On January 27, 2023, the IRS released Revenue Procedure (Rev. Proc.) 2023-9, which provides guidance for real estate developers implementing the alternative cost method (ACM), previously governed by Rev. Proc. 92-29. This new guidance benefits developers as the ACM allows a developer to accelerate estimated costs for common improvements into the cost basis of houses sold in a qualifying project. Rev. Proc. 2023-9 helps make the implementation process much easier.

For the last 30 years, previous guidance required developers looking to apply the ACM to jump through several hoops. Developers had to obtain consent from the district director for the internal revenue district in which the taxpayer was located by providing the director with an extensive list of documents and descriptions for the qualifying project. This administrative hurdle kept plenty of developers from even attempting implementation. Under the new guidance, developers can file a Form 3115, Application for Change in Accounting Method, as an automatic method change to take advantage of the ACM.

What Is the ACM?

The ACM allows a developer to include the share of estimated cost of common improvements in the basis of units sold, even if the costs are not incurred during the tax year but subject to the alternative cost limitation. A developer allocates the estimated cost of common improvements to all units benefiting from the common improvement in the qualifying project. This can be done using any reasonable method consistent with the project, such as pro rata between number of units or relative to fair market value.

Eligibility Requirements

- Developers must be contractually obligated or required by law to provide common improvements as part of a qualifying project and must not be able to recover the cost of the improvement through depreciation.

- Common improvements are any real property or improvements to real property that benefit two or more units that are separately held for sale by the developer. Examples include streets, sidewalks, sewer lines, playgrounds, clubhouses, tennis courts, and swimming pools. Based on our current culture, you could probably throw in pickleball courts and charging stations. Common improvements do not include the costs to manage, mow, maintain, or repair the property; construction period interest; or property taxes.

- A qualifying project would be any project of a developer for which common improvement costs would be incurred.

- The ACM must be applied to all projects in a trade or business that fall under the definition of a qualifying project. This is a change from the previous guidance, which required the ACM to be applied on a project-by-project basis.

Estimated Cost of Common Improvements

The estimated cost of common improvements is the amount of costs incurred as of the end of the taxable year, plus the amount of costs the developer reasonably anticipates it will incur during the 10 succeeding tax years (10-taxable year horizon). This amount may change from year to year; costs could differ from the previous estimate, the estimate itself could vary, new legal obligations could arise, or a new year is added to the 10-taxable year horizon. The change in estimate would not impact any taxable years that have already passed but would be applied on a go-forward basis. No amended returns or change in accounting method would be required to correct changes in the estimated cost of common improvements.

Alternative Cost Limitation

The alternative cost limitation is the total amount of common improvement costs that have been incurred with respect to the qualifying project as of the end of the taxable year. This is the maximum amount that can be included in the basis of units sold or contracts completed during the taxable year. If this limit prevents a developer from including the entire allocable share of the estimated cost of common improvements in the basis of units sold in the taxable year, the costs not included may be considered in a subsequent taxable year to the extent that additional common improvement costs have been incurred.

The limitation is calculated on a project-by-project basis, meaning that any common improvement costs associated with one qualifying project cannot be included in the ACM calculations of a separate qualifying project.

Examples

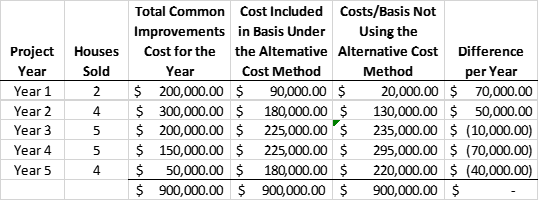

Example 1: A developer will build 20 houses as part of the same project on a tract of land. The project is expected to take five years to complete. The developer is contractually obligated to provide common improvements that will benefit all the houses on the tract equally and estimates that the common improvement costs will total $900,000. In this instance, the estimate does not change during the project.

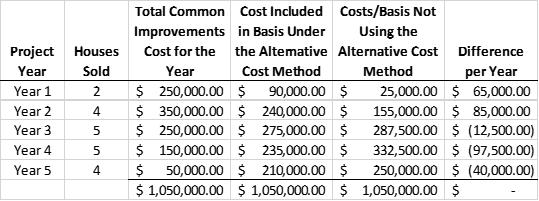

Example 2: Assume the same fact pattern as Example 1; however, the initial common improvements cost estimate of $900,000 was adjusted to $1,100,000 in Year 2 after filing the Year 1 tax return and adjusted again to $1,050,000 during Year 4 after filing the Year 3 tax return.

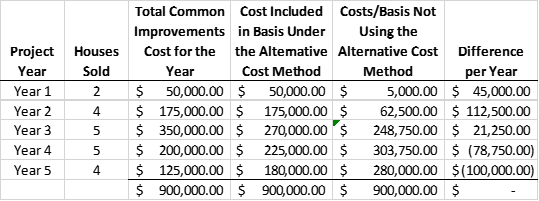

Example 3: Assume the same fact pattern as Example 1; however, a different spread of common improvement costs incurred during each year of the qualifying project (an example of the alternative cost limitation kicking in during Years 1 and 2).

How to Take Advantage

Under the new guidance, certain taxpayers can use the short Form 3115, Application for Change in Accounting Method, to make method changes to apply the ACM if each change results in a Section 481(a) adjustment of zero. New guidance also waives the eligibility rule, which prohibits taxpayers from filing an automatic method change if the taxpayer has made or requested a change for the same item during the five taxable years ending with the year of change. If any §481(a) adjustment is calculated, the standard Form 3115 is required to be completed.

The updated ACM guidance provides a great opportunity to real estate developers. It’s optional as developers using differing methods of accounting for costs are not required to make the switch to the ACM, but it’s definitely worth considering.

If you have any questions or need assistance, please reach out to a professional at Forvis Mazars or submit the Contact Us form below.