Over the past year, inflation, interest rates, and workforce and supply chain issues have significantly increased costs at most organizations. As a result, a record number of nonprofit organizations had negative operating margins for 2022 as expenses outpaced growth in revenue.

For example, higher operating costs, coupled with less favorable market returns on investments, caused approximately half of U.S. hospitals to finish 2022 with negative margins.1 Many organizations are starting to see more stability and improvement in profitability in overall operations as contract staffing rates have decreased, and they have started to put into place financial improvement plans. Despite this, the erosion of the balance sheet and overall liquidity, as well as less favorable operating performance, is prevalent throughout the healthcare industry.

As calendar year-end audits begin and reporting deadlines to lenders approach, it’s important for management to be mindful of bond and loan covenant compliance; required compliance metrics, such as days cash on hand; debt-to-capitalization ratios; and debt service coverage ratios. Reading through loan and bond debt agreements to understand covenant definitions, determining if cross default applies, and what remediation is required if the covenants are not met are important steps in determining how noncompliance with covenants may impact your organization. Some bond and loan agreements contain a grace period that may include hiring a consultant to help turn around operations while other agreements do not. As a result, noncompliance with covenants could result in an event of default and make the outstanding debt immediately callable.

If approval of a consultant, a formalized turnaround plan, waivers, or forbearance agreements are needed due to a breach in a covenant, the time frame to cure the breach can take several months and sometimes more than a year. This can be especially true for organizations with poor financial health that have publicly traded bond issuances where there are multiple investors and there is a requirement of a certain percentage of investors to approve the waiver or forbearance agreement. If management believes a breach of a covenant requirement may exist, we recommend reaching out to your auditor, trustee or lender, and bond counsel to begin discussions on how to proceed to remedy the violation and how these breaches could impact the audited financial statements.

Accounting Standards Codification (ASC) 470-10-45-11 through 470-10-45-12 provide guidance on the classification of debt if a violation of a debt covenant at the balance sheet date that allows the debt obligation to be callable, or if the violation is not cured within a specific grace period, will make the obligation callable. If the violation or breach causes the debt to be callable, generally the debt should be classified as a current liability unless one of the following conditions is met:

- The creditor(s) has waived its ability to call the debt, or subsequently lost its ability to demand payment, for more than one year from the balance sheet date.

- For long-term debt that contains a contractual grace period within which the borrower may cure the covenant violation, it’s probable that the violation will be cured within the period.

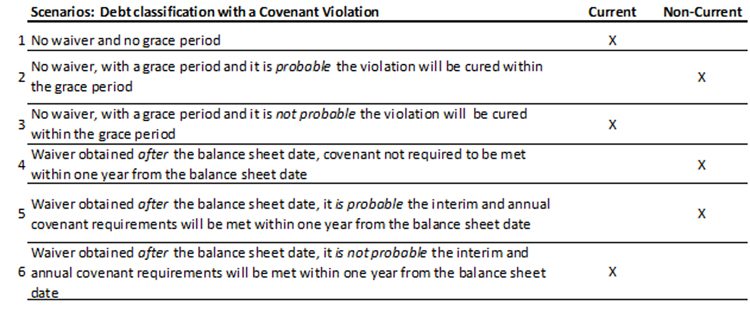

Interim measurement periods, such as quarterly covenant requirements, as well as annual requirements must be considered when determining debt classification between current and noncurrent financial statement presentation. If the organization is seeking a waiver or forbearance agreement, interim periods, in addition to annual covenant measurement requirements, also should be included in the modification agreement. Below is a table to better illustrate considerations of how to classify an outstanding debt obligation at the balance sheet date if the debt obligation is considered callable by the bank due to the violation.

For many organizations, if the outstanding debt obligation is listed as a current liability, this may cause harm to the overall organization that has lasting effects, including liquidity issues. One specific item to consider if the outstanding debt obligations are reclassified as current on the balance sheet may be the need to evaluate a going concern consideration under ASC 205-40.

In summary, obtaining waivers or forbearance agreements can be a lengthy and complicated process. If your organization believes they may have, or are likely to, experience a covenant breach within the next fiscal year, we recommend management begin making plans now to proactively work through any potential breaches. If you have any questions or need assistance, please reach out to a professional at Forvis Mazars or submit the Contact Us form below.

- 1“National Hospital Flash Report,” Kaufman Hall, January 2023