed rate hikes, has increased the chance of recession. Know that this view is widely held and, therefore, should not surprise investors. The possibility of a mild contraction is reflected in stock prices. Given this, the market’s reaction to actual recession should be minor, assuming a deeper downturn is avoided.

Investment markets posted strong returns in the first quarter, exhibiting resilience in the face of disruption. While there is near-term uncertainty surrounding the economy, the performance outlook for diversified portfolios is good over a five-year horizon. This is in large part due to improved return expectations for bonds. Markets routinely cycle through good times and bad, which is why following a disciplined and consistent approach is so important to achieving investment success over the long run.

The Long View

As outlined last quarter, the market tumult in 2022 had an important side effect for long-term savers and investors. After a 15-year absence, mid-single digit interest rates have returned.

A tempting aspect of the broad increase in rates has been the emergence of attractive yields for short-term investments like CDs and Treasury bills. Recently, these rates have been higher than those for securities of longer length. Investors have sought out these instruments en masse, further escalated by investors repositioning deposits out of banks due to recent industry issues.

Is this the right move for investors? The answer depends on the purpose of these funds. We recommend clients maintain six to 12 months of short-term reserves in assets that have little fluctuation in value. This money serves as a rainy-day fund available for unexpected expenses, outside of monthly needs. These funds could be invested in savings accounts, money market funds, CDs, or perhaps Treasury bills (government obligations under one year). Taking advantage of higher yields for these funds is a simple and smart way to enhance returns on excess savings.

However, short-term instruments may not be the best choice for long-term investors beyond the rainy-day fund. The reason is reinvestment risk, which describes the risk associated with interest rates being lower when short-term instruments mature causing reinvestment at lower yields.

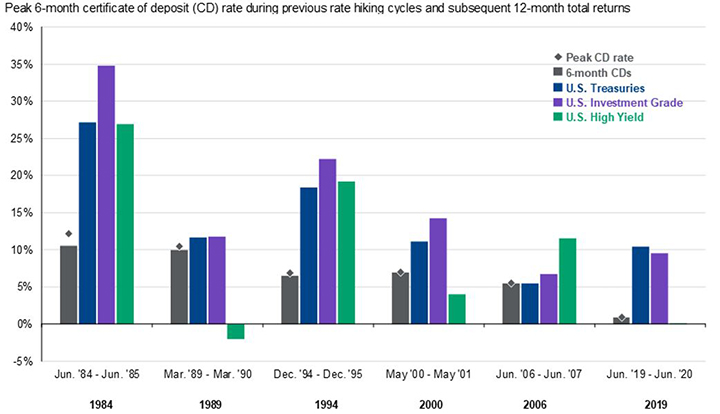

Instead, holding a portfolio of bonds with maturities of different lengths creates an opportunity to lock in yields for a longer period. This concept in its simplest form is called a bond ladder. Holding mutual funds or exchange-traded funds with varying maturity profiles also will accomplish the desired effect. The additional benefit of this approach is the potential to experience price appreciation in addition to income. That potential is outlined in the exhibit below, which shows that longer-term bond returns are typically strong after the peak in six-month CD rates because securities bought during a period of higher yields become more valuable.

Fixed Income Opportunities Outside of CDs

Source: Bankrate, Bloomberg, FactSet, Federal Reserve, J.P. Morgan Asset Management. All fixed income data are represented by the corresponding Bloomberg index. Data as of March 31, 20232

Thank you for the opportunity to assist you with both your short- and long-term investing needs, considering your unique financial circumstances and objectives. And thank you for the confidence you have placed in the Forvis Mazars Wealth Advisors team!

For more information, please use the Contact Us form below.