Did you receive more than $600 in payments last year through e-commerce (Venmo transactions count!) or vacation home leasing? If so, you may be one of many first-time recipients of a Form 1099-K in January 2024. This article covers why you may receive Form 1099-K, the information reported on this form, and what to do with this information.

New 1099-K Reporting Requirements

The American Rescue Plan Act of 2021 enacted stricter Form 1099-K reporting requirements, specifically for those individuals and businesses that receive payments through “third-party settlement organizations.” Third-party settlement organizations are those entities that possess the contractual obligation to settle your transactions. Many third-party settlement organizations, such as eBay, Etsy, and Airbnb, also allow you to market your goods and services to facilitate these transactions.

This means that third-party settlement organizations will be required to file a Form 1099-K for user transactions on their platforms if the gross amount of the reportable payment transactions exceeds $600, regardless of the number of individual transactions. Previously, this threshold was $20,000 and 200 individual transactions.

Transactions that are not for goods or services, including but not limited to personal gifts, charitable contributions, and reimbursements, are excluded from this reporting requirement. So, if you’re selling a couch and get paid via Venmo, that should count, but sharing the cost of an Uber via Venmo does not count toward the new threshold.

Note that originally, this new reporting threshold was set to take effect in 2022 and reported on Form 1099-K starting January 1, 2023 so that taxpayers could report this income on 2022 tax returns. However, the IRS delayed the implementation of the $600 threshold, deeming 2022 to be a transition period to help organizations comply with the new rules. This means you shouldn’t get a Form 1099-K under the new reporting thresholds until January 2024 for your 2023 transactions.

Will I Receive a Form 1099-K?

If you accepted payments for goods and services through payment cards or third-party network payments that met the following requirements, you should receive a Form 1099-K from your payment settlement entity (PSE):

- Transactions settled through payment cards; any amount or magnitude of transactions

- Third-party network payments; any number of transactions in aggregate of $600 or more

Similar to your Form W-2, this form should be provided to you no later than January 31 of each year, beginning in January 2024. PSEs must provide Form 1099-Ks to any persons, including any governmental units, that meet the above requirements. Common examples of PSEs include card processors such as Fidelity Information Services, Wells Fargo, and Citi, in addition to the third-party settlement organizations mentioned above. You should receive a Form 1099-K from any PSE with which your relevant activity met the reporting requirements.

You may accurately receive multiple Form 1099-Ks from a single PSE. Diversified retail operations often generate credit card sales from multiple service lines. If these lines of service are identified to credit card companies under varying merchant category codes (MCCs), a PSE may issue multiple Form 1099-Ks. Furthermore, you may receive a Form 1099-K without reaching the requirements. If you share a credit card terminal with another business, the transactions of the other business could trigger your receipt of a Form 1099-K.

What Is Reported on My Form 1099-K?

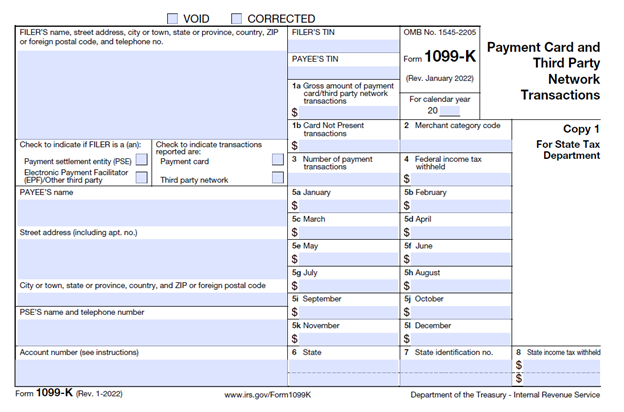

You should receive a Form 1099-K from any entity for which you meet the reporting requirements. These may be furnished to you electronically or through the mail. Here is what the form looks like:

The filer’s name, address, telephone number, and taxpayer identification number (TIN) boxes will detail information related to the entity that was required to file the Form 1099-K. The telephone number provided on the Form 1099-K allows you to reach a person knowledgeable about the payments reported on the form, so you can feel confident in using this number as a contact for any issues or concerns you may have. Directly below, checkboxes indicate the nature of the reported transactions. If your PSE used a third party to settle payments on its behalf, the third party will issue your Form 1099-K. In this case, the details of your PSE are presented in the PSE’s name and telephone number box.

Box 1a reports the gross amount of all reportable payment transactions and does not include amounts that fall under the $600 de minimis payment exception. Furthermore, Box 1a does not include any adjustment for credits, cash equivalents, discount amounts, fees, refunded amounts, or any other amounts. Boxes 5a through 5l provide the monthly amounts of that provided in Box 1a. The sum of these boxes should equal the amount in Box 1a. Box 1a could reflect the total of your taxable income without including deductions. However, in many cases, this amount may be less than or greater than your actual gross receipts.

- Events that may increase actual gross receipts beyond Box 1a amounts:

- You receive income in the form of cash or check

- You use a third-party settlement organization but did not meet the Form 1099-K reporting threshold

- Events that may decrease actual gross receipts below Box 1a amounts:

- You allow customers to receive cash back when they use their debit cards

- You split credit card terminals or third-party network accounts with multiple entities

Card-not-present transactions, which are those where a physical card was not present at the site of sale, are reported in Box 1b. Account information is instead inputted into a physical terminal or point-of-sale software. This typically relates to online sales, phone sales, and catalogue sales. Amounts reported in Box 1b also exist within the amount reported in Box 1a.

Box 2 provides the MCC associated with the transactions reported on your Form 1099-K. If you identify transactions under multiple MCCs, your filer may issue either multiple forms for each code or a single form under the MCC responsible for the highest share of the Box 1a amount. For example, credit card sales of self-employed mechanics who additionally offer auto body repair services would typically be identified under two distinct MCC codes. Box 3 provides the total number of payment transactions.

If you fail to furnish your TIN to your filer, provide an incorrect TIN to your filer, or have a history of underreporting your taxable income, you may be subject to backup withholding on amounts reported in Box 1a. Any federal income tax withheld will be included in Box 4. At a tax rate of 24%, backup withholding can lock away large amounts of funds that may not be collectable until you receive a refund. As such, consider confirming with your filer that they have your accurate TIN. Taxable income should never be underreported. Any state income tax withholding is reported in Box 8.

What Do I Do with This Information?

Your Form 1099-K does not necessarily provide you with specific amounts to input onto your tax return. If you operate your business as a sole proprietorship or a limited liability company (LLC), your actual gross receipts will be inputted on Part 1 of your Form 1040, Schedule C. For C corporations, partnerships, and S corps, gross receipts will be inputted on Line 1a of your Form 1120, 1065, or 1120-S. The amount within Box 1a of the Form 1099-K may represent your actual gross receipts; however, as described above, this may not be the case.

Instead, Form 1099-K is best used as a check against your internal record-keeping. It is important that you keep detailed records of all your transactions, especially those considered reportable for purposes of the Form 1099-K. Failure to properly keep these records could result in an over or understatement of your true federal tax liability. If you—based on the requirements listed above—expect to continue to receive Form 1099-Ks in the future, consider developing a habit of annually reconciling your Form 1099-K Box 1a amounts to your actual gross receipts.

Note that if you do receive a Form 1099-K in 2023, the IRS is working on providing instructions and clarity to taxpayers on what to do given that the new reporting thresholds are now delayed until 2024. For the latest IRS FAQs on this topic, see FS-2022-41.

If you have questions or need assistance, please reach out to a professional at Forvis Mazars.