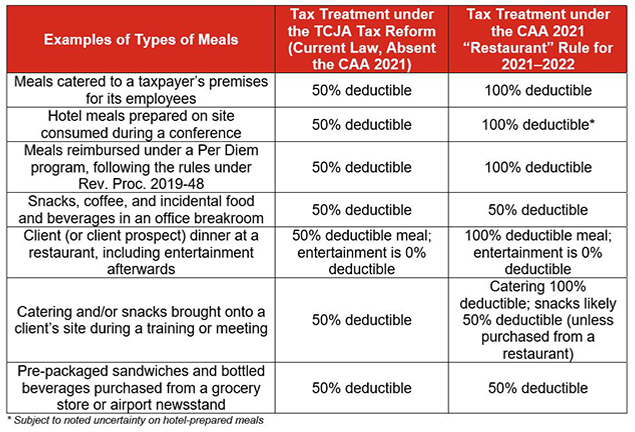

As opposed to the general 50% tax deductibility rule for business meal expenses, taxpayers who purchase meals from a restaurant during calendar years 2021–2022 may be eligible for a 100% tax deduction for such expenditures. This rule should be considered for any quarterly estimated payments as well as the tax return filings for expenses incurred during the calendar years 2021–2022.

Background: IRC Sec. 2741 generally provides that expenses incurred by taxpayers for meals are subject to a 50% deduction for federal income tax purposes. There are, however, certain exceptions to this 50% limitation, most notably:

- Expenses treated as compensation by the recipient; 2

- Reimbursed expenses; 3

- Recreational expenses for employees; 4

- Expenses for goods, services, and facilities made available by the taxpayer to the general public; 5

- Entertainment sold to customers; and6

- Expenses includible in income of persons who are not employees.7

Key Change to IRC Sec. 274: Within the Consolidated Appropriations Act of 2021, the Taxpayer Certainty and Disaster Tax Relief Act of 2020 division provided for a temporary 100% deduction for food and beverages purchased from a “restaurant.”

Specifically, IRC Sec. 274(n)(2)(D) provides that the 50% limitation on meals expenditures shall not apply to any expense if “such expense is for food or beverages provided by a restaurant and paid or incurred before January 1, 2023.”

On April 8, 2021, the IRS issued Notice 2021-25, which provides further clarification on this new exception to the general 50% deduction for meals.

Within Notice 2021-25, “the term ‘restaurant’ means a business that prepares and sells food or beverages to retail customers for immediate consumption, regardless of whether the food or beverages are consumed on the business’s premises. However, a restaurant does not include a business that primarily sells pre-packaged food or beverages not for immediate consumption, such as a grocery store; specialty food store; beer, wine, or liquor store; drug store; convenience store; newsstand; or a vending machine or kiosk.

In addition, an employer may not treat as a restaurant for purposes of IRC Sec. 274(n)(2)(D), (1) any eating facility located on the business premises of the employer and used in furnishing meals excluded from an employee’s gross income under IRC Sec. 119, or (2) any employer-operated eating facility treated as a de minimis fringe under IRC Sec. 132(e)(2), even if such eating facility is operated by a third party under contract with the employer as described in Treas. Reg. Sec. 1.132-7(a)(3).”8

Furthermore, the IRS released Notice 2021-63, which provides that taxpayers that properly apply “the rules of Rev. Proc. 2019-48 may treat the meal portion of a per diem rate or allowance paid or incurred after December 31, 2020, and before January 1, 2023, as being attributable to food or beverages provided by a restaurant” 9(i.e., as defined by Notice 2021-25). The per diem rates are an IRS-approved method allowing a taxpayer to treat a specific amount as paid or incurred for meals while traveling away from home instead of substantiating the actual cost, as required under IRC Sec. 274(d).

Key Takeaways: While food and beverages purchased from restaurants after December 31, 2020 and before January 1, 2023 allow for a 100% tax deduction, there are certain exceptions to this general rule, as well as lingering uncertainty as to what may or may not constitute a “restaurant.”

Exceptions to the term “restaurant”:

- “A business that primarily sells pre-packaged food or beverages not for immediate consumption, e.g.,

- Grocery stores

- Specialty food stores

- Beer, wine, or liquor stores

- Drug stores

- Convenience stores

- Newsstands

- Vending machines

- Kiosks

- Eating facilities located on the business premises of the employer and used in furnishing meals excluded from an employee’s gross income under IRC Sec. 119

- Employer-operated eating facilities treated as a de minimis fringe under IRC Sec. 132(e)(2)” 10

Uncertainty: “The term “restaurant” means a business that prepares and sells food or beverages to retail customers for immediate consumption, regardless of whether the food or beverages are consumed on the business’s premises.” 11

This definition appears to be broad-based. However, based on the definition of “restaurant,” coupled with the list of exceptions, certain types of businesses and/or meals may or may not fit this designation.

For example, many hotels have their own kitchens and facilities where they prepare food and beverages for customers, such as meals prepared by the hotel kitchen for a conference held at the hotel. However, does the definition of “restaurant” as provided under Notice 2021-25 intend to qualify the kitchen operating unit of a hotel as a “business”?

Based on the definition of “restaurant” under Notice 2021-25, an argument exists to claim that a hotel kitchen may fall under this definition. However, there is still some uncertainty in taking this position.

How Forvis Mazars can help: Taxpayers can begin using the increased tax deduction benefit for restaurant meals expenses that are incurred during calendar years 2021–2022. This should be considered in taxpayers’ tax returns, estimated tax payments, and tax provision calculations.

For companies with significant volume, statistical sampling may be available to help determine tax deductibility of meals expenses for 2021–2022. 12

For more information on how these changes may impact your company and to discuss how Forvis Mazars can help with determining the tax deductibility of your meals expenses during 2021–2022, please contact your Forvis Mazars advisor or fill in the Contact Us form below.

- 1Unless otherwise stated or clear from the context, all references to “Section,” “Sec.,” or “§” in this memorandum are to the Internal Revenue Code of 1986 (the “Code” or “IRC”), as amended, and references to “Treasury Regulation,” “Treas. Reg.” or “Reg. §” are to regulations promulgated under the Code.

- 2IRC Sec. 274(e)(2)

- 3IRC Sec. 274(e)(3)

- 4IRC Sec. 274(e)(4)

- 5IRC Sec. 274(e)(7)

- 6IRC Sec. 274(e)(8)

- 7IRC Sec. 274(e)(9)

- 8https://www.irs.gov/pub/irs-drop/n-21-25.pdf

- 9https://www.irs.gov/pub/irs-drop/n-21-63.pdf

- 10 https://www.irs.gov/pub/irs-drop/n-21-25.pdf

- 11 https://www.irs.gov/pub/irs-drop/n-21-25.pdf

- 12 See Rev. Proc. 2004-29