So, you’re thinking about investing in crypto but unsure how to value it. You may have heard there is “nothing backing crypto” and that it’s subject to wild swings in price valuation. You also may have heard that crypto is going to the “moon” and you don’t want to be the only one of your friends missing out on a potential life-altering investment. That would leave you as the only friend in the group without a yacht or “Lambo.” How do you know if, or when, crypto is a good investment? Well, you’re in the right place to get a primer on some factors that impact the valuation of bitcoin (BTC).

Many equate BTC as digital gold because of its many similarities with physical gold. These similarities include items such as its scarcity (BTC has a capped 21 million supply), divisibility (BTC can be divided into smaller holding increments such as 0.05), and intrinsic value (BTC and gold are both arguably seen as an asset that maintains its value over a long period of time). So, if gold and BTC are so similar, shouldn’t we be able to draw some comparisons on value?

Why do gold miners mine for gold? To earn money? You’d think so. A smart gold miner likely has a simple formula in mind when determining why and when they should mine gold. The formula:

Price of Gold > The Cost to Mine Gold

If the price per ounce of gold is greater than the cost to mine that same ounce of gold, then a savvy business decision would be to mine for the gold. If the price per ounce of gold is less, then the operation would show a net operating loss and the decision to mine for the gold should be highly scrutinized. The intent of this example is to establish a simple formula; let’s call it “cost of production.” We can now use the same concept with BTC mining.

BTC mining, while oversimplified, is just a transfer of energy to validate a ledger of transactions on the BTC blockchain. BTC miners attempt to solve an algorithm, known as a hash function, while mining for BTC. Solving the hash function requires computing power and energy consumption; thus, these are the miner’s expenses. If their computers solve the hash function, then the miners are rewarded with the coinbase reward (not to be confused with Coinbase, Inc.). The coinbase reward, which is currently 6.25 BTC per block (average one block per 10 minutes), is newly generated coins. Miners also are rewarded with the transaction fees associated with that block. The transaction fees’ 30-day average is about 16 BTC per day. In general, energy is not free, so BTC miners must pay for the energy costs needed to support the mining computers. Just as physical gold requires tangible assets to mine, so does BTC mining. So the total cost to mine BTC is not only the cost of energy, but also the cost of the computer hardware itself. Thus, we can generate a very similar formula for bitcoin mining as we drew for gold mining. The formula:

