There is a growing body of evidence indicating that climate change is already having an impact on the world. Between 1980 and 2022, there were more than 300 weather-related disaster events causing more than $1 billion in damage across the U.S., including severe storms, wildfires, droughts, and tropical cyclones. In addition, 66% of major global companies have at least one asset at high physical risk under a high-impact climate change scenario in 2050.

Much of this change has occurred since the industrial revolution as a result of human activity, but has only relatively recently become a matter of global urgency—one that is essential for the future health and well-being of all life on earth.

The Intergovernmental Panel on Climate Change (IPCC) found that human-induced climate change has contributed to an increase in the frequency and intensity of extreme weather events such as heatwaves, floods, and hurricanes. In its most recent assessment, the IPCC found that climate change is likely to exacerbate existing problems such as poverty, hunger, and water scarcity.

This being the case, the monitoring and measurement of the potential future impacts of climate change are becoming increasingly essential for operational resilience and business continuity. Climate risk scenario analysis is one powerful tool that supports an organization’s strategic planning and risk management as we enter an unknown climate future. The analysis incorporates a set of assessment activities that help to understand potential risks and opportunities stemming from climate change and considers two possible effects on an organization–physical and transition risks.

Physical risks are defined as either acute (point-in-time events such as floods, wildfires, or other extreme weather events) or chronic (long-term changes in the climate that require permanent and strategic adjustments such as rising sea levels, increased maximum temperatures, or long-term shifts in precipitation patterns that contribute to droughts and flooding).Transition risks refer to more significant changes in strategies and activities caused by the move to a low or zero-carbon economy. This drive toward a climate-friendly future includes changes in attitude and approach to risks such as legal, market, reputational, and technological risk.

Both physical and transition risks have the potential to be assessed in depth using a combination of qualitative and quantitative risk management techniques. These include translating risks (and opportunities) into potential financial losses (or value accretion). Examples of how this might be done include either directly via potential damage to infrastructure in the case of physical risk or via the identification of stranded assets or changes in valuations in the case of transition risk.

The impacts of climate risk are not limited to the direct financial consequences, however, and will go beyond an organization’s doorstep. The entire value chain needs to be assessed to identify climate change implications to a company’s supply chain and its customers, as well as its own operations. As an example, within transportation and logistics, this translates most recently into shipping interruptions and labor shortages caused by extreme weather that have contributed to empty shop shelves in both the U.S. and the U.K.. These interruptions and shortages have a cascading effect across the economy regarding product availability, and require a more thorough and centralized approach to assessing and understanding the impacts a vendor or critical service provider may face due to climate change.

With the impacts of climate change overwhelmingly evident, now is the time for businesses and decision makers to consider how they can reduce their risk exposure and capitalize on the opportunities to help reduce the harms of climate change. There are several ways to mitigate the potential for climate risks to become economic risks; however, organizations must look at the transmission channels of climate risk into the economy and their financial performance.

Reducing exposure to climate risk is essential not only from a capital allocation perspective but also from a social and environmental standpoint. As the world becomes increasingly aware of the dangers posed by climate change, there is a growing expectation that businesses will take action to mitigate their impact on the environment. The increase in mandated climate disclosures and expectations of stakeholders who seek to align their investments and purchasing habits with organizations that share their values highlights this heightened expectation.

Climate Risk Management

Climate change is already impacting businesses around the world, and this is only expected to increase in the coming years—we only need to look at current weather reports to witness the effect of severe storms and cyclones. As a result, businesses need to adapt their risk management programs and strategies to account for the potential impacts of climate change. For risk management, a key first step is being able to identify and prioritize physical and transition risks so that the organization can prepare for and potentially mitigate and adapt to their impacts.

Focusing on the physical risk side, extreme weather events accounted for economic losses of around half a trillion euros over the past 40 years (less than one-third of which were insured) and led to between 85,000 and 145,000 human fatalities across Europe.

With the recent past showing us that events are occurring with more frequency and severity than imagined, technology and climate science are supporting the drive to highlight future potential climate changes and understand the weather extremes that create them. Understanding how exposed your organization might be to flooding, for example, can help business leaders to strategize business continuity and disaster recovery activities that can help continue operational performance. Longer term, understanding exposures to flooding can support capital planning and operating expenses (such as insurance or energy costs) and aid sustainable development. For manufacturing facilities, for example, heat and temperature can have detrimental impacts on employee productivity and even create health and safety concerns. Assessing potential hazards such as extreme heat can help organizations understand the requirement for air conditioning and plan accordingly.

