The investment environment was challenging in 2022, as both stocks and bonds posted significant declines. Here is a summary of key themes currently influencing markets:

- Asset prices dropped in response to the rapid rise in interest rates

- Aggressive Federal Reserve rate hikes are increasing the chance of recession

- Inflation is now decelerating, and the end of Fed rate hikes is near

- With interest rates at 10-year highs and market valuations down, forward return expectations have improved meaningfully

Economic Growth Rebounds but Recession Risk Is Rising

Economic data was murky at best in 2022, due to ongoing pandemic distortions and the related government response. These distortions should fade in 2023, given improvement in supply chain issues and the unwinding of government and Fed stimulus programs.

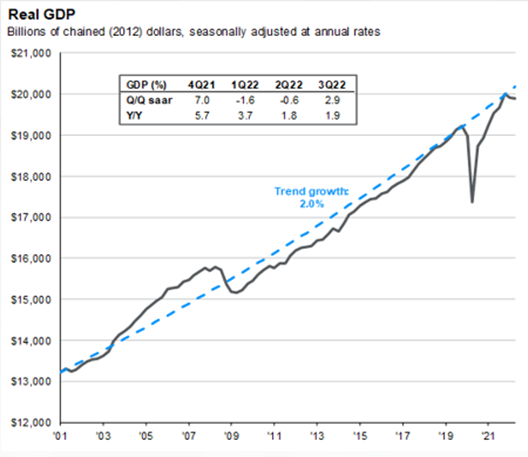

The first two quarters of 2022 were characterized by a modest contraction; however, this was largely due to inventory and trade anomalies and not evidence of recession. The U.S. economy rebounded with a 2.9% gain in the third quarter, and most economists expect another 1% to 1.5% rise for the fourth quarter. Economic output has returned to the trendline of the last 20 years after recovering from the sharp 2020 downturn, as illustrated below:

Source: BEA, FactSet, JPM Asset Management. Data as of November 30, 2022.

While the U.S. economy grew modestly in 2022, momentum slowed in the final two months of the year. Higher interest rates and inflation have begun to erode consumer spending. The ISM manufacturing index fell to a stagnant level, posting the lowest reading since the early stages of the pandemic. Most forecasting models now show a greater than 50% chance of recession in the next 12 months. Each successive Fed rate hike increases that possibility. Fortunately, with unemployment at 50-year lows and consumer and business balance sheets relatively strong, any downturn should be mild.

Stocks Rally in the Fourth Quarter

Investment returns broadly improved in the fourth quarter as inflation declined, interest rates stabilized, and the end of the Fed rate hike cycle nudged closer. The completion of the mid-term election cycle also helped, with the divided government pleasing the markets. International stocks were the star performers for the quarter, largely due to the weakening of the U.S. dollar against most foreign currencies.

Despite the gains in the quarter, stocks posted their worst annual returns since 2008. Notably, U.S. stock market losses were not the result of a collapse in profits. Earnings for S&P 500 companies grew during the year. Instead, the entire decline was due to a contraction in the index price-to-earnings multiple from 22 to 17 during the year, a direct consequence of the spike in interest rates.

| MARKET SCOREBOARD | 4Q 2022 | 2022 |

|---|---|---|

| S&P 500 (Large U.S. stocks) |

7.56% | (18.11%) |

| MSCI EAFE (Developed international stocks) |

17.34% | (14.45%) |

| Bloomberg Aggregate Bond (U.S. taxable bonds) |

1.87% | (13.01%) |

| Bloomberg Municipal Bond (U.S. tax-free bonds) |

4.10% | (8.53%) |

| Wilshire Liquid Alternative (Alternative investments) |

1.73% | (5.65%) |

Fed Rate Hikes Continue, but the End Is Near

After the most aggressive period of rate hikes in 40 years, investors were hoping that the Fed would signal it had done enough. While the Fed did slow the pace of rate increases to 0.50% in December, it said rates would need to end higher than previously indicated. The new peak in rates is expected to be 5% to 5.25%, 0.50% higher than the Fed suggested as recently as September. The new forecast means the Fed should deliver a total of 0.75% in additional hikes from the current 4.25% to 4.50% target.

With employment holding strong, the central bank is completely focused on bringing down inflation. The Fed’s projection for core inflation in 2023 is 3.5%, which in its view supports the case for a higher Fed funds rate. The Fed doesn’t believe core inflation will fall to its 2% target until 2025. While the results of the December meeting disappointed markets and presaged continued rate hikes, there is light at the end of the tunnel. The Fed slowed the pace of tightening and hinted that trend would continue in 2023. They also acknowledged that it would take time for the full impact of higher rates to be known. So, although rates are likely to drift a bit higher, the end of this cycle is near!

Bonds Are Back!

Since the global financial crisis in 2008, bond yields have been paltry. Any temporary periods of improved income were quickly washed away by economic weakness or crisis. This cycle of low rates was quickly and painfully broken in 2022. Aggressive Federal Reserve policy drove bond yields significantly higher over the course of the year. When the dust settled, 2022 delivered the worst calendar year of bond performance since the late 1970s. After witnessing a supposedly safe asset deliver a stock-like downside, many investors wonder if it makes sense to own bonds going forward. The answer is a resounding “yes!” Even when yields were low, owning bonds as part of a diversified portfolio was prudent as they provided protection from market volatility.