Price of Bitcoin > The Cost to Mine Bitcoin

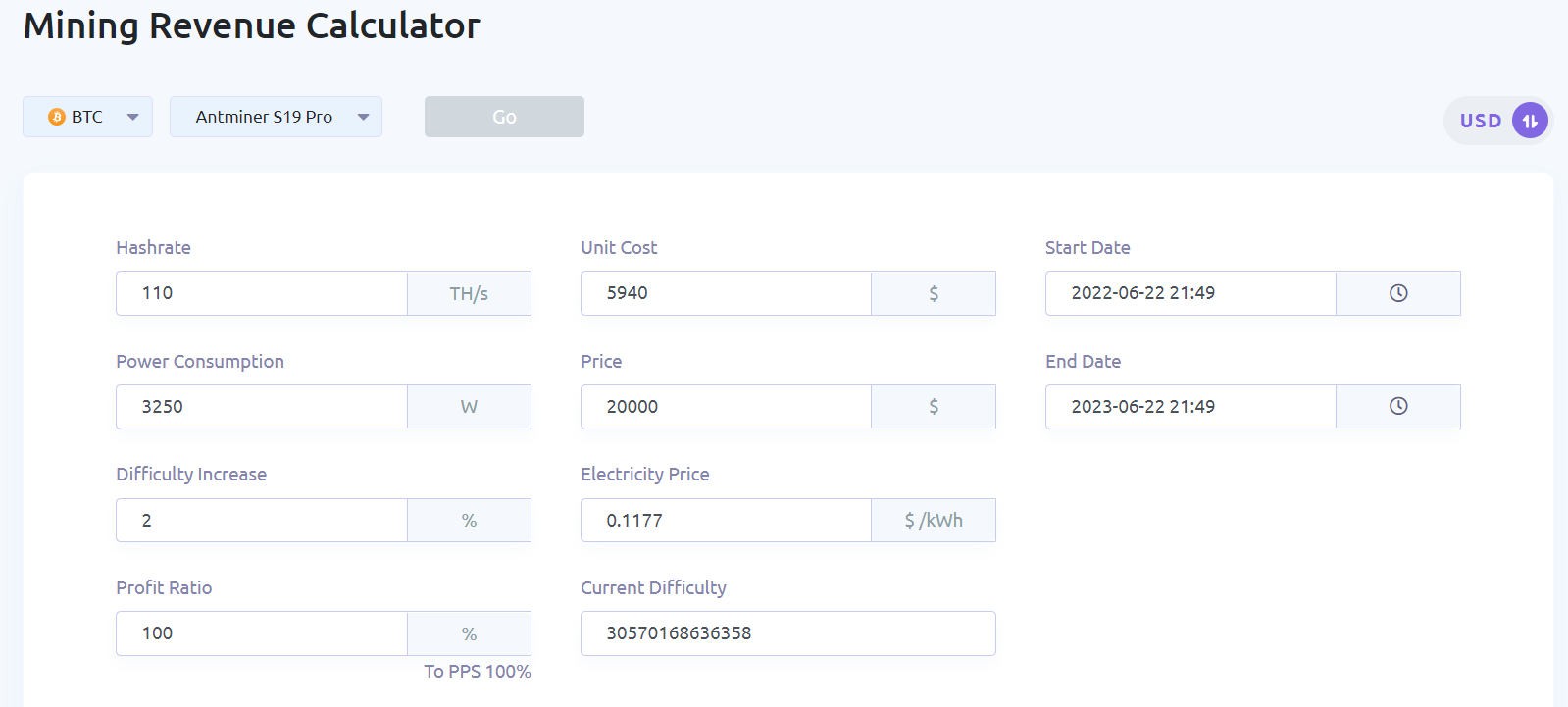

Well, let’s look at the data. F2Pool, the largest bitcoin mining pool by total blocks mined, has done a lot of the work for us by navigating to their mining revenue calculator. If the Bitmain Antminer S19 Pro (S19) is selected (popular hardware option among BTC miners), the calculator will pre-populate most of the numbers for us. There are a couple of numbers that need to be adjusted from their defaults for recent economic events to get a more accurate number than we’re looking for in this exercise.1Consider this screenshot:

Source: f2pool.com

Based on the numbers in the screenshot above, the calculator shows a net loss of $754.98. This calculation does not account for depreciation of the hardware. If we assume a three-year depreciable life on the hardware, the net operating loss would be even more in the red at $2,734.98. Clearly, at the BTC price of $20,000 and at the current mining difficulty, the “cost of production” formula we established above is not in favor of showing net operating income.2

What can we draw from this? Well, either the price of BTC must rise or the difficulty must decrease for the BTC mining cost of production to show net operating income. A key factor in the valuation of BTC is what is known as “mining difficulty.” The mining difficulty measures how difficult it is to mine a block. The higher the mining difficulty, the more computing power it will take to mine the block. Also, note that the bitcoin mining difficulty is adjusted every 2,016 blocks or approximately every two weeks, so when there is more computing power attempting to mine a block, the mining difficulty adjusts upward. In layman’s terms, this means that the more market participants try to mine BTC, the more difficult it becomes to solve the hash function. The opposite is true when market participants leave the ecosystem. In this case, it becomes less difficult to solve the hash function.

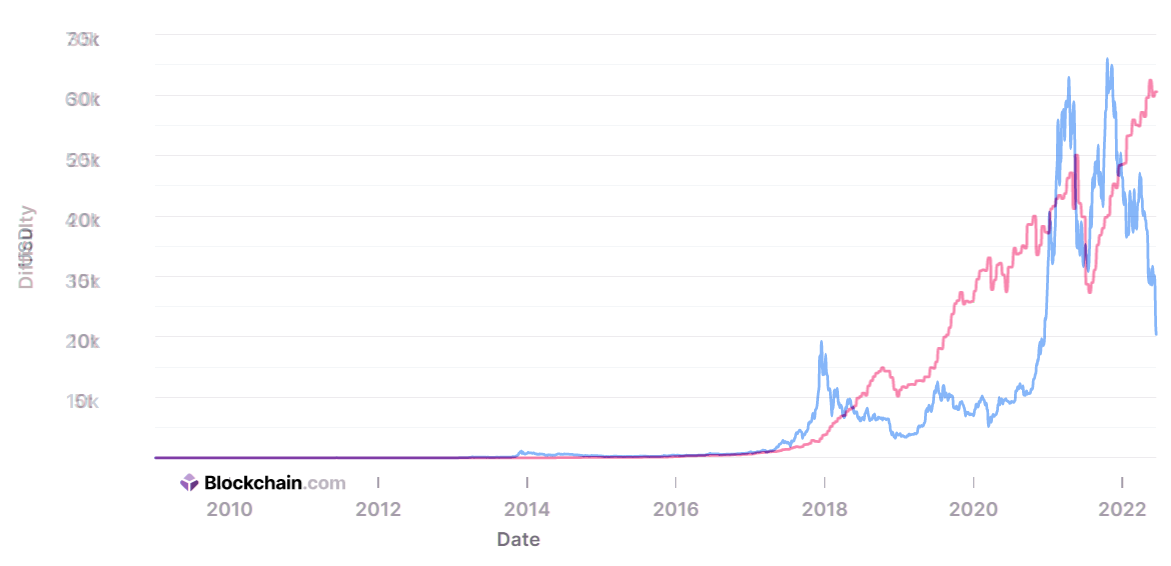

To summarize, the value of BTC to USD can largely be compared to the cost to mine BTC. If the numbers show that mining BTC is profitable, then more participants will enter the market, which drives up the price. If the numbers show that mining BTC is not profitable, then more participants will leave the market, thus driving the price down. This is a vicious cycle until the two find equilibrium. If you overlay the BTC price chart with the bitcoin mining difficulty chart, there are direct correlations. In fact, see for yourself in Exhibit 1 below:

