Environmental, social, and governance (ESG) is an emerging and critical topic for organizations reporting on their environmental and social impacts both domestically and internationally. It is imperative that organizations build a program management office (PMO) to help understand and assess the strategic impact of regulatory changes, data challenges, and risk management associated with ESG. To get ahead of the challenges in this previously unregulated space, organizations need to consider how to establish an appropriate program management office and the key areas to focus their efforts while standing up these global initiatives.

Boards of directors, senior management, and investors (among others) now have a heightened focus on the impacts of ESG risks due to an uptick in disclosure requirements, accounting sustainability standards, and regulation throughout the financial and regulatory landscape. For example, The Proposed Rule for the Enhancement and Standardization of Climate-Related Disclosures for Investors was released by the SEC in late March 2022. The Proposed Rule is intended to strike a balance between offering investors clear, consistent, and comparable information when selecting investments and the potential additional costs compliance might impose on SEC filers.

More information on ESG reporting and consideration for today’s leaders.

Establishing a PMO

Like any large-scale, enterprisewide transformation, implementing an ESG process requires robust program management to monitor execution and drive accountability across the organization. ESG is a complex process that cuts across regions and functions within an organization, requiring buy-in from various stakeholders and a well-thought-out implementation strategy.

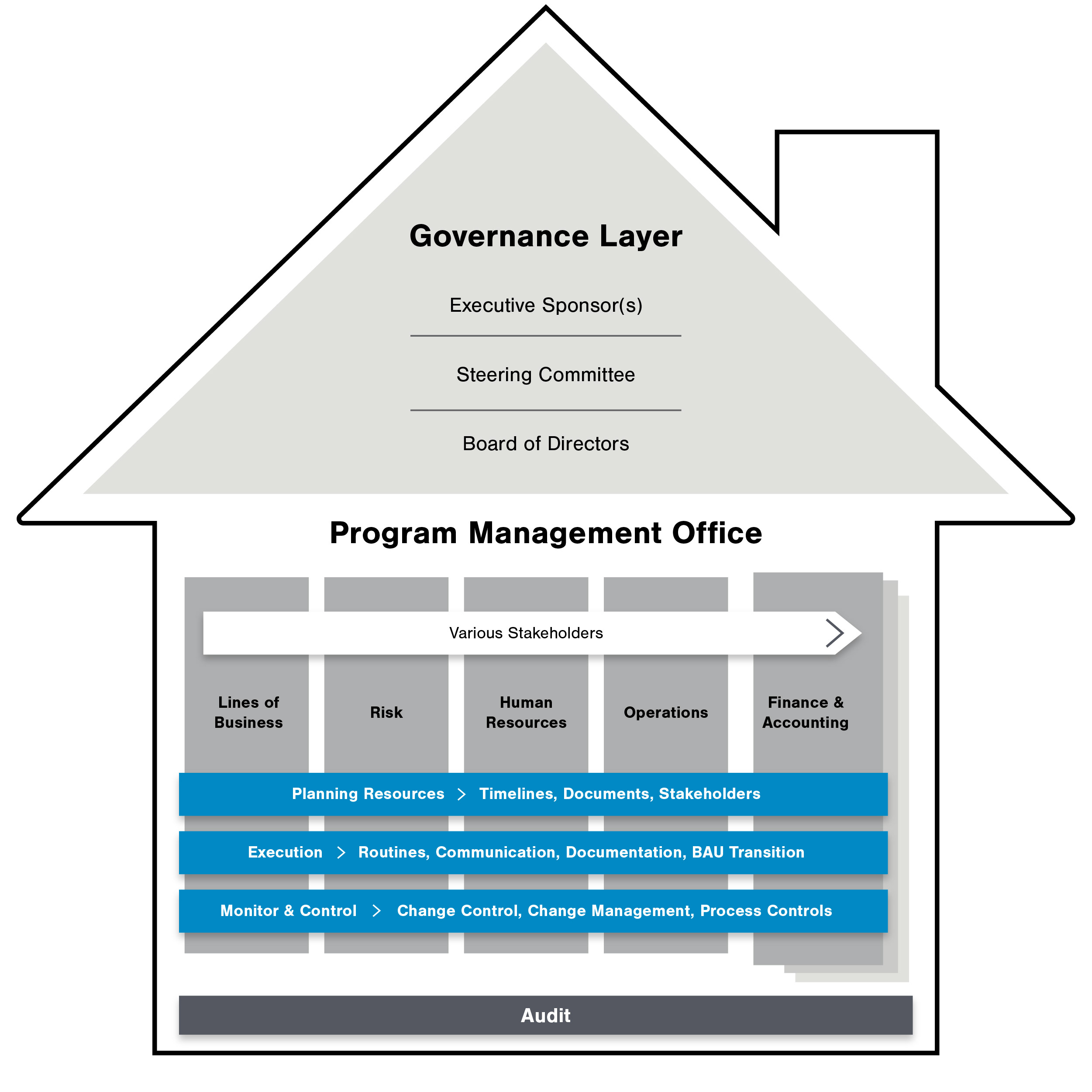

The below diagram depicts the Program Management Office Approach to a complex business transformation such as ESG.