In addition, different regional and international locations will naturally have different potential hazards with varying levels of change and overall impact. Undertaking scenario analysis will support governance and strategic decision making, as well as risk management, by highlighting the impacts of future climate pathways to key operating locations. A particularly vital exercise for multigeographic organizations is an understanding that multigeography in this instance applies to the overall value chain. For example, a multinational company reliant upon IT servers to support operations in areas such as the U.S. Midwest or the Middle East is likely to already better suited to extreme heat. In contrast, equivalent servers in the U.K. will likely be less adaptable to extreme temperatures. This is just one example of the thinking required to approach climate action for risk mitigation and adaptation. Risk modeling provides the necessary insight regarding potential future operating expenditures and infrastructure issues, considering differing climates.

Furthermore, businesses are facing an enhanced request for transparency from their investors and clients. The SEC has issued an exposure document that may ultimately require certain public companies to make disclosure, or may already be required to disclose under the Task Force on Climate-Related Financial Disclosures (TCFD). The information needs for these disclosures include how an organization assesses its resiliency to climate risk and its methods for governance, planning, execution, and management of climate change implications. Climate risk scenario analysis is the process needed for producing credible information across both physical and transition risks.

Globally, every sector must proactively react to the increasing demand for transparency and a shift toward sustainability. The change in behavior across demographics is creating new demand for innovative climate-centric solutions, further driven by increasing investor demand around credible and transparent ESG and climate risk reporting obligations. Whether driven by investor demand or a desire for purposeful impact, incorporating climate risk scenario analysis is a wise choice for forward-thinking businesses in today’s world.

Physical Climate Risk Dashboard (PCRD) by Forvis Mazars

At Forvis Mazars, our role in supporting the global drive to net zero and helping our clients navigate the complexities of our collective unknown climate future is to design solutions to assist with risk management and opportunity capture. With the UN IPCC predicting we have until 2030 to limit global temperature rises by 1.5˚C, it is going to require a collective human effort to enact change at every level. We are reacting by developing, innovating, and adapting to the challenge ahead of us to help ensure a prosperous future remains viable for all.

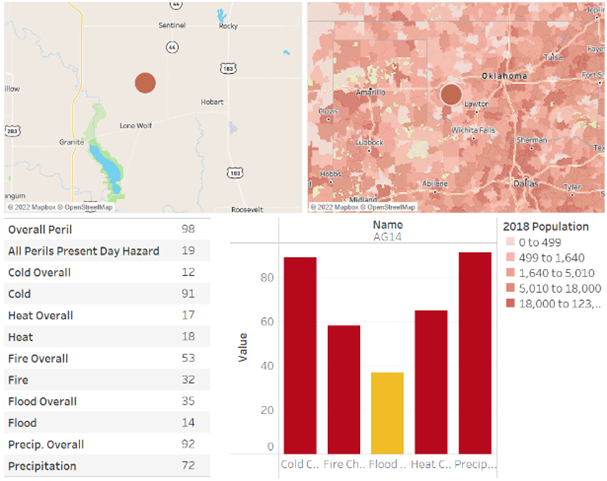

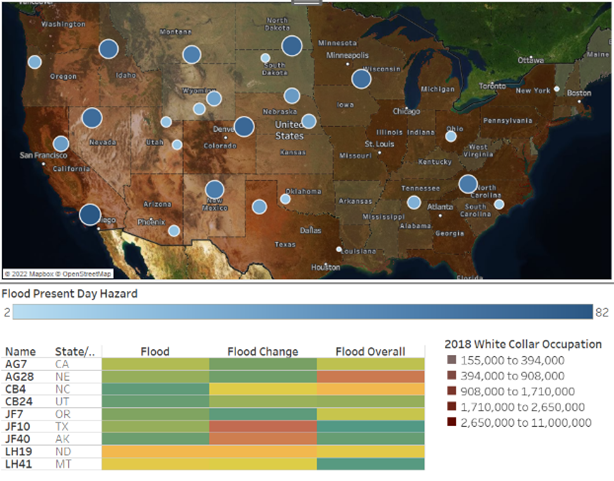

For our clients, we have created the Physical Climate Risk Dashboard (PCRD) solution—leveraging leading scientific data and climate modeling to provide invaluable insights that help assess your physical risks while building an in-depth strategy to mitigate and adapt to risks, including eight core perils of extreme heat, extreme cold, wildfire, drought, flood, wind, precipitation, and hail.

PCRD supports regulatory disclosures, climate risk management, strategic planning, and sustainable development across all sectors, anywhere in the world. Utilizing the Shared Socioeconomic Pathways (SSPs), we can apply our expertise to contextualize PCRD’s outputs specifically to your business, value chain, and future performance enhancement.

Image Caption: Physical Climate Risk Dashboard provides a forward-looking analysis of the potential risks and opportunities resulting from physical climate perils, such as flooding or drought, helping you to decrease risk and develop potential competitive advantages for future business operations.