Exhibit 1

Blue Line: BTC Price

Red Line: Mining Difficulty

Source: blockchain.com

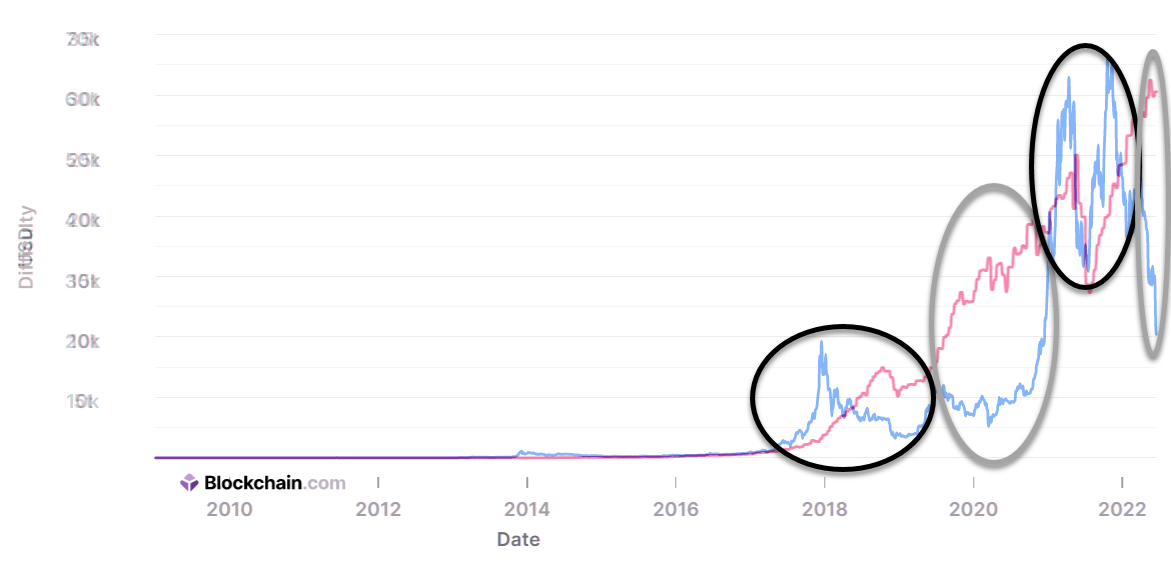

To show examples of the correlations, we’ll look at Exhibit 2. Take, for example, when BTC hit a low of about $3,191 in the second week of December in the 2018 bear market. About 10 days later, the bitcoin mining difficulty hit its lowest point of the 2018 bear market. At that point, price and difficulty were in equilibrium (the first black circle in Exhibit 2), so more market participants joined back in, thus, driving price up (the first gray circle in Exhibit 2). During the 2021 bull market, bitcoin hit an all-time high in November 2021. However, the bitcoin mining difficulty didn’t peak until May 2022 (the second black circle in Exhibit 2). The price and difficulty were no longer in equilibrium because too many participants were entering the market, likely seeking to capitalize on a bullish price pattern; thus, a price reduction (the second gray circle in Exhibit 2).

Exhibit 2

Source: blockchain.com

At the time of this publication, the equilibrium between bitcoin price and bitcoin mining difficulty is off. The price of BTC to USD is too low to return a net operating profit. You can probably anticipate that first, the participants will leave the market. Then, bitcoin mining difficulty will decrease. When bitcoin mining returns become profitable due to the difficulty drop, the price generally stabilizes. Then, more market participants enter the market, driving the price up. This is the vicious cycle.

Stay tuned for Part 2 of this series to read a similar concept applied to valuing Ethereum. If you have any questions or need assistance, please reach out to a professional atcForvis Mazars

- 1The S19 spot price is listed on Bitmain’s website at $5,940 so the unit cost is updated to match. Because of price volatility in the market, assume bitcoin: USD currently trades at a flat $20,000. Also, the cost of energy has significantly increased over the last couple of years. Per ChooseEnergy.com, the average commercial energy rate in the U.S. in March 2022 was 11.77 c/kwh.

- 2Are you wondering at what price it would be profitable (assuming the same difficulty level) to mine BTC with an Antminer S19 Pro? The answer is $41,100, but let’s say we just want to spend $425 on a Bitmain Antminer S9. Well, the hashrate for this machine is much lower than the Antminer S19 Pro, so the odds of solving the hash function go down. The price of bitcoin for one Bitmain Antminer S9 to break even, you ask? A whopping $95,139. Keep in mind these numbers do not account for economies of scale. These are numbers for one mining rig.