Program Executive & Governance Layer

Executive buy-in and presence in designated governance forums is critical to ensure appropriate dedication of resources and prioritization of activities. Frequency of reporting to this layer should serve to keep executives informed of project health and trends to reduce time required to re-allocate resources or respond to a given issue if an escalation event occurs.

Execution Layer

The success of an initiative is predicated on the effectiveness of communication and program resources of the Execution Layer. Various stakeholders are supported by horizontal workstream phases driven out by the PMO. A PMO is established to support the overall project and impacted stakeholders while ensuring deliverables and milestones are met and progress is communicated via standardized PMO templates, data visualizations, and analytics.

Independent Review Layer

Engagement of independent reviewers throughout an initiative will serve to inform the Execution Layer of standards required to meet project closure requirements as well as to adhere to expectations for future internal and external examinations.

Planning

When considering where to begin, first determine the scope and impact ESG standards have on your organization.

- Who are the stakeholders affected?

- What are the risks and opportunities involved?

- Are there specific resources dedicated to understanding ESG requirements that can help our organization implement them?

Creating your program management office helps your organization answer these questions ahead of mandated ESG changes.

Align the Right Resources to the PMO

Devoting a specific group of individuals with project management, risk management, accounting, and finance knowledge to lead the PMO is critical to its success. A dedicated group of individuals responsible for understanding ESG requirements and how these requirements affect the organization is imperative to communicate, implement, and manage the changes well ahead of prescribed regulatory deadlines. Experience in ESG is critical when getting the PMO off the ground. Not only does the PMO need project management professionals who can manage a multi-stakeholder organizational change, but they also need to have the ESG knowledge and experience to understand the implications and magnitude of the changes for a successful implementation.

Organizations need to determine if they have the right resources to establish their PMO in house, if they need to look for external hires to stand up their PMO, or if advisory professionals with experience and knowledge in ESG are the best option. Having the right team of professionals who can understand ESG changes in the industry, advise on how program metrics should be captured, and evaluate program risks and opportunities contributes to the success of the program. The team should understand data mapping, be knowledgeable in processes and controls, and understand audit and attestation implications when building out the ESG framework. The PMO team should have the necessary skill set to understand the regulatory changes and how to manage them going forward.

Understand the Changes

Once the PMO is established, the team needs to work with internal ESG professionals to understand upcoming ESG-related financial metrics and disclosure requirements. It is the responsibility of the PMO to communicate these changes to the necessary stakeholders and use the program to manage ESG adoption. Material impacts of ESG-related risks on business strategy and outlook are key in assessing risk management and areas of opportunity within the program. ESG-related goals and targets need to fit into the organization’s mission and future vision while also being reported and disclosed to investors in alignment to regulatory requirements.

Identify the Stakeholders

Determining stakeholders affected by ESG is another important aspect of the PMO. Not only are external stakeholders interested in ESG-related metrics and disclosures, but internal stakeholders are also important to consider. Stakeholders are not just the end users of the data or the reporting team, but also the data providers and other areas along the data transformation chain.

For example, as many of the data elements needed for ESG reporting are not currently part of the reporting landscape, new stakeholders may be identified in the reporting process that were not previously exposed to the rigor and controls around reporting. These stakeholders include everyone from HR and marketing to external third-party vendors and rating agencies.

It is imperative for the PMO to lay out and communicate with stakeholders what is required of them going forward and what process and control changes need to be implemented. By communicating with stakeholders, the PMO understands the risks and challenges throughout the organization and documents their understanding of those challenges to develop a robust framework to overcome them.

Quantify the ESG Risks & Opportunities

As with any enterprisewide initiative, the risks and issues need to be identified, tracked, monitored, and communicated to leadership. Depending on the quantity and magnitude of the discovered program risks and issues, management can help make informed decisions about how to manage them going forward. Key performance indicators (KPI) should be defined at the program inception to help the PMO measure and monitor program progress consistently.

In addition, the organization should consider the program opportunities involved in collecting ESG metrics.

- What do the stakeholders want to see?

- What is in it for them?

- How does the organization contribute to the overall ESG landscape and betterment of the community?

- How can we serve our internal and external stakeholders by providing clear and transparent ESG-related information?

In having a formal ESG PMO, the organization is better equipped to manage these program risks and opportunities throughout the life of the initiative.