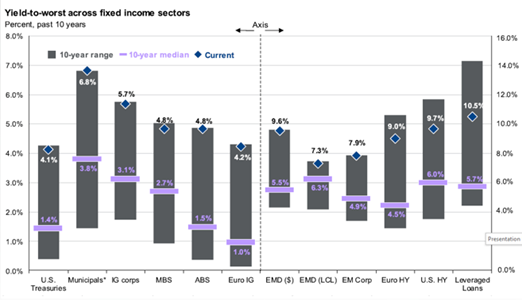

Despite the tough year in 2022, bonds still produced better returns than stocks and cushioned portfolios against even greater losses. Importantly, bonds now provide a more robust income stream and are poised to make a much greater contribution to balanced portfolio returns going forward. Yields on investment grade bonds range from 3.25% for municipals to 4.50% for taxable bonds. Adding an allocation to noninvestment grade securities can bump yields to 4% and 6%. These are the highest bond yields in more than a decade, as indicated in the chart below:

Source: Bloomberg, FactSet, JPM Asset Management. Data as of September 30, 2022. Taxable Equivalent Yields shown for Municipals.

Market & Economic Outlook

2022 was a year of transition. The U.S. economy fully reopened after two years of pandemic restrictions. Governmental COVID-relief programs largely expired, eliminating a key driver of consumer demand. The Federal Reserve pivoted from a period of extremely easy money to a much more restrictive stance, raising the Fed funds rate from 0% to 4.50%. Asset prices fell in response to the rapid rise in rates. This caused stock valuations to contract and bond yields to rise, resetting both toward long-run average levels.

2023 begins with a continuation of last year’s trends, which could result in more market turbulence in the near term. However, conditions should stabilize, and returns should improve as the year progresses. Here are some of the factors that lead to this conclusion:

- While the Fed may hike rates a bit more in 2023, the top is near

- Inflation peaked in June 2022, and should continue to decline throughout 2023

- Bond yields are now at 10-year highs, greatly increasing forward return expectations for this asset class

- Speculative excesses were purged in 2022, as certain cryptocurrency investments, special purpose acquisition companies, and overvalued technology stocks declined by 50% or more. The result is a healthier market environment going forward

From a risk standpoint, there are two primary areas of concern. First, in 2023 the focus will transition from inflation to recession risk. The cumulative effect of Fed rate hikes will likely cause a slowdown in consumer spending, a key driver of U.S. economic growth. This could cause a mild recession in the new year. Secondly, profits could be at risk. While stock valuations have come down to attractive levels, 2023 earnings estimates have begun to drop. The combination of lower margins and the potential for unit volume declines could create a tough year for profit growth.

But know that markets are forward-looking, and much of this risk is already reflected in stock prices, which are down roughly 20% from a year ago. As markets anticipate a better environment later this year and into 2024, returns should start to improve despite the near-term challenges.

The Longer View

Over the last couple of decades, the markets have been influenced by two historically unusual characteristics: consistently low inflation and interest rates. These two factors have persisted primarily because the Federal Reserve needed to address two unexpected events (the global financial crisis and COVID-19 outbreak) with unprecedented stimulus. After 20 years, low rates and inflation became the norm and changed certain long-standing assumptions about money. This reshaped the thinking of a generation of investors, savers, and policymakers. For that reason, the significant rise in interest rates and inflation in 2022 was a shock to each of these constituents.

So how should today’s world of above-average inflation and historically normal interest rates be interpreted? The financial media would have you believe that we are in for major challenges. There are certainly real challenges related to the shift in the economic environment, but this change also may provide some long-term benefits and opportunities.

Howard Marks, co-founder of Oaktree Capital Management, was recently quoted as saying a “sea change” is occurring, noting that investors don’t have to rely as much on riskier investments now that they can potentially get solid returns from bonds.

He published a simple outline comparing today’s backdrop with that of the post-2009 market environment. He characterized the investment mood today as “guarded” versus the optimism that existed before. He noted a rise in risk aversion and suggested that investors are far more worried about investment losses today than the fear of missing out (FOMO) on future gains that existed in the past. But he also noted that prospective returns will be “more than ample” given the improvement in stock valuations and much higher bond yields.

As mentioned earlier, stock valuations have returned to historically normal levels or below, and bond rates have more than doubled over the last 12 months. The result is a meaningful improvement in forward return expectations for diversified portfolios. The implications for income planning were highlighted in a recent Morningstar report that determined a “safe” starting withdrawal rate for a balanced portfolio is now 3.8%, up from 3.3% the year before!1

Have we encountered a “sea change” or fundamental shift toward a full-return world? An era of historically normal rates, more attractive valuations, and the potential for higher returns with less speculation may be upon us. The past 12 months have been an uncomfortable journey but could set the plate for some real benefits to long-term investors going forward!

Thank you for the confidence you have placed in the Forvis Mazars Wealth Advisors Team, and best wishes for a prosperous 2023!

For more information, please submit a Contact Us form.

- 1Morningstar, “The State of Retirement Income,” December 2022. Assumes a balanced (50% stock/50% bond) portfolio with a 90% success rate of not running out of funds over a 30-year horizon. Annual withdrawals adjusted for inflation.