Create the Implementation Timeline

The PMO is responsible for establishing an intake process for new rules and regulations that document changes to the current regulatory landscape, analyze the impact of those changes, and establish the appropriate project set up to incorporate those changes into the future environment. The PMO needs to work with the organization’s leadership to determine reasonable timelines for the adoption of ESG-related changes.

For example, large, accelerated SEC filers would want to consider setting up their PMO in advance of FY 2023 per the proposed SEC guidance. International timelines may be accelerated due to previously released guidance and review dates.

Define Program Governing Documents

In addition to creating the implementation timeline, the PMO needs to outline the program charter/scope and include the core workstreams. They need to think through and design the governance structure for the program and determine what routines need to be executed once the initiative is underway. KPIs need to be identified for each workstream to ensure consistent and appropriate program reporting as well as the establishment of change management protocols and governing documents for the program. Ongoing updates to the program should take into consideration changes approved via a change control governance process.

To help get your PMO program underway, Forvis Mazars can provide a variety of example accelerators:

- Project Program Reporting & Financial Model

- Change Management Change Request

- Road Map & Success Criteria

- Project Charter

- Implementation Task Timeline

- Task Tracking

- Gantt Chart

- RACI Matrix

- RAID Template

- Test Tracking Aggregation Template

Execution

With the proper framework of resources, stakeholders, risks, implementation timelines, and program governing documents established, organizations can begin making the necessary changes for adherence to ESG. The PMO needs to have the necessary communication routines and participation, as well as program documentation, tracking mechanisms, and defined milestones in place to timely implement identified changes. This would include not only documentation during the initiative, but also documentation of program closeout and transitioning all efforts to business as usual (BAU) as the initiative nears completion.

Implement Communication Routines

Program scope, goals, and progress need to be communicated to management, executives, and leadership on a routine and consistent basis. It is important to align the appropriate team members to drive those conversations and relay a concise message. Communications should be routine either daily, weekly, or monthly (as required by leadership) and within the agreed-upon adoption timeframe. Methods of communication could vary from email correspondence, reporting portals, or meetings. Impacted internal stakeholders should be present or involved in the communications as representation from all key lines of business and control functions increases its success. Frequency of reporting to executives should serve to keep them informed of project health and trends to reduce time required to reallocate resources or respond to a given issue if an escalation event occurs.

Maintain Program Documentation, Tracking Mechanisms, & Program Milestones

Filers benefit from a clear and well-defined project plan along with robust project management routines to identify, source, and compile the KPIs and draft qualitative disclosures, as well as help ESG-related risks integrate into business operations appropriately.

Project plans, Risk/Issue/Decision logs, reconciliations, testing evidence, audit memos, process maps, and control points are a few of the program documents that need to be maintained by appropriate stakeholders during the initial process changes. Teams need to evaluate major risks in the process and mitigate them with appropriate documentation and execution of controls. Program managers need to track the progress to milestones with transparent and consistent project plans across the initiative.

Complete Program Closeout Documentation & Transition to Business as Usual

As the PMO efforts wind down and approach ESG metric and disclosure adoption, teams are responsible for closing out initiatives and transitioning implemented changes into business-as-usual reporting. This requires organizations to stand up an ESG and sustainability team that contains knowledgeable professionals and liaisons going forward.

The ESG team is responsible for monitoring any upcoming ESG-related changes that would affect the organization and cause for additional process improvement and adherence efforts, which could trigger additional PMO engagement. The ESG team needs to have specialized roles in place and clear lines of communication across stakeholders and departments impacted to continually assess for improvement opportunities and new rules and regulations.

Change Control/Change Management

Throughout the PMO, a consistent change control process should be established when implementing enterprisewide change. If there are any alterations to the project plan or timelines, a change control should be implemented and approved by the appropriate leadership bodies, e.g., steering committee or board of directors. Change controls help track any budget changes, scope alterations, or timeline shifts and provide an audit trail of those changes.

Management of the Internal Control Framework

The PMO also should consider management and implementation of the appropriate Internal Controls framework over ESG Reporting. PMO should work with internal audit and compliance partners to ensure controls are well thought out and inclusive of the ESG changes implemented throughout the program.

Appropriate information and communication processes should be developed to drive engagement throughout. This includes development of internal reporting processes to management and the governance committee, as well as development of external reporting processes for third parties and regulators. Effective and timely conveyance of information is important for the success of the ESG program.

Monitoring activities should be developed as part of the existing risk management and internal audit functions. This should include scoping of ESG processes for independent evaluations, as well as identification and management of deficiencies in internal controls.

How Forvis Mazars Can Help

Forvis Mazars has considerable experience with ESG and PMOs across major industries. Our professionals range from industry leaders in environmental and social governance to experienced project management and regulatory change consultants. Forvis Mazars has a strong history of establishing PMOs and helping clients meet their organizational and process improvement goals.

If you would like more information or have questions related to establishing a PMO within ESG, reach out to a Forvis Mazars professional.